This stock recommendation is a part of our Investing section called -"The Timeless Leader Series"

| Name | Colgate Palmolive |

| Type of Report | Fresh Recommendation |

| Report Date | 22-Mar-2015 |

| Price on Report Date | Rs. 2010 (Post Bonus Price Rs. 1005) |

| View | Buy |

| Indicative Target Price* | Rs. 3500-4000 |

Colgate is the undisputed Goliath of the oral care market - It is the #1 leader not only in India but also in the world. Globally, Colgate has a 200 years legacy and its brands are sold in over 200 countries. In India, Colgate Palmolive India (Colgate) commands such a powerful brand equity that the term 'Colgate' came to be used as a verb - "Maine Colgate kar liya" which implies that "I have brushed my teeth". The iconic brand which has become generic to the category is also a master marketer - Repeated advertisements and communication over the years have made consumers believe that the brand Colgate is endorsed by dentists translating to greater acceptability.

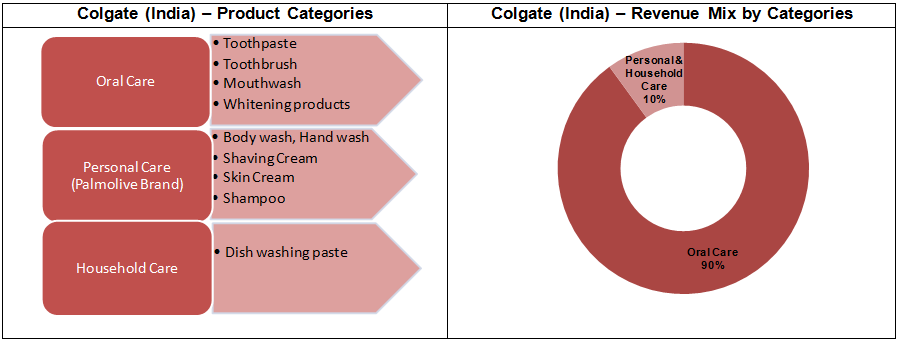

In India, Colgate sells products across 3 categories - Oral Care, Personal Care (under Palmolive brand) and Household Care. However, oral care accounts for ~90%+ of the revenues with the toothpaste segment alone contributing to ~75%+ revenues.

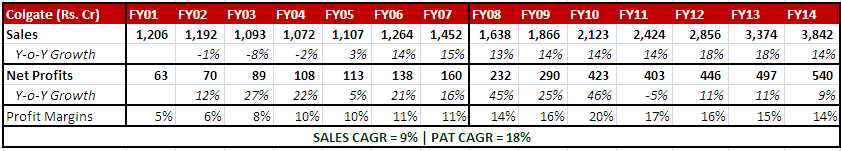

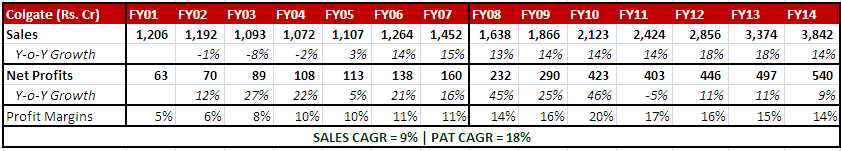

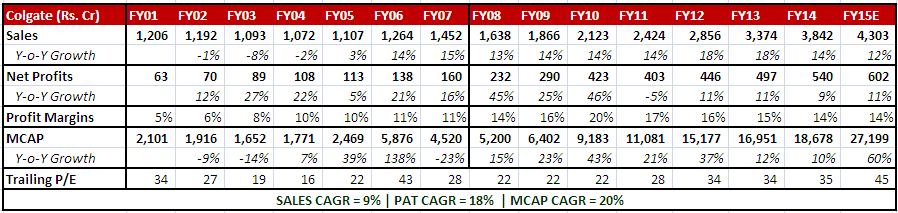

In India, the oral market heavyweight has over the last 13 years, delivered Sales CAGR of 9% & PAT CAGR of 18%. In the last 5 years, the sales growth has been quite aggressive at 16% CAGR; however, the profit growth has languished at 13% CAGR due to continuous dip in margins.

Colgate (India) - Financial Snapshot

Colgate (India) has clocked double-digit or close to double-digit volume growth for the last 23 quarters which showcases its stability and resilience across economic cycles. We believe that Colgate’s revenue and profit can continue to grow consistently due to the reasons enumerated below.

