Bankex - the index tracking the performance of the leading listed banking stocks has delivered 65% returns in CY2014. In the same period, Axis Bank and Yes Bank's stock prices have nearly doubled while stocks of State Bank of India, Punjab National Bank and Bank of Baroda have delivered ~70% returns. However, the valuation gap between private and PSBs continues to remain wide. While there are multiple reasons for this difference, Prospero Tree enlists the 5 most important factors - liability franchise, loan book profile, fee income profile, operating cost structure and asset quality. This article will help you understand the nuts and bolts of the aforementioned factors on the performance metrics of a bank.

1. Why Public Sector Banks (PSBs) earn Low Yields on their Loan Book?

Generally, yields or interest rates on loans are related to the risk associated with the loan product and the borrower™s ability to repay the loan. For instance, interest rates on home loans, a secured product (property is provided as a collateral) range between 10% to 12% while interest rates on personal loan, an unsecured product, vary between 13% to 16%. Also, corporates with higher credit rating, implying lower risk of default on loans, are charged lower interest rates on their borrowings.

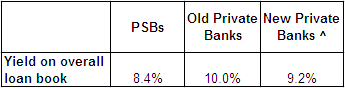

Yields on Loan Book Private Banks enjoy Higher Yields

Source: Company filings

^ New Private Banks are Kotak Mahindra Bank, Yes Bank, IndusInd Bank in the context of this entire article.

The above exhibit shows that yields of PSBs are lower vs. their Private peers. It is only natural to expect that PSB loans carry lower risk due to the lower interest rates it charges. However, the reality is quite opposite; it is common for PSBs to charge lower interest rates even in cases involving higher risk as lending decisions could be driven by political compulsions:

a) The PSBs may be forced to lend to certain corporates at lower yields.

b) The Govt. also uses PSBs to achieve its social objectives which could translate to lower yields – lending to Agriculture, SME & MSME segments at subsidized rates.

2. Liability Franchise – A Key Moat for Banks

Equity, Current Account, Savings Account (CASA) deposits, Term Deposits, borrowings from money markets, bond markets, RBI and other banks are the various sources of funds for a bank. It is desirable to have a larger share of CASA deposits as:

a) Its a stable source of funds Theoretically, the maximum maturity period of CASA deposits can be infinite while that of term deposits and money market borrowings can be 10 years and 1 year respectively. Even during an economic downturn, banks like SBI, HDFC, Axis with a 42%+ CASA share (as on FY14) have always had a stable funding profile while banks like Yes Bank (22% CASA), Kotak Mahindra Bank (32% CASA) with low CASA share and which are heavily dependent of wholesale funding face headwinds in their funding profile.

b) CASA is a cheap source of funds – 0% interest is paid on CA deposits while 4% to ~7% interest is paid on SA deposits. Â

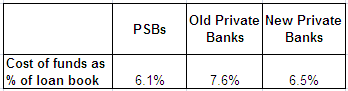

Cost of Funds PSBs enjoy Low Cost of Funding Advantage

Source: Company filings

The above exhibit clearly demonstrates that Public Sector Banks have a low cost funding advantage vs. the Private banks. Nevertheless, the PSBs have lower Net Interest Income (NII) as the low cost of fund advantage is offset by lower yields.

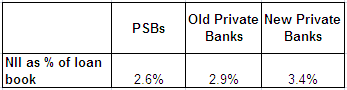

Net Interest Income (NII) – Private Banks Lead the Pack

Source: Company filings

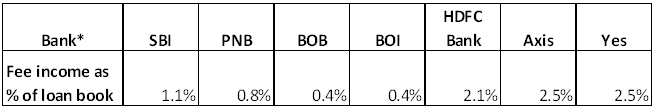

3. Fee Income Profile Why Private Banks score over Public Sector Banks?

The fee income profile of private banks is superior as unlike the PSBs, private banks have performance-based incentives for employees making cross-sell a quintessential feature of banking relationship with customers. Typically, Private Banks have a dedicated and more aggressive analytics’ team which provides income maximization frameworks and tracks cross-sell efficacy through metrics such as Products Per Customer (PPC).

Private Banks Record Superior Fee Income Profile

Source: Company filings (FY14)

SBI State Bank of India; PNB Punjab National Bank; BOB Bank of Baroda; BOI Bank of India

In Private banks, a robust back-end infrastructure aids in providing a seamless banking experience to customers through various traditional and alternate banking channels – Branch, ATM, Phone Banking, Mobile Banking and Digital channels. This enables Private Banks to provide relatively better customer service thereby leading to sticky customers having a wider range of banks’ product offerings.

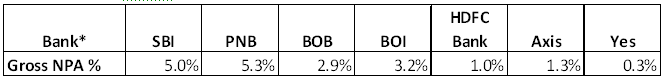

4. Asset Quality PSUs Laden with Higher Levels of Stressed Assets

Stressed assets (Non-performing assets combined with restructured assets) constitute a relatively large share of the loan books of PSBs as credit appraisal process may not be as stringent. Government influenced lending and appointment of Board of Directors in PSBs could lead to less oversight from Board which in turn could lead to bad/loose credit decisions in PSBs.

Asset Quality Yet Another Weak Spot of PSUs vs. Private Banks

Source: Company filings (FY14)

*SBI – State Bank of India; PNB – Punjab National Bank; BOB – Bank of Baroda; BOI – Bank of India

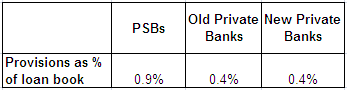

These higher Non-Performing Assets (NPAs) translate into higher provisioning costs thereby denting the profitability.

High Provisioning Costs Crimps the Profitability of PSBs

Source: Company filings

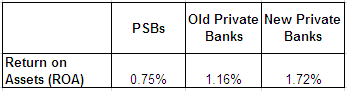

The Return on Assets (ROAs) of PSUs is low due to lower yields on assets, lower fee income and high provisioning for stressed assets.

Low RoA of PSBs due to Low Yields, Low Fee Income & High Credit Costs

Source: Company filings

Prospero Tree View

Over the years, PSUs have been losing the market share in both, assets and deposits, to private banks as they are nimbler and are able to offer better service quality vis-Ã -vis their PSU rivals. In order to read more about the declining market share, you may click here - . Going forward, competitive pressures for deposits from small banks, payment banks and extant private banks could further erode the low cost funding advantage of PSUs. Feeble fee income profile and not-so-stringent credit appraisal process only further prevent PSBs from registering higher returns.

Some structural reforms could go a long way in improving the competitiveness of PSBs – longer tenures of CMD/CEOs ensuring continuity in bank’s strategy, doing away with political interference in appointment of key management personnel and lending decisions, performance-linked-incentive structure for employees, compensations in line with those of Private Banks & implementation of robust processes and systems. We will keenly watch for changes implemented by the new government and point out investment opportunities in this space as and when they arise. You can also read our stock recommendations on financial companies here.