It's easy to get lost and confused in the myriad of options available in the health insurance space. The insurance regulator, IRDA, directed the insurance companies to standardize their basic health insurance offerings which were implemented last year; you might have had to fill a form accepting the new basic health covers and could have witnessed higher premiums, too. You may have an existing health insurance policy or may have just bought one in a jiffy towards the end of the previous financial year to ostensibly plan your taxes or you don’t have one at all. In either case, Prospero Tree will aid you in selecting and evaluating the health policies across various parameters, through this article.

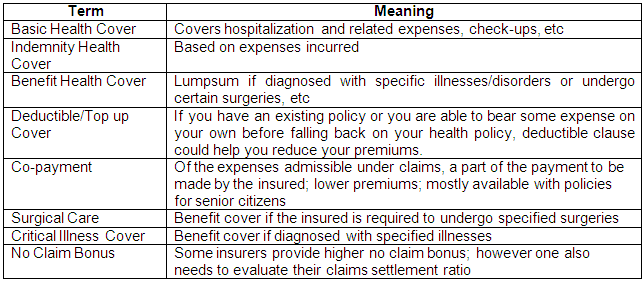

It is now possible and easy to change insurers while simultaneously retaining most of the basic features and benefits. Further, age slabs have also been standardized for increasing premium rates. First let us introduce a few terminologies:

In addition to the aforementioned variables, one also needs to compare claim settlement ratio of the insurers, admissible expenses for hospital bed, convalescence expense etc.

Prospero Tree View: What Type of Health Policy should you choose?

After a thorough analysis of the several available health policies, we realize that instead of relying on a single health policy, the best course for an individual is to have:

- A small basic policy from a public insurer (since their claim ratios are the highest)

- A higher cover with deductible equivalent to the basic cover / group cover available from a private company

- A benefit policy for critical illness/disability (most life insurance policies do not cover or cover is inadequate; also insurers cover 13-20 critical illnesses, please do your due diligence)

How to Select Family Floater Policies?

Family floater policies provide health coverage for the entire family. The premiums in a family floater policy depend on the age slab in which the age of the oldest member falls. Please be careful because we saw wide variations in premiums in relation to the age of the insured. For instance, with some insurers, the family floater for 2 could be more expensive in age slab 46-50 years than sum of individuals. We also suggest a similar course if you decide for family floater:

- Basic family floater from a public insurer

- Top up cover from a private insurer

- Critical Illness Cover

Are Multiple Policies Necessary?

An earlier simple procedure like child delivery could now cost Rs. 20,000 - Rs. 3,00,000; further given the lifestyle and food habits of the youth and working generation, the health issues will set in at an earlier age which will send the medical expenses soaring. In our opinion, a family should have a minimum health cover of Rs. 5,00,000 for each individual and an equivalent cover under critical illness.

We also estimate that the premium for a family floater of 4 could remain within tax benefit limits till the age of the oldest insured in the plan is upto 45 years. However, for senior citizens, insurance will always come at a high cost. Our suggestion to you is that if you are working, please inculcate saving habits so that you have a sufficient corpus at the time of your retirement to avoid being dependent on expensive health insurance to cover possible health expenses!!

You may also want to read:

1) ULIPs - Version 2.0 - Changed for Good

2) Insurance - Wisdom in simplicity

3) ULIPs - Low on insurance, high on charges

4) Insurance - Innovation and complexities