"Running an airline is like having a baby - fun to conceive, but hell to deliver" - C.E. Woolman, Founder, Delta Airlines.

The chronic dismal state of the Indian aviation industry - Kingfisher Airlines' (KFA) fall from grace and consistent losses recorded by the likes of Jet Airways, SpiceJet and Air India only serves to vindicate C.E.Woolman. Historical analysis of global aviation industry suggests that for every two years of profits, aviation industry has posted 3 to 5 years of losses and that at an aggregate level, the industry has made negligible profits over the past century.

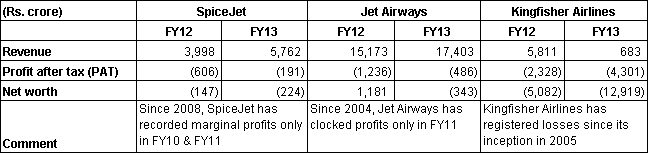

Financial snapshot - SpiceJet, Jet Airways and Kingfisher Airlines

Source: Company filings, Prospero Tree research

Source: Company filings, Prospero Tree research

Intensifying competition, elevated fuel prices & taxes to remain a drag on profits

Aviation, once an oligopolistic industry in India, has now become a crowded space post the opening up of the sector to private players in 2005. To add to the increasing competition, supply has outpaced demand since the last three years - capacity utilizations have hovered around ~75% in FY12 & FY13 vs. ~85% in the previous years. This coupled with high fuel prices and taxes have ensured weak economic performance by all the airlines. In case of an economic recovery, aviation players may enjoy a year of two of modest profits. However the above discussed problems are chronic and will ensure that no meaningful money is made by any player in the long term due to the following reasons:

Competitive pressures continue to erode pricing power

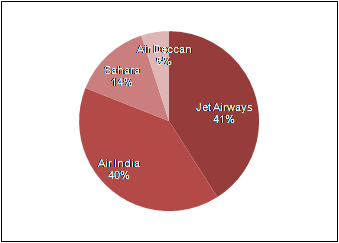

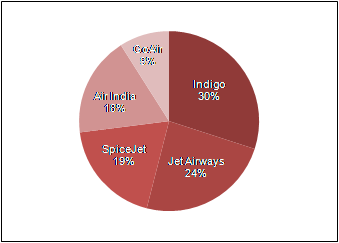

The introduction of LCCs like Air Deccan, SpiceJet & GoAir completely altered the competitive landscape with LCCs gaining domestic market share from incumbents - Jet Airways & Air India. Air Asia India, another LCC (launched commercial operations in June 2014) and Tata Singapore Airlines (expected to operationalize by September, 2014) will only further fuel price wars. Airline players are currently sacrificing margins for market share gains. However, a revival in margins looks like a distant goal.

|

The big boys dominated the aviation space in FY05 (Domestic market share in FY05)... |

...while the LCCs emerged as a dominant force in FY14 (Domestic market share in FY14) |

|

|

Source: Prospero Tree research

-Unfavorable cost structures - High fuel prices and taxes

Jet fuel costs constitute ~40% of total costs. In India, jet fuel tax is a state subject with taxes varying from 4% to as high as 30%. Foreign airlines are more cost competitive vis-vis India as average annual jet fuel price in India is 40%-60% more expensive than its foreign peers. The softening fuel prices and strengthening rupee have to a certain degree eased the cost pressures but it's not material to positively impact the profitability. This is further compounded by the inability of the airline companies to pass on the rising costs completely to the customers.

Prospero Tree view - Opportunities for investors

Kingfisher Airlines, SpiceJet & Jet Airways are the only three listed aviation companies. Given that they have fallen 60-90% from their all time highs, it might appear as a buying opportunity to an unseasoned investor. However, we recommend against it as Kingfisher has ceased operations and there is no revival on cards while others continue to make operating losses.

There could be sharp trading rallies in aviation stocks if the economy revives but our opinion is that it will be temporary and it would be difficult for an investor to time such a rally and to make a timely exit from these stocks. We believe that long term economic health of these firms will remain weak and there are plenty of good investment opportunities in other sectors where investors can bet their money. Aviation stocks can at best be trading bets and not investments.