Megatrends, in the context of investing, are sustained economic developments that impact economy and businesses in a manner that has a substantial impact over a period of two to three decades. One such megatrend in India is the financialization of the economy. This refers to the consistent long term increase in the size and depth of a country’s financial sector.

In the past, the financialization of the economy has occurred in many countries making massive changes in the way the economy and businesses operate. Below are some key pointers in relation to this megatrend.

1. Aadhar Card: A large majority of our population already has an Aadhar Card. With the law surrounding the use of Aadhar now stabilized, the biggest beneficiary of this is the government, who can now easily implement welfare programs without large scale leakages. Examples include food subsidy schemes, gas subsidy schemes, farmer subsidy schemes, kerosene subsidies, payments for rural employment schemes among others. The time is not far away when all such schemes will be implemented through the use of Aadhar.

As of Feb20, the total number of Aadhar card issued stands at 125.52 crores with incremental monthly addition of 15-20 lakhs.

In addition to the welfare schemes, various segments of the financial markets in India are also allowed to use the Aadhar based e-sign verification making the entire account opening and verification process completely paperless. This has led to the humungous change in the way companies operate giving them tremendous efficiencies and speed.

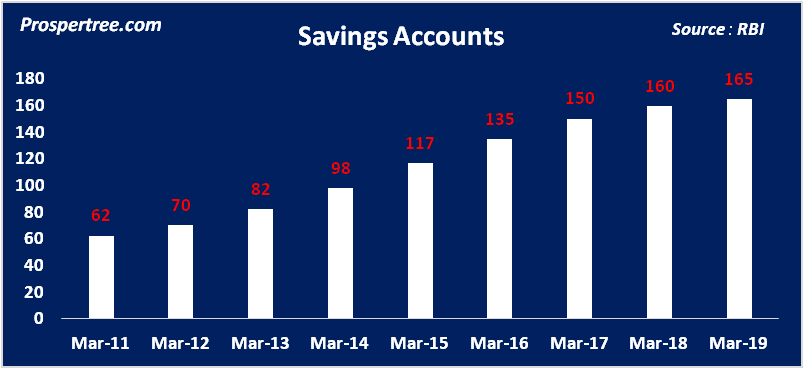

2. Bank Accounts: With the drive and focus on inclusive banking by the government, the number of savings bank accounts has increased from 62 crores in Mar11 to nearly 165 crore accounts in Mar19. It creates a host of benefits for the entire ecosystem. The governments led programs can have an efficient distribution of subsidies directly to the bank account of the beneficiary. It has also enabled a lot of people to take benefit of the banking credit availability which will typically be far less predatory in nature than the local money lenders system.

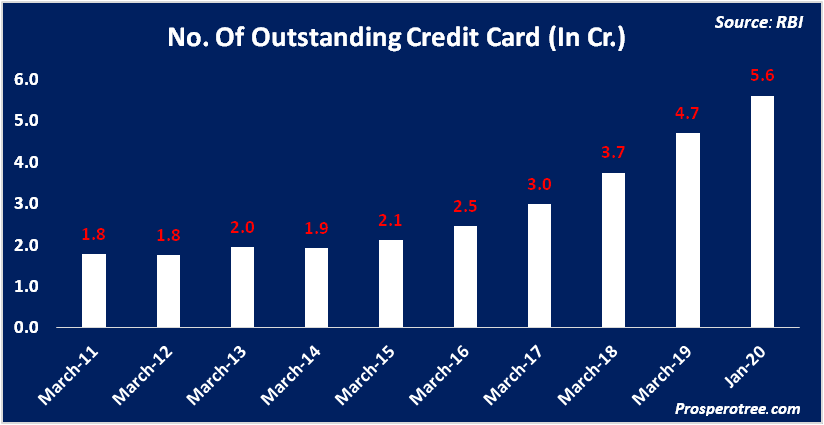

3. Credit Cards & Debit Cards: Without getting into the rights and wrong of the usage of credit card debt, there is a clear trend of an increase in the number of credit cards issued. Credit cards and other electronic modes of payment make payment functioning easier. When compared with the statistics of comparable and better economies in terms of GDP, India still has a long way to go in terms of credit card issuance.