Investment Arguments:

1. Years of Consistent Growth Ahead: "Product Premiumisation, Rural Penetration, and Cultural Change are the three most important factors that will drive consistent growth in sales." Over the years, Colgate has ramped up its focus on more value-added differentiated products with specific benefits - regular to functional toothpaste (eg: sensitive, whitening). This has led to the share of premium products increasing from a negligible portion to ~11% of revenues in FY14. The Average Selling Price (ASP) per kg for toothpaste and toothbrush is 2.5X & 3X respectively in China Vs. India, indicating the headroom for value-driven growth through premium products in urban India.

The oral care penetration in rural India is only ~63% vs. ~91% in urban India while populous states like UP, Bihar, MP have penetration levels that are much lower 52%, 30% and 42% respectively; thereby presenting a huge opportunity for volume growth in rural India. Large opportunity pie combined with Colgate’s wide pan-India reach through over 50 Lakh outlets will provide a further fillip to its growth. To understand the seriousness of the company’s efforts, just pause and think for a moment: Colgate almost doubled its rural coverage between CY12 and CY14.

The marketing campaigns of oral care players have strived to increase awareness about the benefits of brushing twice a day and related oral hygiene. This could go a long way in changing a deep-rooted cultural habit amongst adults and children in India - Currently <10% of Indians brush their teeth twice a day and over ~33 crore Indians do not use toothpaste at all. A gradual change in this habit will ensure long term growth in volumes even in the highly penetrated parts like urban India.

The troika of value growth in urban India driven by premium products, volume growth in rural India thanks to increasing rural penetration and the increasing per capita consumption due to brushing twice a day will be the key levers of consistent growth for Colgate (India) in years to come.

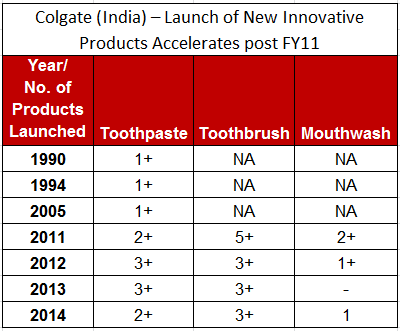

2. Impressive Track Record of Product Innovation and Supporting Marketing: Colgate's leadership position since the last several decades is a proxy barometer for its ability to identify gaps, create needs, and to launch innovative products in consonance with evolving customer preferences. Colgate has come a long way since it commenced its operations in India in 1937 and started selling its toothpowder on handcarts in 1949. Over the years, Colgate then started launching several new toothpastes and toothbrushes’ Stock Keeping Units (SKUs) straddling across price points and functional benefits - regular, gum care, freshness, sensitive and whitening. This launch of new innovative products gathered pace post FY11.

Colgate’s marketing and communication strategies have also played a pivotal role in its long-lasting success. In order to understand the unparalleled magnitude of its reach through the awareness programs, try to stomach below numbers and its humongous impact:

•Till date, Colgate has reached out to ~10.7 crores young children in over 2 lakh schools through its "Bright Smiles, Bright Future" program to create awareness about oral health at a very impressionable age.

•In association with ‘Indian Dental Association’, Colgate has been conducting the "Oral Health Month" program since the last 10 years - This provides free dental check-ups in dental clinics and mobile vans for an entire month in a year (free for 2 months in a year since 2009). In FY13, Colgate reached out to ~38 lakh individuals across 1,000+ towns with 25,000 dentists' participation.

Colgate has established tremendous brand equity and goodwill through pioneering such thoughtful initiatives since decades.

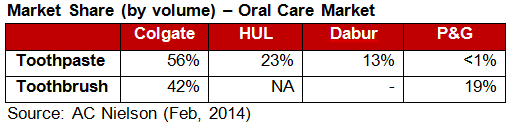

3. Ability to Gain Market Share despite Intense Competition: Colgate has been and continues to be the market leader of Oral Care category. The #2 players in both toothpaste and toothbrush segments trail Colgate by a significant margin as seen in the below table.

Despite the heavy onslaught of competition from formidable FMCG companies - HUL (Pepsodent & Close Up), P&G (Oral-B), Dabur (Meswak, Dabur Red Toothpaste), Colgate has not only protected but also managed to grow its market share by 12% in 6 years - toothpaste market share (by volume) for Colgate inched upwards from 44% in 2007 to 56% in 2013 while rival HUL’s market share declined from 32% to 23% in the last 10 years.

