Housing Finance sector has seen one of the most secular bull runs in the past, with loan book of banks and Housing Finance Companies (HFCs) growing at CAGR of 20% and 24% respectively over the past 10 years. Prospero Tree had also written on Housing Finance Stocks - Will the Dream Run Continue? This boom was led by accelerated urbanization and increasing affordability of the salaried class. It’s only recently that we are seeing early signs of saturation in large metros like Mumbai, NCR, Ahmedabad, etc.

However, the housing boom is far from over and we believe that over the next 10 years, the activity will shift towards the affordable housing space - mainly in smaller towns and peripheries of large cities. HFCs such as Gruh Finance, Repco Home Finance and Shriram City Union Finance remain well positioned to capture this impending boom.

Opportunity Size and the Addressable Market

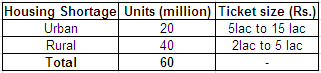

The new Government at the Centre has unveiled its Big Bang vision of "Housing for All by 2022" in which it aims to provide 60 million affordable housing units by 2022 at an approximate cost of Rs. 108 trillion. This will translate into an additional financing opportunity of Rs. 800,000 crores, almost equivalent to the current size of housing finance sector!

Housing for All - Targets for 2022

Source: Budget 2015

The rural opportunity may not be material for HFCs as they do not have adequate presence in those areas, nor would they be comfortable with the limited credit appraisal that can be done in rural areas. Within the urban opportunity, 56% of demand stems from the Economically Weaker Sections (EWS) category which is again difficult to appraise. The other 44% of the demand originates from Low Income Group (LIG) category where small HFCs like Dewan Housing, Repco Home Finance, Gruh Finance and Shriram Housing are active.

Housing Finance Landscape - Banks and HFCs

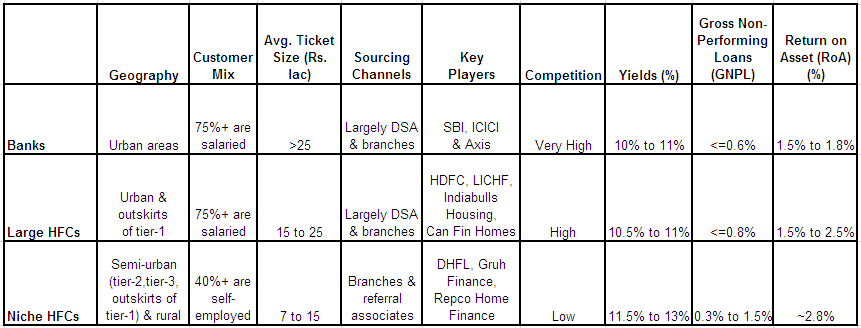

As of FY14, banks have 60% market share while HFCs account for the remaining 40% share. The HFCs can further be sub-divided into the large HFCs which have models similar to banks and niche HFCs which have a unique business model. The table below highlights the subtle differences between each of these categories

Housing Finance Landscape - Diverse Business Models of Banks, Large & Niche HFCs

Source: Company filings

- Banks - They are by and large focused on highly competitive salaried customer segment in the urban areas. These are typically low risk customers as formal income documents are available and therefore, credit appraisal becomes simpler. The DSA is the primary sourcing channel and ticket sizes of loans are relatively larger by virtue of loans being disbursed to urban areas.

- Large HFCs - The business model of large HFCs like HDFC and LICHF is similar to that of banks except that because of their focus on a single product (housing finance – home loans, LAP, developer loans), they are able to offer faster and superior service quality vis-à -vis banks.

- Small/ Niche HFCs - Niche HFCs like Gruh, Repco and Shriram Housing have a relatively differentiated business model. Unlike banks and large HFCs, they target self-employed customers in semi-urban (tier-1 outskirts, tier-2 & tier-3 towns) areas which are under-penetrated markets with little competition. They have developed capabilities and systems to appraise this relatively difficult self-employed segment without putting their asset quality to high risk.

Prospero Tree View

The next 10 years will belong to players that can operate in the affordable housing space, just as the past 15 years belonged to players who financed housing in large cities. HDFC, LIC Housing Finance and certain private sector banks were the leaders in urban housing finance boom of 2000-2014 while players like Repco, Gruh Finance and Shriram Housing could be the leaders of the affordable housing boom.

While there are multiple challenges in the affordable housing space such as land acquisition and lack of adequate policy incentives for developers, the new government is slowly trying to address them. Players mentioned above have developed expertise in this segment and stand to benefit from any positive steps taken by the government.

We have recommended Repco Home Finance and Shriram City Union in the past and we continue to like them. These reports can be accessed here - Investing. We will try and point out attractive opportunities that may arise in the due course of time. Watch out our Investing section for stock specific updates.