This stock recommendation is a part of our Investing section called -"The Timeless Leader Series"

| Name | Page Industries |

| Type of Report | Fresh Recommendation |

| Report Date | 31-May-2015 |

| Price on Report Date | Rs. 16200 |

| View | Sell Partial# |

| Indicative Target Price* | NA |

#If already invested, we recommend to limit your allocation in Page Industries

The fascination for brands amongst Indians is no longer restricted to things that are visible; the craze for brands has also extended to hidden things; yes, we are talking about innerwear! The Rs. 18,000 crores innerwear market, which constitutes approximately 8% of the domestic apparel market, has grown rapidly over the last 10 years and is expected to continue its upward trajectory. The large innerwear market potential in India has made it one of the hottest markets and has attracted numerous international innerwear brands and many small indigenous players.

Established in 1994, Page Industries, known for its marquee brand, 'Jockey', is the most celebrated name in the Indian innerwear industry. Page Industries has been a new trend-setter for selling and retailing innerwear in India - Traditionally, small as well as large retailers have been shy and fearful of bringing the innerwear out of their closet and showcasing them inside their stores. However, Page Industries managed to get the retailers to shed their resistance by educating the retailers about in-store advertising and merchandising of innerwear by equipping them with point-of-sale material and separate dispensing units specially designed for display.

Page Industries is promoted by the Genomal family with deep experience in manufacturing innerwear. The management motto is, there should be no reason for clients to buy any other brand, be it for quality, comfort, fit, style, packaging, marketing, image, and availability. The innovative efforts carried in that direction have borne fruit for Page Industries making it an enviable market leader with 8-10% market share in the innerwear segment. In FY15, Page Industries manufactured approximately 12-13 crore pieces of innerwear/sportswear for men/women through its 9 plants where it employs more than 17,000 employees, majorly women.

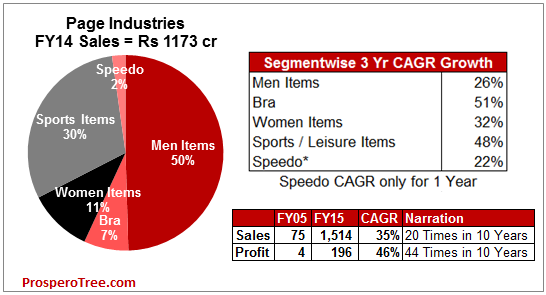

After tasting success in men's items, Page extended its offerings to other segments. By FY14, contribution from Men’s segment reduced to 50% of its total sales from 65% in FY08. However, even on a higher base, the Men’s segment has grown at a very healthy rate of 26% CAGR over last 3 years. Of course, all its other segments have grown at a much faster pace than the Men’s category. For instance, the Sports Items, Women Items, Bra have recorded stupendous growth of 48%, 32% and 51% respectively in the last 3 years as against 26% growth in Men’s Items in the corresponding 3-year period.

Economic theories and textbooks would have suggested that it is impossible to achieve supernormal growth in sales and profits for a sustained period of time. However, Page Industries seems to have challenged these theories. The arguments presented below highlight the reasons due to which Page Industries may continue its superior growth in the future.

Investment Arguments:

1. Strong Brand and Leadership Position: Jockey has been an early entrant in the Indian innerwear arena - it entered in 1995 while a bulk of its MNC peers and new domestic brands entered only after 2005. Page completely capitalized on its early-mover advantage by building a dominant brand presence through excellent marketing and by developing a huge distribution network.

Page Industries re-wrote the rules of retailing innerwear in terms of in-store display, advertisements and opening up the mind-set of retailers to showcase innerwear in their shops. The excellent fixtures, modules, lighting and shop boards helped Jockey to build itself as a premium branded player. The brand’s strength is visible not only inside the retail stores but also outside them - Innumerable small retail stores/ multi brand outlets selling innerwear have their shop boards christened as Jockey while the store’s actual name is written in very small font at the bottom of the board.

Page’s string of advertisements reinforces its premium brand positioning and conveys the look-and-feel of an international brand. Unlike its competitors, Jockey did not use celebrities to endorse its brand; instead, it showcased young foreign models in its advertisement campaigns. For them, their brand is the celebrity. The iconic 'Just Jockeying' & 'Jockey or Nothing' ('Best or Nothing' proposition) campaigns were able to create a long term aspirational brand positioning of the Jockey.

As a result of these efforts, today, Jockey India (Page) is the largest franchiser of Jockey across the world while within India; Jockey has the highest market share in both male and female innerwear segments.

2. Current Size vs. Potential Market Opportunity: The size of the Indian Innerwear market is ~Rs. 18,000 crores; the category is also growing at an impressive CAGR of 10-15% based upon which reports you check. The growth of the Indian innerwear market should be in a similar range of 10-15% for the next decade with the mid-to-premium market growing at an even faster rate. Within the innerwear industry, the women's innerwear market is growing at a much faster pace than that of men's innerwear segment. Even if we assume an increase of 10% in current market size per year, each year the market size increases by more than the current sales of Page Industries. This indicates that Page Industries has substantial growth potential for years to come and provides the visibility of long term growth.

3. Solid Distribution Network that is still Growing: One of Jockey's biggest strengths is its distribution network, which new entrants will find very difficult to replicate. Page Industries commands widespread pan India distribution encompassing ~30,000 retail outlets in 1,200 cities and towns. It is also present across the country through its exclusive Jockey Outlets numbering 170+ currently. This retail presence and distribution network is also expanding consistently and Page has the best distribution network within its industry. Based upon the total retail outlets in India, it looks that Page has significant room to expand its distribution network and reach its maximum potential in terms of distribution network.

