| Name | National Aluminium Co |

| Type of Report | First Recommendation |

| Report Date | Sep 19, 2016 |

| Price on Report Date | Rs. 45 |

| Current Market Cap | Pre BuyBack: Rs. 11,600 cr Post BuyBack: Rs. 8,700 cr |

| View | Buy |

| Indicative Target Price* | Rs. 80 |

Company Background: National Aluminium Company Ltd (Nalco) is one of the largest integrated aluminium manufacturer and has been awarded a Navratna Public Sector Enterprise status. Aluminium is produced in three stages as follows:

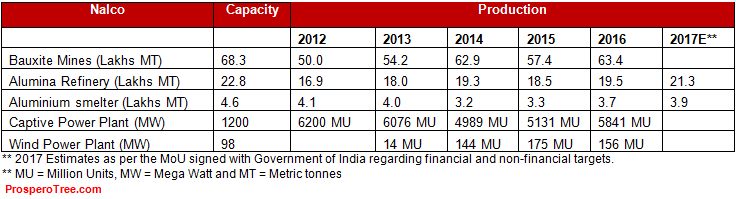

Step 1: Mining: In first stage, Bauxite Ore is mined and cleaned. Nalco has its own captive bauxite ore mines with extraction capacity of 68.25 lakhs MT per annum.

Step 2: Refining: In second stage, alumina is refined from Bauxite ore. Nalco has alumina refining capacity of 22.75 lakhs MT per annum.

Step 3: Smelting: The alumina produced is then smelted into aluminium and allied products for which Nalco has a smelting capacity of 4.6 lakhs MT per annum.

Aluminium smelting is highly energy intensive process and requires constant availability of power. For this reason, Nalco has its own captive Thermal Power Plant of 1200MW (10 X 120MW) and wind power plant of 98 MW. Nalco also has its owned Port facility at Vishakhapatnam mainly used for exporting up to 14 lakhs MT per annum and import of caustic soda.

Investment Arguments:

1. Better Capital Allocation Will Improve Return Ratios: Nalco had a cash and current investments worth Rs. 5777 crores in FY16, making it one of the highest in terms of cash to its balance sheet size. This large amount of cash on balance sheet dragged its return ratios significantly. Finally, the company decided to go for a large buy back and redeem its most expensive source of Fund i.e. Equity.

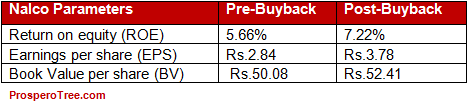

Nalco launched a large buyback program worth Rs. 2835 crores (Buyback Rate: Rs. 44 / Share) that will reduce net worth by 22% but will decrease its total shares outstanding by 25% as the buyback is done below book value and has therefore benefited the shareholders who have not tendered in the buyback. Overall,now that the buyback has completed, in coming times, it should improve the return ratios for the company.

It is important to note that the ROE still looks quite lower; however, it needs to be seen in the context of lower Aluminium prices.

2. Strong Performance Indicated By Volume Growth: Due to global slowdown, the prices of Aluminium crashed by more than 22% from $2050 in FY12 to $1592 in FY16. However, even after this, Nalco has been continuously making operating profit in each quarter. This is mainly achieved by higher operational efficiency and better utilization of assets.

As seen from the above table, Nalco was able to increase its production of Bauxite and Alumina quite substantially. Though the production of Aluminium fell in FY12-FY14, it has also increased drastically and may near 4 Lakh MT in FY17 as per the MoU signed with the Government.

3. Strong Domestic Demand: Aluminium has wide range of applications across various sectors. There is a clear uptick in the Domestic Sales of Aluminium by Nalco increasing from 2.18 lakh MT in FY14 to 2.77 lakh MT in FY16 indicating a growth of 27% in FY16. Based on various reports, the Domestic demand is likely to be strong and will lead to 6%-8% growth in volumes mainly driven by Power and Automobile sector. The assistance of a strong domestic demand and potential uptick in global economy may lead to sustainability of price in Aluminium.

4. Strong margin of safety: Currently, Nalco has a market cap of Rs. 11600 crores. However, post buy back of shares, the market cap stands at approximately Rs. 8700 crores. Even after the Buyback, Nalco remains a cash rich company having around Rs 2900 crores in cash & cash equivalent. This means 35% of market cap still remains as cash. This provides a strong margin of safety in commodity down cycle that the company is going through.

