Whilst evaluating a potential stock investment, investors invariably would have focused on the quintessential company elements – financial statements, tracking the quarterly results, industry outlook and management’s guidance on the company’s prospects. But there are some other equally important factors which when overlooked, could prove to be fatal chinks in the stock-analysis armor. These often ignored elements have been outlined below:

1. Corporate governance issues

Corporate governance is closely linked with the level of transparency and disclosures of financial as well as non-financial transactions. These issues are more pronounced in companies having a greedy management and lax policies and controls.

- The recent Rs. 5,600cr NSEL scam involving Jingesh Shah, the poster boy of commodity markets, was committed through its subsidiary NSEL and management was hand-in-glove with promoter.

- Revenues and profits for Satyam Computers were overstated by US$1.5bn. After the shocking scandal was revealed, share prices tanked and caused investors a loss of Rs.14,162cr. While it's not always easy to spot corporate governance issues, certain practices of management should raise red flags. Investors should watch out for large related party transactions, frequent change in auditors or accounting policies and regulatory observations against the company.

2. Statutory auditor's reports

These reports can provide information on company’s financial and operational challenges - questionable accounting policies, default in loan payment obligations, lacunae in company’s internal controls, inadequate provisioning for doubtful debts, receivables, payables, diminution in value of investments , disputes with banks, suppliers, regulators, customers, to name a few.

This report is a part of company's Annual report; qualified statements are issued by auditors if there a deviation.

3. Contingent liabilities and non-provisioning

Contingent liability is a potential liability where there could be an economic outflow in future due to event of the past; it is disclosed in the annual report but not recognized. Contingent liabilities arise due to bank guarantees, disputed taxes and excise duties. A few illustrations below will highlight the risks associated with non-provision for contingent liabilities.

- Department of Telecom (DOT) served a notice to Bharti Airtel demanding Rs. 5,200cr for levy of one-time spectrum fee. Bharti Airtel had not made any provisions for this fee.

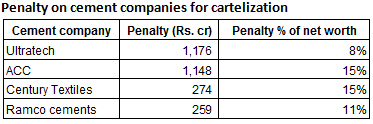

- CCI had imposed penalties on several cement makers for alleged cartelization. Cement companies have treated this as a contingent liability but not made any provisions against it. This matter is yet to be resolved.

In the above type of cases, if the final decision is not in the company’s favor, then it could materially impact their profitability. A discerning investor should be wary of these practices.

4. Low promoter/ institutional holding

A promoter with a high stake in the company would channelize efforts towards delivering superior results which would directly reward the promoter with monetary benefits - dividends and stock price. The promoter could be individual or corporate bodies/ institutional investors or both. The below companies with high stakes have delivered superior returns.

But this relation need not necessarily hold true in case of a professionally run company such as L&T. Also, in case of a bank, RBI directive mandates that no single individual/ entity should hold more than 10%.

Prospero Tree view

As minority shareholders, one may not be in the know of day-to-day business activities of the company. Also, it’s impossible to always be able to figure out an impending corporate mis-governance issue as demonstrated by the high profile frauds - auditors were complicit with Satyam’s management in its accounting fraud and regulators were also unable to unearth the NSEL scam for a long time.

In this backdrop, a thorough due diligence assumes even greater importance. While evaluation of standard elements combined with the above parameters would still not be a foolproof method of screening stocks, but these indicators could serve as potential red flags. As a thumb rule, avoid penny stocks, companies with dubious management and non-transparent policies and disclosures.