4. Foray in New Product Categories & New Segments to fuel Growth: Notwithstanding the huge opportunity in the innerwear category, Page is ambitious and has been trying to tap multiple engines of growth – women’s wear, leisurewear, swimwear (in-licensing of Speedo brand) and brand extensions within each of the aforementioned categories. Over the next few years, the overall contribution from men's items is expected to decrease from current ~50% despite registering a decent 20%-25% growth. On the other hand, the revenue contribution of women's wear, sportswear and leisurewear categories which have been growing at ~30%+ CAGR (last 3 years), is expected to gain momentum. The company will also soon foray into kid’s undergarments and innerwear which should help provide a new growth lever for the company.

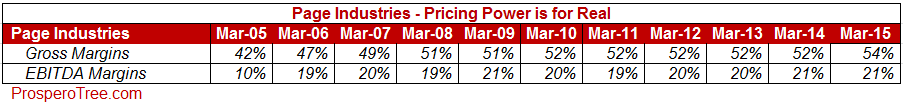

5. Pricing Power is for real: The table below shows the gross margins for Page Industries. The gross margins increased from a low 40-45% in FY05 to 52-54% range in FY15 despite the period of wild volatility (up and down both) in cotton and cotton yarn prices. This competitive strength to slowly increase its gross margins stems from its ability to continuously evolve its product portfolio and to pass the increase in raw material costs to the customer.

The EBITDA margins have also been maintained between 20-21% for many years now. Compare this with the competition, Page’s operating margins (EBITDA) are higher than its competition even after paying a 5% royalty to Jockey USA and sizeable investments (~3% of net sales) in advertising and brand promotional activities - This phenomenal pricing power bears testimony to Jockey's brand power.

Key Risks:

- Increase in labor costs

- Drastic Increase in prices of raw material can affect the margins temporarily

- Changing customer trends

- Competition in women’s inner wear market

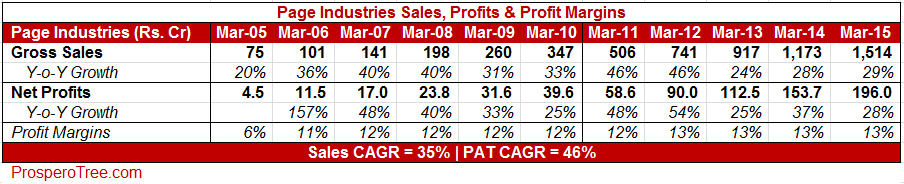

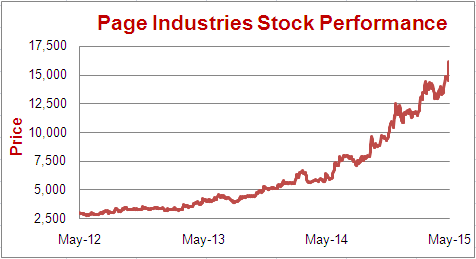

Wealth Creation so far: Since the last 10 years, Page has registered sales and profit growth of 35% CAGR and 46% CAGR respectively. This can be attributed to its aspirational brand status, strong distribution, along with a wide range of products supported by excellent advertisements. All of this has also helped the company to achieve a market leadership position combined with strong pricing power. We think Page has a long way to grow with sectoral tailwinds in its favor and thus provides very strong visibility for the future.

Page Industries at Rs. 16,200 - Should you Buy, Hold, Sell?

On the financial side, Page has an extremely strong balance sheet, robust cash flows, excellent dividend payouts and a steady return on equity of 50%+, all of which are unusual for a textile company.

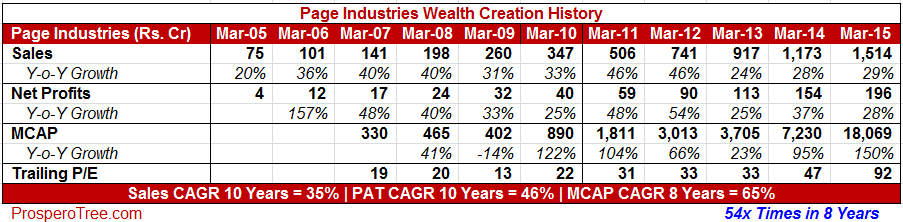

As shown in the table, over the last 8 years, the stock of Page has given CAGR returns of 63% (dividends extra). This means that the stock has gone 54 times in 8 years, by far one of the best wealth creators within Indian stock markets. At the CMP of Rs. 16,200, Page Industries has a market capitalization of Rs. 18,200 crores.

Verdict on Page at CMP of Rs. 16200: Page Industries is a fantastic business but definitely Not a BUY currently for first time buyers due to its astronomical valuation.

Currently Page has a market cap of Rs. 18,000 crores which is equal to the total estimated market size of inner/leisure wear segment in India.

It seldom happens that a company's valuation breaches its total potential market size. Nor can one find companies trading at such stratospheric valuations of 92 times multiple.

What if you are already holding Page Industries? Page Industries has a long road ahead and there is a very high degree of certainty attached to its future. However, when we compare the price against its estimated value, we think that the price is discounting a very distant future as suggested by its 92 times trailing price to earnings ratio and its market cap that has crossed its theoretical opportunity size. We think that the risk-reward ratio is not at all in favor of Investors at this price.

Page Industries is a spectacular business. However, we suggest to limit Page Industries to a certain percentage of your portfolio, and slowly reduce anything above the desired level of portfolio allocation.

When to Buy Page? Though seldom, there will be time periods when Page's business will have some problems of its own. It could be due to internal factors like inability to manage labour or operational issues, or could be external factors like increased competitive scenario. In these times, Mr. Market may provide great entry points that should be considered after re-evaluation of the same.

Here is the Historical Stock Price:

ProsperoTree.com has applied to SEBI under Research Analyst Regulation and is awaiting approval from SEBI.