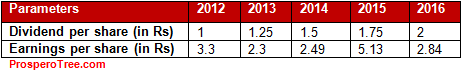

5. Increasing Dividends: Nalco has been continuously increasing dividend from Rs. 1 in FY12 to Rs 2 in FY16. At current market price Rs. 45 and dividend of Rs. 2 per share, Nalco provides a dividend yield of 4.5%. Considering its free cash flow generation around 1500 crores per year, we expect that the company will easily maintain its current dividend and may also increase it due to reduction in equity post buyback making the dividend yield even more attractive.

Valuation: National Aluminium (Nalco) is trading at Rs. 45 with a post buyback market cap of Rs. 8700 crores having a net profit of Rs 731 crores in FY16. Even if we consider reduction in other income due to reduction in cash, the volume growth should somewhat compensate the same. With improvement in return ratios, strong margin of safety, performance improvement led by volume growth improvement and dividend yield protection, we think NALCO is a BUY at current price. Looking it from a different point, Nalco is an Aluminium producing company having its own bauxite mine, Alumina refinery, a captive power plant and a port. The opportunity is that Nalco is available at a net market cap that is less than the cost of its own 1200 MW power plant.

Risk: Sharp Further Reduction in Aluminium Prices

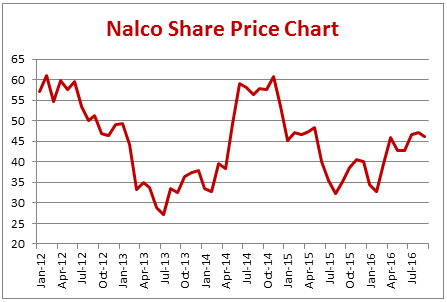

Historical Prices:

Dhruvesh Sanghvi is a Research Analyst registered with SEBI having registration No: INH000000875.

- Fresh Recommendation Reports: These reports are first-time initiation reports on the concerned stock. Usually these reports are followed by updates on the same.

- Update Reports: These reports include result update, event updates, annual report analysis and/or any other information that may be useful for the investor in relation to the concerned stock. Most of these update reports will have our current view on the same.

- Buy: This means buying the concerned stock at current market price.

- Buy on Dips: This means buying the concerned stock on the explained fall in price.

- Hold: This means holding the concerned stock until further update.

- Sell Partial: This means selling half of the existing position in the concerned stock.

- Exit: This means completely exiting the concerned stock.

4. Explanation of Indicative Target Price: Achievement of Target Price does not imply Exit / Sell Partial. We will explicitly release Exit/ Sell Partial Report at an appropriate time. If required, Indicative Target Price could be revised based upon business performance, market environment or any other important event.

DISCLOSURES by RESEARCH ANALYST UNDER SEBI (RESEARCH ANALYSTS) REGULATIONS, 2014 is as under:

• Introduction: Prospero Tree Financial Services is an independent equity research proprietorship firm of Mr Dhruvesh Sanghvi.

• Business Activity: Prospero Tree Financial Services is committed in providing honest views, opinions and recommendations on financial markets opportunities.

• Report Written by: Dhruvesh Sanghvi

• Disciplinary History: None

• Terms & Conditions: https://www.prosperotree.com/termsofuse

• Details of Associates: Not Applicable

• Disclosure with regards to ownership and Material Conflicts of Interest:

1. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services, its associates, its Research analysts hold any position in the subject company.

2. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services, its associates, Research Analysts, nor its relatives, have more than 1% ownership of the subject company at the end of the month immediately preceding the date of publication of this report.

3. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services, its associates, Research Analyst nor its relatives, has any other material conflict of interest at the time of publication of the research report or at the time of public appearance.

• Disclosure with regards to Receipt of Compensation:

1. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services or its associates, or Research Analyst has received any compensation or other benefits from the subject company or the third party in connection with the research report in past twelve months.

2. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services or its associates, or Research Analyst have managed or co-managed public offering or securities for the subject company in past twelve months.

• Other Disclosures:

1. The Research Analyst has not served as an officer, director, or employee of the subject company.

2. The Research Analyst is not engaged in market making activity for the subject company.