Name Standard Industries

Type of Report Stock Update

Report Date 05-Aug-2015

Price on Report Date Rs. 26.5

Current Market Cap Rs. 170 Cr

View Buy

Indicative Target Price# Rs. 45-52

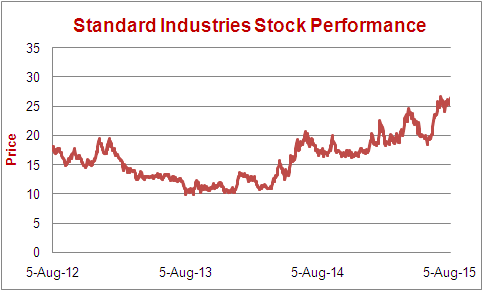

We recommended Standard Industries in June2013 at a price range of Rs. 10-14 with a report titled "Standard Industries: Company for Free". The stock has gone up to Rs. 26.5 giving 120% returns including dividends. We once again recommend a BUY in Standard Industries at CMP of Rs. 26.5 (cum dividend).

Standard Industries is a Pradeep Mafatlal Group company which had a textile business in the past. The company has a 62.25 acres land parcel in Navi Mumbai and high value residential buildings in Mumbai as mentioned in the earlier report.

In our June2013 report, we had mentioned, "Our view of investing in Standard industries is for a very long term as it is impossible to predict the time of value unlocking in the company."

In light of the recent Maharashtra IT / ITes 2015 policy now in place, the incentives that this policy provides may help Standard Industries to unlock the value faster than expected.

Some of the incentives of the new Maharashtra IT / ITes policy 2015 are as below:

1. IT Township Development: The policy proposes a walk to work concept where it plans to have an integrated township comprising commercial (60%) and residential & other purposes (40%) areas. This 40% includes residential apartments and social infrastructure such as schools, hospitals, malls, multiplex, parks and other such areas. These IT parks have a minimum requirement of 25 acres area. Large land holders like Standard Industries may be benefited as they hold single location land of 62.25 acres in Navi Mumbai.

2. Higher Construction Area Allowed: The developer is allowed to construct with a basic FSI of 2.5 under this policy. Additionally this policy also allows 200% extra FSI with a payment of just 30% premium on the ready reckoner rates in that area.

3. Other Incentives in IT / ITes Policy 2015:

- Exemption to IT/ ITeS from stamp duty

- Power cost at industrial rather than commercial rates, along with additional subsidies on electricity tariffs

- Property tax at residential rates

- No octroi, entry tax and Local Body Tax

- Various concessions on Works Contract Tax and VAT

4. Recent Announcement / Deals suggest high interest in developing IT / Residential Parks: Some of the recent deals/announcements suggest high interest for developing large parcels of land.

- Maharashtra Government's new IT policy has succeeded in fetching the two IT / ITes projects for Mumbai worth Rs. 1,500 crores in central Mumbai and one project for Rs. 1,050 crores in Navi Mumbai from Blackstone private equity fund.

- In a recent auction in the last month, CIDCO was able to generate Rs. 450 crores for 3 plots at Khargar, Navi Mumbai. This deal amounted to a whopping rate of Rs. 65 cr per acre in Khargar, Navi Mumbai.

- At the time of Digital India Inauguration function, Mr. Kumar Birla Chairman of Birla Group had announced the development of 100 acre IT Enabled Township in one of the Mumbai suburbs.

At the CMP of Rs. 26.5 (cum dividend), Standard Industries is trading at a market cap of Rs. 170 crores. Considering the potential value unlocking from its land parcel and trigger seen from the Maharashtra IT / ITes policy, we recommend a BUY on Standard Industries.

#Achievement of Target Price does not imply Sell. We will explicitly release a Exit/Partial Sell Report at an opportune time.

Dhruvesh Sanghvi is a Research Analyst registered with SEBI having registration No: INH000000875.

Definitions of Rating system:

1. Explanation of Type of Report

Fresh Recommendation Reports: These reports are first-time initiation reports on the concerned stock. Usually these reports are followed by updates on the same.

Update Reports: These reports include result update, event updates, annual report analysis and/or any other information that may be useful for the investor in relation to the concerned stock. Most of these update reports will have our current view on the same.

2. Explanation of Time Horizon: All the Fresh Recommendation reports in the investing section have a view of 3-5 years.

3. Explanation of Views: Views can be any one among these - Buy, Buy on Dips, Hold, Sell Partial, Exit

Buy: This means buying the concerned stock at current market price.

Buy on Dips: This means buying the concerned stock on the explained fall in price.

Hold: This means holding the concerned stock until further update.

Sell Partial: This means selling half of the existing position in the concerned stock.

Exit: This means completely exiting the concerned stock.

4. Explanation of Indicative Target Price: Achievement of Target Price does not imply Exit / Sell Partial. We will explicitly release Exit/ Sell Partial Report at an appropriate time. If required, Indicative Target Price could be revised based upon business performance, market environment or any other important event.

DISCLOSURES by RESEARCH ANALYST UNDER SEBI (RESEARCH ANALYSTS) REGULATIONS, 2014 is as under:

• Introduction: Prospero Tree Financial Services is an independent equity research proprietorship firm of Mr Dhruvesh Sanghvi.

• Business Activity: Prospero Tree Financial Services is committed in providing honest views, opinions and recommendations on financial markets opportunities.

• Report Written by: Dhruvesh Sanghvi

• Disciplinary History: None

• Terms & Conditions: https://www.prosperotree.com/termsofuse

• Details of Associates: Not Applicable

• Disclosure with regards to ownership and Material Conflicts of Interest:

1. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services, its associates, its Research analysts hold any position in the subject company.

2. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services, its associates, Research Analysts, nor its relatives, have more than 1% ownership of the subject company at the end of the month immediately preceding the date of publication of this report.

3. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services, its associates, Research Analyst nor its relatives, has any other material conflict of interest at the time of publication of the research report or at the time of public appearance.

• Disclosure with regards to Receipt of Compensation:

1. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services or its associates, or Research Analyst has received any compensation or other benefits from the subject company or the third party in connection with the research report in past twelve months.

2. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services or its associates, or Research Analyst have managed or co-managed public offering or securities for the subject company in past twelve months.

• Other Disclosures:

1. The Research Analyst has not served as an officer, director, or employee of the subject company.

2. The Research Analyst is not engaged in market making activity for the subject company.