If used correctly, a large number of people may get genuinely benefited from the increased availability of short term credit that is not linked to their cash flows. Needless to say, the economy will reap benefits in the form of the reduced cost of currency circulation along with opportunities in terms of offering new services to a completely new set of customers. We are already seeing a part of it playing out in terms of banking sector tie-ups with the product and service manufacturers to create market places that help customers to decrease costs and increase offerings along with providing product or service providers to access large volumes.

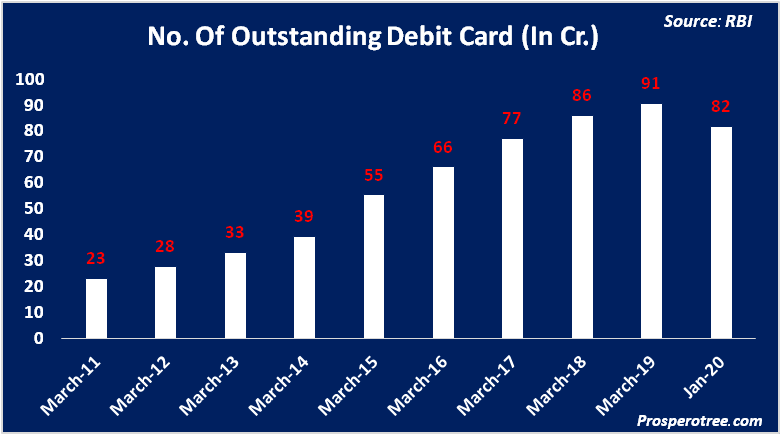

Similarly, a lot of banking customers have now started to use the debit cards to withdraw cash, make payments, online login, resetting passwords and multiple other common service-related issues. The number of debit cards issued by the banking systems now stands at more than 82 crores and is also witnessing a rising trend.

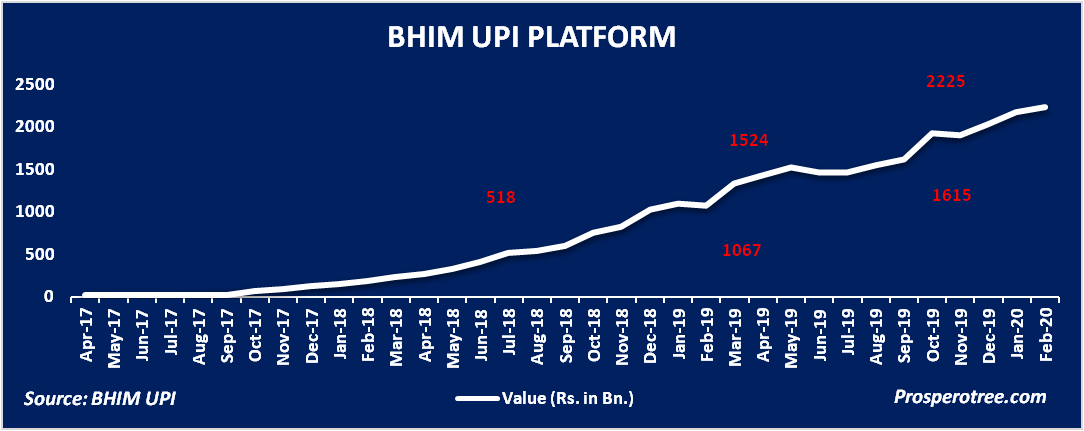

4. Payments interfaces: Unified Payments Interface (UPI) is a system that powers multiple bank accounts into a single mobile application. It also caters to the “Peer to Peer” collect requests that can be scheduled as per requirements. Incrementally a lot of features are being experimented on this interface. One such feature was allowing IPOs to done through UPI which saw SBI Cards IPO having a huge response of 40 lakh applications in the retail segment.

