Adani Enterprises Ltd. (AEL), the holding company of Adani Group, had announced its big bang restructuring's Demerger of its existing businesses and listing each of them. In the entire pre-demerger to post-demerger scenario, several smart traders earned sizeable gains whereas a lot of other set of investors (not only retail) lost a significant amount of money. It was a classic case of Zero-Sum-Game where one man's loss was another's gain.

1. How Smart Traders Made Money in this Demerger?

Strategy: Buy Adani Enterprises Pre-demerger at Rs. 630-640; Sell the 4 Parts post Demerger

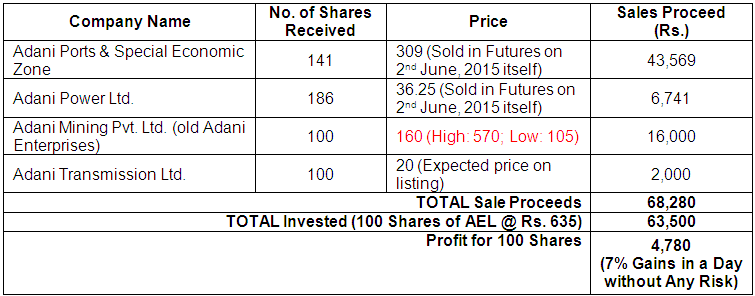

The price of Adani Enterprises on 2nd June, 2015 end of day was Rs. 635. Every 100 shares of Adani Enterprises bought on or before 2nd June, 2015 would convert to shares of 4 companies as below. Three companies out of these are already listed and the fourth one (Adani Transmission) will get listed soon.

Now imagine this at a scale of 10 Lakh shares or 1 crore shares. Also, there were many smart traders who could sell their Adani Mining shares at prices ranging from Rs. 200 to as high as Rs. 570. This means that their gain multiplies. Assuming that the sale price was Rs. 300 for Adani Mining (old Adani Enterprises), the gains for the same transaction would increase from Rs. 4,780 to Rs. 18,780 (~30% gains on investment in a single day).

1. How some Set of Traders / Speculators Lost a Huge Fortune in the Same Transaction where Others made Good Clean Profit?

There are a lot of ill-informed traders / speculators who have a habit of buying whatever falls steeply (in excess of 10%) in expectation that it will bounce back in a day or two. This happens invariably all the time. Many traders/ speculators who saw that Adani Enterprises is down by 10% in the pre-opening session, placed order of Buying Adani Power at various from levels from Rs. 570 to all the way down to Rs. 200. These traders / speculators were so ill-informed that they did not know that the price fell due to demerger and not generally as it may happen on a general bad day. Nearly 10 lakhs shares were traded between Rs. 570 to Rs. 191 which implies that the potential loss to all those 10 lakhs shares worth buyers was anywhere between 40% to 75% in a single day!

2. ProsperoTree.com View - Key Lessons from the Demerger

- Being ill-informed can be extremely costly in Stock Markets: Smart traders who bought the shares of Adani Enterprises exited with a very decent gain. However, the ill-informed traders who mistakenly bought shares of Adani Enterprises on 3rd June morning between Rs. 570 to Rs. 180 lost anywhere between 33% to 80% in a single day. That is a big jolt! The same people might never come back again to stock markets and would blame the stock markets for their own mistakes. We advise the novice investors / traders to refrain from dealing into stocks where they don't have any expertise or knowhow. Do not buy just because things have fallen.

- Efficient Market Hypothesis - Just a Theory: Efficient Market Hypothesis states that "prices of securities fully reflect all available information at any point of time." This theory implies that there is no information asymmetry but as we saw in this case that certain smart traders did profit by playing this event right. As investors in markets, we should always remember that theories may be true and proved mathematically in theorems, corollaries, etc but its practical application has limitations.

- Something the Stock Exchanges could do: As the stock exchanges were aware about the demerger of Adani Enterprises, the broad fair value of Adani Enterprises post demerger was easy to calculate. If so, why did the exchanges (BSE and NSE) not allow the first one hour of trading for determining the fair value based on the demand and supply situation as done in the new listings? If it would have been allowed, the fatal losses by ill-informed traders could have been minimized.