The history of global investing has time and again taught us all about the mistakes of extrapolating the recent past into the distant future. However, most investors in India are finding themselves to be extremely comfortable in doing exactly the same in the current phase of the stock market.

Jan2018 to Dec2019 – Index Performs & Investors Hurt

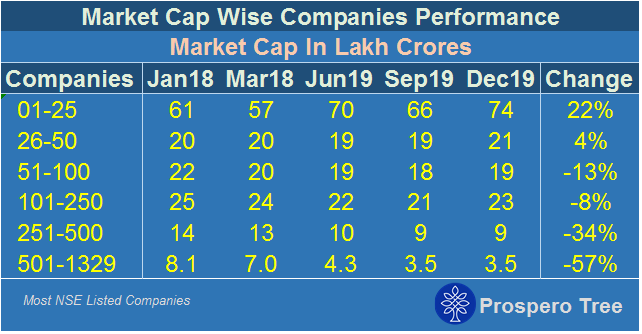

Even though the BSE Sensex and Nifty have performed pretty well over the last 24 months, a lot of investors are brutally injured in the last 24 months due to a wide fall in the stock market over the same period. As seen below, it can be broadly concluded as, “larger the company, better the performance.”

From another perspective, let’s look at the results of a study conducted by ProsperoTree on wealth creation of major NSE listed companies.

It was found that between Jan2018 to Dec2019, there has been a massive wealth destruction to a tune of Rs. 27 lakh crores across ~1100 out of ~1300 companies being studied.

What then explains the BSE Sensex and Nifty performing well over the same period? In the same study, it was found that top 30 companies by market cap had created wealth worth Rs. 22 lakh crores in the same period suggesting a massive polarization of funds moving towards extreme perceived safety.

Strong Recency Bias Established

Naturally, more and more investors are spellbound due to this recency effect. For those who are unaware, recency bias means a presumption in investors mind that whatever has been happening in the recent past will continue to happen in the future. This recency bias along with substantial fear quotient due to lower economic growth assisted by easy global liquidity has moved a large investments to perceived safety. This has created polarization in valuations and it may continue to remain so for a long period of time.

Quality Company vs Quality Investments

However, what is perceived to be safe may not really be safe over a long period of time. In today’s context, quality companies are getting completely mixed up as quality investments.

It is therefore important to understand that the one thing that comes between quality companies being called as quality investments is the price at which those investments are made.

Of-course everyone would like to invest in a market leader in a sector that is growing. However, that does not make that quality company a good investment at all prices.

Opportunities Anywhere?

The other effect of the same recency bias is that whatever has not worked in the recent past will not work for a very long time in the future. This along with loss aversion mindset has led investors to completely move out and shun away from all mid and small category companies where the near term visibility of earnings is even slightly uncertain.

However, there are many companies doing credible work in their respective sectors having a decent probability of adequate success and are now available at attractive or reasonable prices.

This is where investors willing to understand those companies along with some courage to commit long term capital may find opportunities that have true attributes of lower real risks and higher potential rewards.