Additionally, transactions through UPI have is also witnessing a very good momentum as seen below with monthly transaction in value terms has crossed 2225 lakh crores.

5. Pan Cards: This is an identity proof for a taxpayer and the number of Pan Cards issues now stands at 30.75 cr as on 31Jan20. Additionally, nearly, 17.58 cr Aadhar cards are now linked with the Pan Cards creating a solid environment for data mining, improving taxpayer services, and improving tax services delivery systems. The number of taxpayers filing returns has also increased substantially over the last 5 years and is further estimated to grow over time.

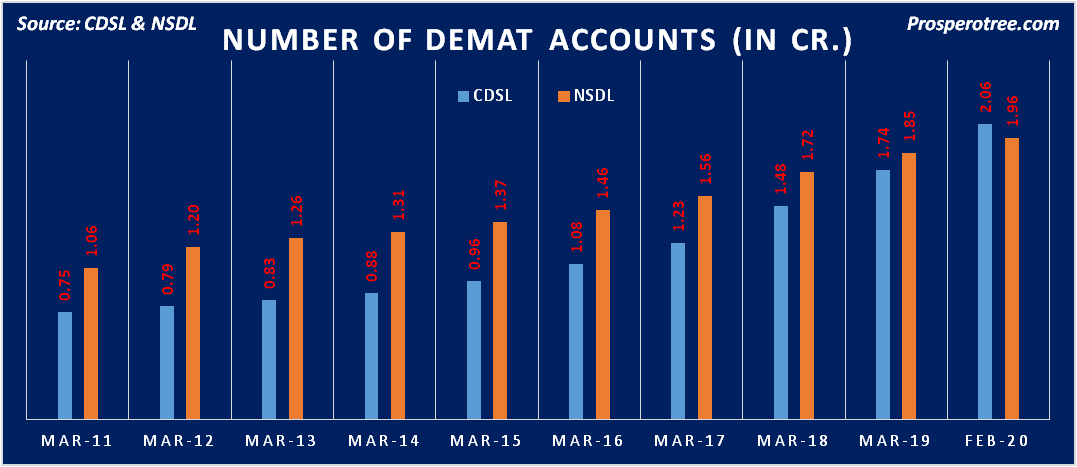

6. Demat Account: There has been a tremendous increase in the number of Demat accounts in India. The way a bank account is used to store money, the Demat account is used to store financial securities like shares and bonds among others. Even though the number of Demat accounts has increased by 2.25 times in the last 8-9 years, we could see consistent growth as our size of economy grows along with increasing awareness of the financial assets.

