We had first recommended to Buy Lloyd Electric at Rs. 115 on 25-Jul-2014. The first report can be accessed here Lloyd First Report. We again suggested a buy on Lloyd Electric at Rs. 137 after it announced its 1QFY14 results. After our recent interaction with the management, we further recommend a BUY on Lloyd at CMP of Rs. 152 with a target price of Rs. 275 – Rs. 300.

After our interaction with the management, we were able to solve a lot of our questions and get clarity on working capital requirements, segment-wise margins, and segment-wise growth among others. So here is the story of Lloyd in further detail.

1. Sources of Revenue: As discussed in the first report, Lloyd’s revenue segments are:

Consumer Durables sales under Lloyd Brand

AC sales to OEM

Heat Exchangers & Radiators

Railways AC solution

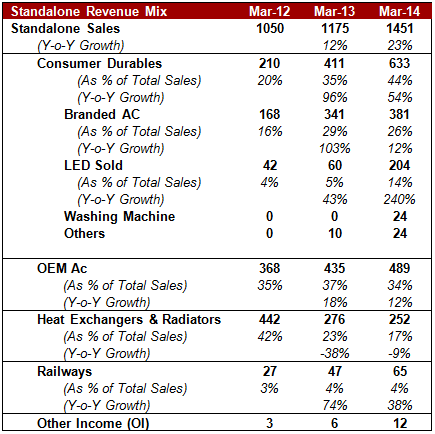

The important point to note is that the company has laid a substantial thrust on its consumer durables business. From nearly NIL revenues from its consumer durables in 2005, the segment is now contributing 44% of standalone sales. In the last 2 years, consumer durables sales has more than trebled from Rs. 210 crores in FY12 to Rs. 633 crores in FY14.

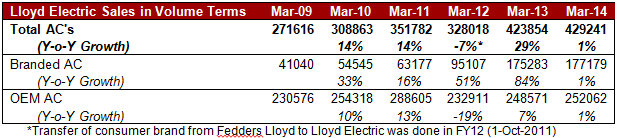

2. Branded AC sales will be higher than OEM sales: Lloyd started as a manufacturer of AC coils and soon started making entire AC sets for the branded players like Voltas, Whirpool, Onida, Godrej, Croma, etc. One third of Voltas’ total home AC requirements are being supplied by Lloyd.

Post 2011, Lloyd started focusing on room AC market under its own brand when all the consumer businesses of Lloyd group were merged into Lloyd Electric & Engineering Ltd. It was at this time that the brand name and logo of “Lloyd” was also transferred to Lloyd Electric and Engineering Ltd. A look at the sales figures under its own brand against that for OEMs will give a clearer picture. We expect that the AC sales under its own brand will be higher than that of OEMs.

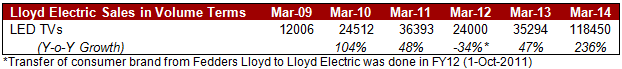

3. LED TVs and other consumer durables: Lloyd is trying to position itself as a consumer durables player with a large basket of other products mainly LED / LCD TVs, washing machine, refrigerators, etc. It would be surprising to know that Lloyd has sold TV sets worth Rs. 200 crores in FY14 against a mere Rs. 42 in FY12.

Lloyd follows an outsourcing model for all consumer durables apart from ACs. This makes its entry into other consumer durables fairly risk free as large investments are not required in the form of capex. Due to this, the company also intends to grow in the non-AC consumer durables space at a much faster rate than all other business segments. For instance, the company intends to sell LED TVs worth Rs. 300 crores; 50% higher than what they did in FY14. The other consumer durable product including washing machine has just scratched the surface with sales worth Rs. 50 crores only.

4. Working Capital to remain at current levels due to high growth and push strategy: We would like to highlight the reason for Lloyd’s high working capital requirement. We also think that a growing company like Lloyd has no other options at this stage. So here are the reasons:

- Not so popular brand leading to higher debtor days: As Lloyd brand is not as popular as the established names like Voltas, the entire marketing setup is based on “Push” marketing. Naturally, the debtor payments are quite high. For instance, the debtor days for its dealers / distributors are between 75-90 days, whereas, the debtor days for Whirlpool and Hitachi are less than 7 days.

- High growth & expanding distribution requires higher inventory: As Lloyd has been able to grow much faster than its peers backed by expanding distribution network and increasing product basket, the company has to maintain relatively high inventory to cater to the growing demand.

- Integrated AC manufacturer translates to lower creditor days: Llyod manufactures entire AC sets on its own; unlike many other players who assemble the AC sets. As has been the industry practice, large raw material supplier does not provide a creditor days beyond a certain period. However, player like Voltas who source the ACs from other vendors get substantially large credit period.

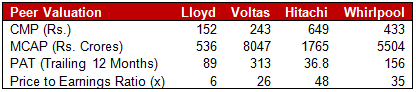

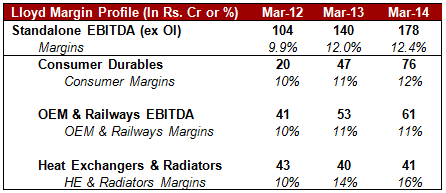

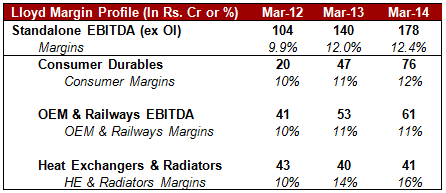

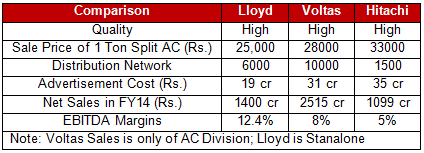

5. Higher margins compensate for high working capital requirement: Though Lloyd has a quite lengthy working capital cycle for the reason described above; its margins profile is higher than all other industry players like Hitachi, Whirlpool, Voltas, etc. Lloyd has been able to increase its margins every year since the last 3 years despite rapidly increasing advertisement and distribution costs.

Lloyd’s branded AC margins are just 1-2% higher than that of the OEM margins as Lloyd’s AC are 10% cheaper to players like Voltas and the operating leverage has yet not kicked in. However, as the brand awareness increases and operating leverage begins to kick in, profit growth for Lloyd should be much higher than the sales growth.

6. Branding efforts by Lloyd: The company has been very focused in developing its brand. For the same, the company has aggressively increased its branding budgets from Rs. 2 crore in FY10 to Rs. 19 crores in FY14. Now, the advertisement costs are quite high and are comparable with players having high market share.

7. Subsidiaries: Though the subsidiaries have contributed negatively in the past, the company believes that the operations within the subsidiaries have now stabilized and are expected to yield reasonable profits in FY15.

8. Lloyd is available at a very attractive valuation: Lloyd is currently trading at Rs. 152 with a market cap of Rs. 536 crores. With 44% of its standalone revenues coming from consumer durables segment, the company is available at a very attractive valuation of 6x price to earnings ratio. The risk reward looks very favorable.