"Happiness is... just one more pair of shoes"

With India's consumerist, brand-cum-fashion conscious young population living the above mantra, branded footwear retailers in India have experienced a fabulous surge in demand over the last couple of years. Bata, the current leader in the branded footwear segment in India, has been a key beneficiary of this trend. After registering negative Profit After Tax (PAT) from 2002-2004, Bata scripted a terrific turnaround story and went on to achieve the numero uno position in this industry. Prospero Tree traces Bata's journey below.

Bata's Financial Snapshot - Reflection of a Turnaround

| CY07 | CY08 | CY09 | CY10 | CY11 | CY12 | CY13 | |

| Sales Rs. Cr | 880 | 998 | 1,100 | 1,273 | 1,564 | 1,872 | 2,097 |

| EBITDA% | 9.3% | 10.2% | 12.6% | 14.4% | 16.7% | 16.3% | 16.8% |

| PAT% | 5.8% | 6.1% | 6.1% | 7.4% | 7.6% | 9.2% | 9.1% |

| RoCE% | 22% | 25% | 31% | 37% | 37% | 36% | 35% |

Source: Company filings

1. Product Portfolio Overhaul - Shifting Gears to Premium Brands

Bata deals with over 15 owned and licensed brands, spread over plastic, rubber/ canvas and leather segments in ascending order of selling price. During CY01 to CY04, the low margin rubber/canvas segment contributed to half the volumes and 30% of sales while in CY13, the highest margin leather footwear contributed to 50%+ volumes and 65%+ of sales. Increasing premiumization has led to average realizations improving from Rs. 183 in CY06 to Rs. 400+ in CY13.

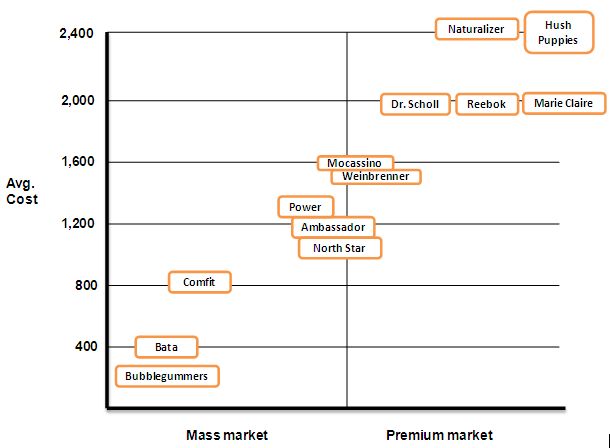

Bata's Brand Map

2. Revamp of Store Formats

Bata operates under broadly two store formats - 'Family' and 'Flagship' stores. Family stores are low on aesthetics and predominantly stock low margin plastic, rubber and canvas footwear while flagship stores are more on the lines of Bata's international store designs, layout and aesthetics & majorly stock high margin leather footwear. In consonance with the premiumization theme, it became mandatory to open all new stores in metros with a minimum 3,000 sq. feet area. Several existing stores were renovated and closed basis the commercial viability.

Bata's market share was also adversely affected due to low store operating hours - some stores were operational for only 5.5 days from 10 am to 7 pm and were closed on Sundays. This shortcoming was addressed by a change in company-wide policy -since 2007, all stores remain open for 365 days a year from 10 am to 9 pm.

3. Expansion of Distribution Network

Widening reach is a key lever for revenue growth and Bata has successfully done so by deeper penetration in metros, tier 1 & tier 2 towns through appropriate store formats. Bata has an enviable network of 1,200+ stores across 500+ cities through Exclusive Brand Outlets (EBOs) and Shop-in-Shop outlets in premium department stores. During CY04 to CY08, Bata maintained a run rate of opening 60 stores annually and also closed some of its less profitable stores. Its brands are also sold through Multi Brand Outlets (MBOs) and online channel.

4. Employee Worries Abate - Overstaffing and Unionization

Until CY04, Bata was significantly overstaffed which squeezed its margins. In order to rationalize the workforce, VRS was issued which reduced number of employees by 37% from 7,854 in CY07 to 4,944 in CY13.

Additionally, circa CY04, the company had 8 recognized trade unions which hampered productivity and compounded the problems. The concept of Commission Agents (K-Agents) was introduced in 2007 to keep these union problems at bay. A K-Agent would be hired as a Store Manager who would be in-charge of running the store, hiring and paying the employees of the store. The K-Agent was incentivized basis the turnover of the store. However, the store rent, furnishing and employee training costs were to be borne by the company.

All these measures led to a steady reduction in its employee costs as % of sales from ~21% in CY07 to 10.2% in CY13.

5. Re-engineering Manufacturing and Supply Chain

Bata restructured its supply chain's hub and spoke model and utilized more automation & technology at its stores and manufacturing plants thereby enabling real-time tracking of inventory. This kept operational costs under check and reduced its inventory holding period which in turn led to a reduced Working Capital Cycle (except for a deterioration in CY12 & CY13)

Improving Working Capital Cycle

| CY07 | CY08 | CY09 | CY10 | CY11 | CY12 | CY13 | |

| Inventory Days | 259 | 221 | 197 | 184 | 197 | 194 | 224 |

| Receivable Days | 10 | 10 | 8 | 9 | 7 | 9 | 9 |

| Creditor Days | 157 | 137 | 128 | 133 | 119 | 92 | 110 |

| Working Capital Cycle Days | 112 | 94 | 77 | 60 | 85 | 111 | 123 |

Source: Company filings

Prospero Tree View

After Bata rebooted in CY04, it has turned the corner by relentlessly focusing on achieving growth and rationalizing costs through the implementation of above measures. Its stock price movement has also, to an extent, mirrored Bata's transformational journey - stock price has risen from the lows of Rs. 27 in CY03 to *~Rs. 1,300 in CY14.

Undoubtedly, Bata has successfully turned around by building a formidable brand in the fast evolving footwear market. Its revenue growth has witnessed some moderation over the past five quarters on account of overall slowdown in the Indian economy. However, we at Prospero Tree believe that Bata is a brand built to last and will post a strong revival once the economy is on an upswing. Bata can certainly find a place in the portfolio of very long term investors.

* Stock price as on 10-Oct-2014