In the euphoria surrounding the Narendra Modi led Government, the cement stocks have been on a frenzy since March, 2014 - large-cap stocks like ACC, Ambuja and Ultratech have gained 30% to 50% while mid and small cap stocks like Heidelberg, Sanghi, Orient and Ramco have gained 70% to 150%. With this secular rally, the spotlight is back on the cement sector and its future prospects. Should you enter these levels? Is there more juice left in these stocks at current valuations? Read on to find out.

Policy focus and economic recovery to ensure revival in cement demand

A relative slowdown in housing and infrastructure activity, the key drivers of cement demand, led to a tepid 5.5% CAGR in cement consumption in the last 4 years. The 20%-25% cut in Govt. spending on key schemes like NREGA, Indira Awas Yojna, Pradhan Mantri Gram Sadak Yojna, etc further dampened the demand.

Cement - A cyclical play on realty and infrastructure activity

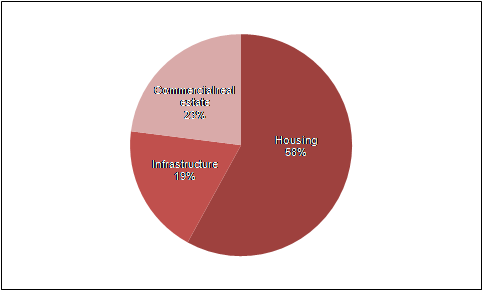

Source: Prospero Tree research (Commercial Estate 20%, Housing 58%, Infrastructure 19%)

In a bid to revive the sagging economy, the NDA Govt's manifesto has laid a massive thrust on infrastructure development with a focus on below areas:

- Urbanization - Development of 100 new cities and satellite towns

- Rural housing - Low cost housing programs to ensure cemented (pukka) house for every family by 2022

- Infrastructure - Development of industrial corridors connecting key metros, new metro rail projects, dedicated railway freight corridors and integrated township projects and fast-tracking of stalled infra projects

The renewed optimism and above policies will set the stage for a strong cement demand recovery. We are already seeing some signs of demand pick-up in South India.

Earnings performance of cement companies to remain strong over next few years

Strong long-term demand during the boom period of 2004-2007 fuelled by the high GDP growth rates led to a massive ramp-up in production capacities. But, with the onset of slowdown in 2008, demand moderated and resulted in excess capacities. This triple whammy of oversupply, sluggish demand and debt battered the profitability and balance sheets of several cement companies. With the hope of revival in cement demand, this is set to change and profitability is set to improve.

1. Volume offtake to accelerate; capacity utilizations to trend upwards

Manufacturing plants having idle and underutilized capacities incur high fixed costs. In the current scenario, an augmenting demand firmly anchored on Govt's policies, will result in volume growth which will improve capacity utilizations (currently stands at ~67% pan India) and thus benefit the companies by providing operating leverage. Cement demand in South, which has faced the maximum headwinds, could witness an uptick after the split of Andhra Pradesh into two new states.

The average pan-India cement prices have risen by 9-10% in Q1FY15 while prices in South have witnessed a spurt of ~20% in the last 1 month. Notwithstanding the monsoon deficit worries, a combination of volume growth and increase in cement prices will positively impact the topline of cement-makers.

2. Subdued cost concerns Stable coal price, benign freight hikes not a showstopper

Fuel and freight costs account for nearly 40% to 60% of total costs. Given that coal shortage issues are likely to be addressed by the new government, cement companies can gradually reduce the dependence on high cost imported coal. The recent 6.5% hike in rail freights and the impending rise in diesel prices would be in line with expectations. Currently, the industry EBITDA margin is at historic lows of ~15% which is expected to improve as revenue increases and costs are kept under check.

Prospero Tree view - Opportunities for investors

The outlook for cement sector is significantly better given the possibility of economic revival over the next three years. Cement stocks have already rallied 50-100% in the anticipation of economic recovery. Valuations of large cap cement companies such as ACC, Ambuja and Ultratech appear to be stretched with most of them quoting at nearly 2X its replacement cost. We would recommend investors to wait for 15-20% correction before entering them.

The Prospero Tree team is closely tracking large, mid and small cap cement companies - ACC, Ultratech, Shree cement, India cement, Ramco Cements, Prism, Heidelberg, Mehta Group, Sanghi, Mangalam to name a few. Mid-cap cement companies appear to be attractively valued and offer an investment opportunity. Follow our stock recommendations to know about specific stocks that we recommend.