We first recommended PTC Financial at the price of Rs. 34 per share in July'14 based on its strong growth prospects in the energy sector.

Since then, the stock has delivered 76% returns in nine months and our target price of Rs. 62 per share has been achieved. At the current juncture, we recommend our long term investors as well as new investors to buy/add more at current levels of Rs. 55 to Rs. 60 with a time horizon of two years and price target of Rs. 85.

Read below our investment arguments for the same.

Strong Governmental Focus on Renewable Energy

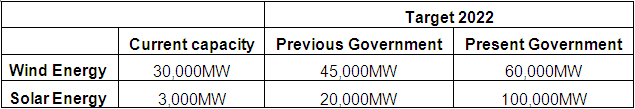

The new government at the center has announced its intention to promote renewable energy development as the way ahead for the power sector. In fact renewable energy is seen as the way out of the current power sector mess. The previous Government’s infrastructure boom of FY09-12 happened through huge capacity expansion in thermal energy space (coal fired). This Government’s infrastructure boom will have renewable energy as one of its biggest contributor. The table below highlights the aggressive targets set by the Government in renewable energy space.

Work is already under way to support this aggressive target through policy actions. The State Electricity Boards have been advised to increase procurement from renewable energy generators while banks and financial institutions have been nudged to support the developers with attractive schemes.

PTC Financial’s Strong Presence in the Renewable Energy

Segment PTC Financial was early to spot the slowdown in thermal space by FY12 and diversified towards renewable energy financing. Our channel checks suggest that it has developed a niche in this segment and is amongst the preferred choice of developers. Quick appraisal and strong advisory are its strong areas when compared to competitors like IDFC, L&T Finance, PFC and other banks.

PTC Financial has a strong order book of Rs. 7,000cr of which ~70% would be in the renewable energy space. Given its current loan book size of Rs. 5,800cr, disbursements towards these sanctions will translate to strong loan book growth in coming years. We expect additional financing opportunities to come along its way as the governmental push to renewable energy translates into on-ground execution FY16 onwards.

Historical Stock Performance