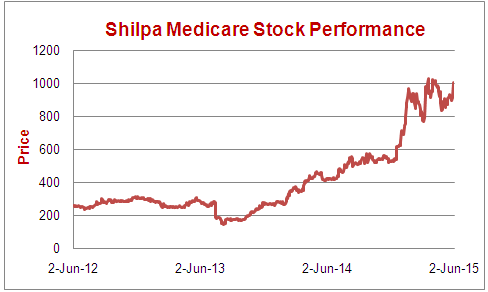

We had first recommended Shilpa Medicare to be accumulated between Rs. 260 - Rs. 275 in January 2014. We came out with a report titled "Shilpa Medicare: Riding on Cancer Medicines" that explained the reasons for the investments. We recommended buying again at all prices – Rs. 285, Rs. 309, Rs. 420 and Rs. 558. The current market price of Shilpa Medicare is hovering around Rs. 950-1000 range.

Here is the summary on what lies ahead:

- The sales grew by around 8% and operating profit (EBITDA) grew by 12%. The tax rate in FY15 was around 33% as against 21% in FY14. This was the main reason for flat growth at profitability levels of the company.

- The company has been expanding heavily in terms of capacity building with its gross assets rising from Rs. 271 crores in FY12 to approximately Rs. 600 crores in FY15. The majority of the capex was on Jadcherla oncology formulation unit and capacity creation for the JV with Italian partner. Shilpa is further expanding its capacity in Oncology formulation, Oncology API and non-oncology APIs. In addition to above, Shilpa is also ramping up its R&D efforts to support the process innovation and future pipeline.

- Status of Business Segments:

- Oncology API: Until now, Europe has remained the biggest contributor to Shilpa Medicare's oncology business. Currently, USA’s contribution to Shilpa’s revenue is NIL. Both its Oncology API plants in Raichur were inspected by USFDA in Mar’15. The company is awaiting final approval from USFDA on the same. Through its 2 oncology API plants, Shilpa has applied for 15 DMF filings in the US market.

- ICE JV / Custom Synthesis: Shilpa Medicare sells a product known as ursodiol to a single client named ICE in Italy. This single product contributes to nearly 40% of Shilpa’s total revenues. Shilpa Medicare formed a joint venture (JV) company named Raichem Medicare Pvt Ltd. with its client (ICE, Italy). Through this JV, Shilpa has built a capacity through capex of Rs. 150 crores for the same. This JV will start its operations soon and first major revenues will come from Q3FY16. Post the operations begin in the JV, there will be shift in revenues from Standalone entity to the JV. As Shilpa holds 60% in this JV, there could be potential loss in revenues and profits that will be paid in the form of minority interest to ICE. To offset this loss to Shilpa Medicare, the client may increase sourcing from this JV.

- ARVs: Shilpa planned an entry into ARV by getting an affiliation from Gilliad lifescience. The freed capacity after the transfer of ursodiol business to JV will be used for producing ARVs (Anti-Aids). The Gilliad ARV business will should start contributing from Q4FY16 or from early FY17.

- Oncology Formulation: The new formulation plant at Jadcherla is ready and regulators from Mexico, Brazil and EU have already inspected the same. Approval from Mexican authorities has been received whereas the final approval from Brazil and EU is still pending. The company is expecting the USFDA audit to take place for the formulation plant in FY16. To support the formulation business, the company has already filed for 12 ANDAs in EU and 12 ANDAs in the US market. Jadcherla plant being in a SEZ will also attract tax benefits once the commercial production starts. Shilpa is further expanding capacity at this plant in anticipation of better demand and future prospects. The company is also creating new formulation units with focus on ROW and Indian market.

- Japanese Crams Opportunities: As highlighted in this report -Shilpa Medicare: Riding on Cancer Medicines, the company was in advance talks with a couple of Japanese customers for long term business. It seems that something on the similar lines has fructified and Shilpa Medicare is creating a block for its Japanese customer for custom manufacturing. This block should be ready by Mar'16.

In a nutshell, the growth in FY16 may remain in single digits, whereas the real thrust for the company should be seen FY17 onwards when all its segments will contribute in a substantial manner:

JV ramp up, Oncology API thrust due to USFDA approval, Formulation sales in EU & USA , ARV business start, Japanese Crams Opportunities

Valuations:

At CMP of Rs. 960-1,000, the stock is trading at Rs. 3,800 crores market cap with a consolidated profit of Rs. 74 crores and standalone profit of Rs. 85 crores in FY15. The consolidated profits are lower mainly due to the losses from US subsidiary where there is zero revenue so far. Though the profitability in comparison to its market cap looks quite low, by FY17 there should be a huge increase in earnings. To estimate the same at this stage is extremely difficult. However, considering the size vs. its scope, Shilpa Medicare is definitely worth a HOLD for long term investors. At the same time, it is important to understand that FY16 revenue growth will remain muted and may lead temporary under performance of the stock.

Historical Stock Performance

Previous Reports for your reference:

Report 1: Shilpa Medicare: Riding on Cancer Medicines

Report 2: Shilpa Medicare: Multiple Engines of Profitable Growth

ProsperoTree.com has applied to SEBI under Research Analyst Regulation and is awaiting approval from SEBI.

DISCLOSURES by RESEARCH ANALYST UNDER SEBI (RESEARCH ANALYSTS) REGULATIONS, 2014 is as under:

• Introduction: Prospero Tree Financial Services is an independent equity research proprietorship firm of Mr Dhruvesh Sanghvi.

• Business Activity: Prospero Tree Financial Services is committed in providing honest views, opinions and recommendations on financial markets opportunities.

• Report Written by: Dhruvesh Sanghvi

• Disciplinary History: None

• Terms & Conditions: https://www.prosperotree.com/termsofuse

• Details of Associates: Not Applicable

• Disclosure with regards to ownership and Material Conflicts of Interest:

1. Neither Mr Dhruvesh Sanghvi, Prospero Tree Financial Services, its associates, nor its Research analysts have any position in the subject company. However, his relatives holds the shares of Balaji Telefilms.

2. Neither Prospero Tree Financial Services, its associates, Research Analysts, nor its relatives, have more than 1% ownership of the subject company at the end of the month immediately preceding the date of publication of this report.

3. Neither Prospero Tree Financial Services, its associates, Research Analyst nor its relatives, has any other material conflict of interest at the time of publication of the research report or at the time of public appearance.

• Disclosure with regards to Receipt of Compensation:

1. Neither Prospero Tree Financial Services or its associates, or Research Analyst has received any compensation or other benefits from the subject company or the third party in connection with the research report in past twelve months.

2. Neither Prospero Tree Financial Services or its associates, or Research Analyst have managed or co-managed public offering or securities for the subject company in past twelve months.

• Other Disclosures:

1. The Research Analyst has not served as an officer, director, or employee of the subject company.

2. The Research Analyst is not engaged in market making activity for the subject company.