The competition intensified with P&G’s foray in the toothpaste category with Oral-B brand in July, 2013. Colgate responded by massively increasing its Advertising & Promotions (A&P) spends from 15.5% of sales in FY13 to 19.2% of sales in FY14 which hurt its margins but it managed to increase its market share. However, there is a strong chance that over the long term, Colgate should see its A&P spends stabilize its historical levels and that would give a big boost to its margins.

Also, unlike its peers, Colgate’s mainstay is oral care which contributes to 90%+ of its total India revenues while the corresponding contribution for HUL, P&G & Dabur is a meager 6%, ~2%, and 9% respectively. Hence, Colgate's competitors in India will find it difficult to match Colgate’s A&P budgets for this category; for instance, P&G’s current A&P spends on oral care is <1/3rd in absolute terms than that of Colgate's.

Notwithstanding the competitive pressures, Colgate has demonstrated its ability to grow its market share and strengthen its leadership position on the back of new innovative product launches, deeper penetration in urban and rural areas and smart marketing. We also believe that the increasing share of premium products, stable A&P spends over longer periods and cost control will boost margins in the long run.

Wealth Creation - Prospero Tree View: Colgate (India) has delivered Sales CAGR of 9% & PAT CAGR of 18% over the last 13 years. Colgate’s iconic brand, the longevity of future growth, ability to innovate and premiums its product portfolio & strong distribution network are its key moats that will help the company to grow very well for a seriously long term. Oral care is far from being a mature category in India and the nature of its products makes it's business nearly recession-proof.

On the financial side, it has a strong balance sheet which is cash-rich with its business operation running on negative working capital. The company’s profitability and cash flows are extremely strong and the company has a track record of superior return ratios and an impeccable dividend payout record of more than 60%.

Colgate Wealth Creation History

Since Colgate got listed in India in 1978, its stock has delivered a stunning 27% compounded returns till 30th April, 2014 after adjusting for rights, bonus issues and dividends. In the last seven years, Colgate has traded at an average of 28 times its trailing multiple. However, Colgate’s valuation has increased sharply and is valued currently at 46-48 times earning which is quite expensive. However, given its business strengths, longevity of growth, and potential margin expansion, it could deliver strong earnings growth.

We therefore think that even though Colgate’s valuation is steep, for those investors who want to have immense safety and around 15% CAGR returns, we suggest buying 50% of Colgate at current market price of Rs. 2,000 - Rs. 2050 and the remaining 50% once it falls to Rs. 1,800-1,850.

Potential Future Corporate Action: In order to increase the stake in their Indian company, several MNCs like HUL, GSK, United Spirits amongst others have already completed their open offers at a substantial market premium to the prevailing market price. Considering that foreign promoters of Colgate Palmolive (India) are currently holding only 51% stake in the company, there is a strong likelihood that the MNC promoters may want to use an open offer route to increase their shareholding. It could execute the open offer by paying a premium to the then market price. This possibility of the open offer in future also provides extra cushion to any downward price pressures on the stock.

Historical Stock Price:

*Achievement of Target Price does not imply Sell. We will explicitly release an Exit/Partial Sell Report at an appropriate time.

Introduction: Prospero Tree Financial Services is an independent equity research proprietorship firm of Mr Dhruvesh Sanghvi and was incorporated in 2015.

Business Activity: Prospero Tree Financial Services is committed in providing honest views, opinions and recommendations on financial markets opportunities.

Disciplinary History: None

Terms of Use: Prospero Tree Term & Conditions

Details of Associates: Not Applicable

Disclosure with regards to ownership and Material Conflicts of Interest:

- Neither Prospero Tree Financial Services, its associates, Research Analyst nor its relatives, have any position in the subject company.

- Neither Prospero Tree Financial Services, its associates, Research Analyst nor its relatives, have more than 1% ownership of the subject company at the end of the month immediately preceding the date of publication of this report.

- Neither Prospero Tree Financial Services, its associates, Research Analyst nor its relatives, has any other material conflict of interest at the time of publication of the research report or at the time of public appearance.

Disclosure with regards to Receipt of Compensation:

- Neither Prospero Tree Financial Services or its associates, or Research Analyst has received any compensation or other benefits from the subject company or the third party in connection with the research report in past twelve months.

- Neither Prospero Tree Financial Services or its associates, or Research Analyst have managed or co-managed public offering or securities for the subject company in past twelve months.

Other Disclosures

- The Research Analyst has not served as a officer, director, or employee of the subject company.

- The Research Analyst is not engaged in market making activity for the subject company.