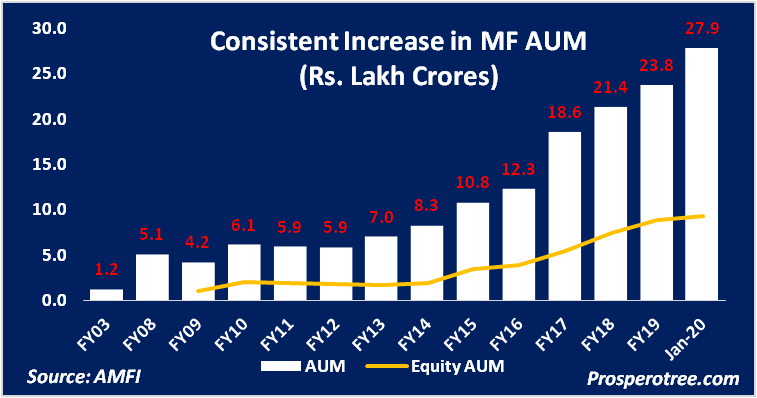

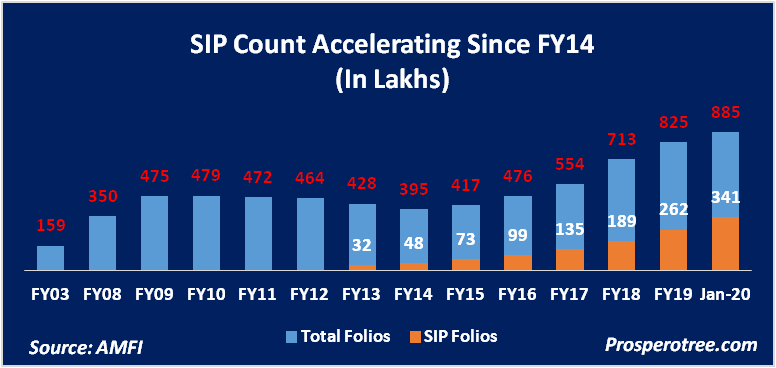

7. Mutual Funds: The mutual funds industry has seen a dramatic increase from Rs. 1 lakh crore to nearly 25 lakh crore in Mar2020. Even though the growth is phenomenal, there are just about 8.85 crores people holding at least one mutual fund folio. India today stands at a juncture where the size of the mutual fund industry can see quantum leap over the next decade.

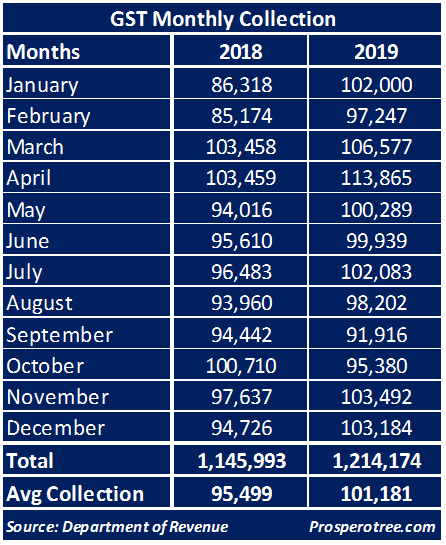

8. GST Registration: With GST now implemented in India, one can have a fair understanding of the number of decent-sized businesses in India. With the kind of data that the government will collect over time, timely action in channelizing policies can now take place more easily. For instance, there are a total of 1.22 crores GST registrations collecting and depositing with the government an approximate amount of Rs. 1.01 lakh crores a month.

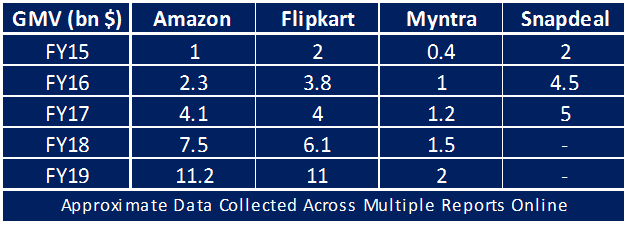

9. Online Shopping: We are already witnessing a massive displacement of businesses due to the advent of online platforms. If you talk to any traditional businessmen, you would most likely figure out the pain his business is going through. Though most people end up cursing the government for this painful period of adjustments, the real reasons for many are due to the large shifts in consumer habits from physical market place to the online market place. Some of the below points may help you understand the level of displacement of businesses that would have taken place from the physical market place to that in the online market place of few very large players like –Amazon, Flipkart, Myntra and Big-Basket.

Conclusion: If you holistically think about all of the above patterns, one clear point that emerges is that India is undergoing the financialization of the economy. Not only does it influence business models and economic policy, but also impacts people’s behavior and habits. The three major trends for investors to be mindful of are:

- The Market place is shifting from Physical Market to Online Market

- Payment methods are shifting from Physical to Electronics (Credit Card, Wallets, UPI)

- People are looking to increase financial assets as a portion of their surplus.

Though a lot of this can be brushed off as already been discovered, investors in search of long term opportunities should not ignore these megatrends, as by definition, they tend to last for a very long time, sometimes decades.