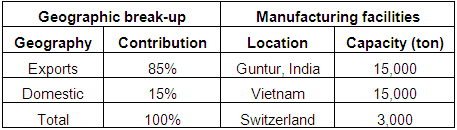

| Name | CCL Products |

| Type of Report | Fresh Recommendation |

| Report Date | 12-Jan-15 |

| Price on Report Date | Rs. 173 |

| View | HOLD |

| Indicative Target Price* | Rs. 220-250 |

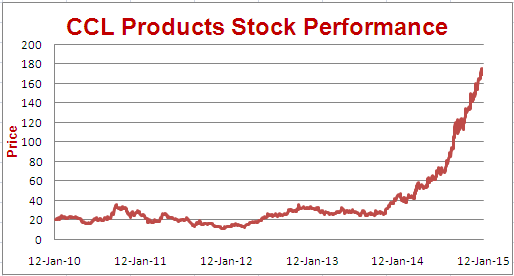

We had recommended CCL Products as a trading idea around Rs. 80 levels in Aug'14 (Click here). Later, we recommended it again at Rs. 103 levels in Sep'14 (Click here). Further research and management interaction makes us believe that CCL Products is poised for strong multi-year growth in revenue and earnings and the stock can deliver reasonable upside even from current levels. Investors with existing position in the stock should continue to HOLD for the long term. New investors can look to add the stock on every fall. This is the first time we have recommended CCL Products in the investments category.

A. Company Background

CCL Products is India’s largest contract manufacturer of instant coffee with exports to more than 67 countries. Nestle dominates the instant coffee retail market across the world. However, every country has some local challenger brand to Nescafe (Nestle), many of which are CCL’s customers. Over years, CCL has been able to develop the right blend of instant coffee for its large and diverse customer base.

B. Investment arguments

1) Presence in a difficult but highly profitable segment:

Developing the right blend of instant coffee requires long hours of trial and error. Further, the taste and preference varies across countries and communities. It usually takes three years to win over a client and establish one’s credentials in the instant coffee market. These dynamics create an entry barrier for new entrants and hence, few companies have been able to scale up their instant coffee business. Through its innovation and advanced technology, CCL has been able to achieve the right blend and win customers across the globe. This, we believe, is a sustainable competitive advantage for CCL.

2) Strong ramp-up in Vietnam operations: The Vietnam facility got commissioned in Q4FY14 and already has a strong order pipeline. Stroche is CCL’s largest customer and will increase its procurement from 2,000tons to 3,000tons. Also, CCL has entered into tie-ups with new customers in ASEAN region like Japan, China and Korea. In addition to the above, some of the low value added products will be migrated from Indian plant to Vietnam facility while the Indian plant will cater to more value added coffee as well as for its own branded foray. Thus, it would be easy for the Vietnam operations to improve its utilization from 15% in FY14 to 75% in FY16e.

3) No risk associated with coffee bean prices: CCL follows a back-to-back ordering process - it orders for green coffee beans within 30 minutes of receiving order from its customers. Thus, price is locked for delivery that will happen after one or two months. There is no price risk, except in an event like 2008 when coffee prices crashed 50% in a month. The customers ordered a re-work of contract, which CCL then tried to work with its suppliers. Unlike most suppliers of CCL who procure coffee and then try to sell, CCL will pre-sell and then order its raw material.

4) Well diversified customer list, risk of Russia limited: CCL has exposure to more than 60 countries. Russia and other oil related countries contribute ~20% of its total revenue. The sharp currency depreciation in these countries could result in increased coffee prices in local currency terms and thus decreased consumption. CCL will have to make up for the reduced future consumption from some other countries. Chances of its customers defaulting look remote. Europe, Japan-Australia belt and Russian contribute 30%, 30% and 20% of overall revenue.

5) Switzerland operations, branded play could add to upside from FY16: Switzerland reported loss of Rs. 4 cr in FY14. This is set to break-even in FY15 and report a modest Rs4cr profit in FY16. CCL’s pilot to sell branded coffee has been successful in Andhra Pradesh and the pilot is being extended to north India. This business will have 2x margins of its normal business. Any success here could catapult the company to a different orbit.

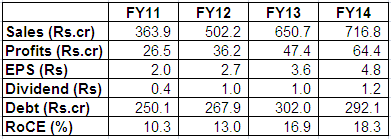

6) Strong balance sheet management, profit pool to expand significantly: CCL has increased its capacity by 10x over past twenty year, largely through internal accruals. The Indian operations are virtually debt-free while the Vietnam subsidiary will witness strong internal accruals and could be repay most of its debt by FY17. Despite assuming no significant gains from branded coffee play, CCL could report significantly higher profits than what will be reported in FY15. Based on the highly improved profitability expectations of 2017, the current market cap of Rs. 2,300 crores does offer a upside of 40-50% from current levels in the next 2 years.

C. Key risks

Increase in competition: The high margins in instant coffee processing business could attract new players. However the strong entry barriers in terms of technology, goodwill and right blend will ensure that competition doesn’t increase over-night.

Slowdown in Russia & Eurozone: Given the economic turmoil in Eurozone and the oil price decline related turbulence in Russia could result in lower consumption from these countries and hence, lower sales for CCL Products.

D. Financials

E. Stock Performance

*Achievement of Target Price does not imply Sell. We will explicitly release a Exit/Partial Sell Report at an appropriate time.