"Aiming for too much too soon is tantamount to courting a disasterÂÂ┬Ø. Dhanlaxmi the 85-year-old private bank seemed to have shrugged off this wise advice and grabbed headlines for all the wrong reasons. Prospero Tree unravels the Dhanlaxmi story for you.

2004 to 2009: Feeble growth

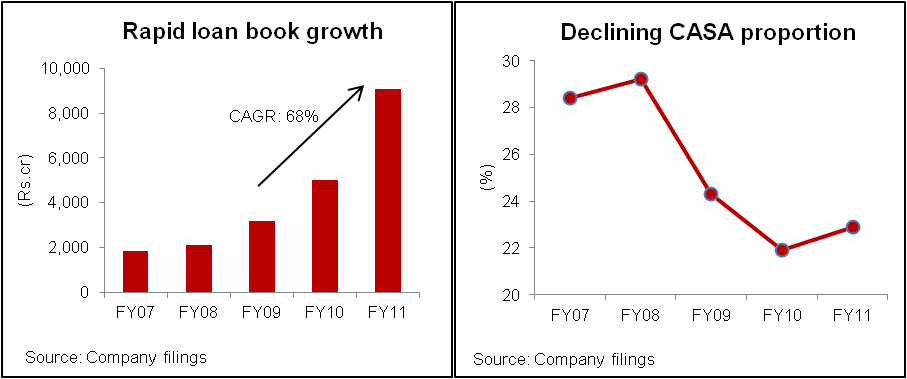

During FY04-09, the bank witnessed very subdued growth in its loan book coupled with declining CASA proportion from 28% in FY07 to 24% in FY09 which was attributed to an inexperienced management team.

Meteoric rise with new management FY09 to FY11

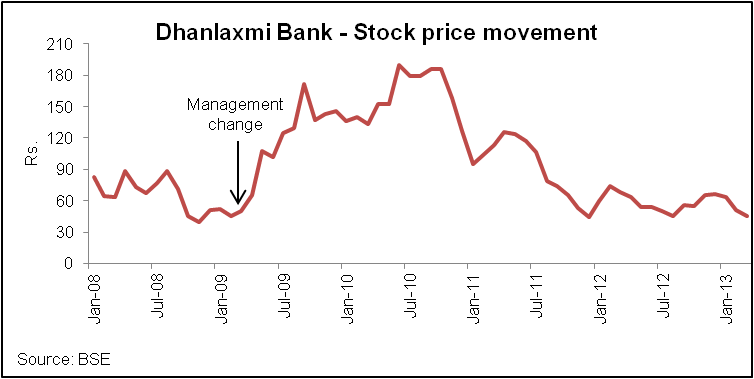

A new management team was appointed in FY09 under the leadership of ambitious Amitabh Chaturvedi, CEO who put the bank in an aggressive growth trajectory.

- Rapid loan book expansion undertaken at CAGR of 68% over FY09-FY11.

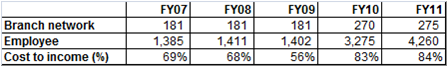

- Branches increased by 1.5x and recruitment of non-unionized employees trebled the employee count to 4,260 in FY11.

- The bank also heavily invested heavily in technology upgradation and in building a plush Head Office.

The story looked promising - phenomenal super-growth in business but then it seemed to have hit a speed-breaker.

What went wrong with the expansion plans?

ALM mismatches - Dhanlaxmi's weak CASA profile compelled it to raise bulk market borrowings to finance its rapid loan growth. This resulted in Asset Liability Management (ALM) mismatches leading to rising cost of funds and low margins.

High operating costs - Rapid branch expansion and a trebled workforce significantly increased its operating costs. Its cost-to-income ratio increased from 56% to 84%

Employee unrest Severe employee unrest among the old, unionized staff resulted in low productivity.

Tipping point in FY12

All these high costs could be absorbed in the bank profitability as long as the credit growth was intact. Then, macro problems surfaced in India in FY12. Dhanlaxmi credit offtake slowed, borrowing costs and operating expenses surged and the bank reported losses for the next three quarters. The flamboyant CEO resigned and the old Union took over the bank management and is currently in charge of bank operations.

Prospero Tree view

The bank is currently in a state of deadlock it needs a loan growth spurt to contain the impact of high operating costs but it doesn't have the pre-requisite capital for that growth (Tier 1 capital = 9% as on Dec12) and investors are unwilling to pump in the capital.

Stock trades at 0.6x BV. In order to attain profitability, the bank will have to raise capital or reduce costs by shutting down branches and lowering the employee count. If the bank can execute either of the two possibilities, it can turn out to be positive for Dhanlaxmi.