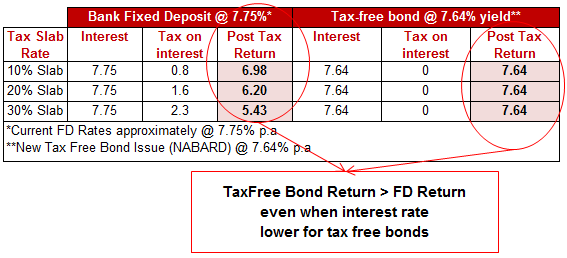

Although most people are subconsciously aware of the concept of tax-adjusted returns, they still tend to ignore it while taking investment decisions. To better understand the effectiveness of tax-free returns; please refer to the table below. It is clear that even if you are in 10% tax slab, effective returns are higher when invested in tax-free bonds.

Though, most investors in India habitually invest funds in fixed income earning instruments through the Bank FDs, it may not be the most efficient and smart way. The interest income on Bank FD is taxable in the hands of investor at the normal rate of income tax in which investor's income fall. However, the interest income while investing in tax free bonds / NCDs is tax free and therefore gives higher return in the hands of those investors.

Moreover, as these bonds / NCDs are listed on stock exchanges, it provides a chance of capital appreciation during the time of falling interest rate period. The market price of bonds is inversely proportional to the movement in interest rates. If interest rate falls; bonds price rise and when the interest rates rise, the bond prices fall.

It is therefore advisable to an investor to change the natural habit of investing in bank FDs and rather invest in tax efficient instrument like tax free bonds of Government owned companies. The interest income from these bonds is tax free and further provides chance to earn capital appreciation in a falling interest rate scenario.

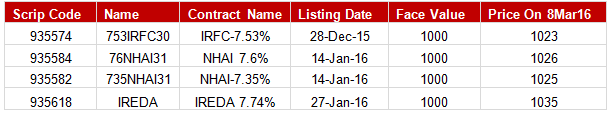

Over the last 3 months there were many tax free bonds that were issued and listed on the stock exchanges.

On the similar lines, NABARD Tax Free Bond Issue is starting from 9Mar2016 having a coupon of 7.64% for a 15 years period. This instrument will be listed on BSE once the allotment is done. Retail investors can apply in this issue with maximum of Rs. 10 lakh.

You can also explore our earlier articles related to fixed income securities from below links

- All you should know about NCDs

- Price fluctuations in NCDs - How to benefit?

- Tax Free NCDs and its benefits

- Where do NCDs score over fixed deposits?