Name Roto Pumps

Type of Report Fresh Recommendation

Report Date 28-Dec-14

Price on Report Date Rs. 139

View Buy

Indicative Target Price* Rs. 200-220

A) Company Background

Roto Pumps has a 40 year history in manufacturing of industrial pumps and spares. The pumps manufactured by Roto Pumps are used in industrial applications involving viscous liquids and are more technology intensive compared to the pumps used for water related applications. The company has its presence in more than 70 countries and exports account for ~70% of the total sales.

Geographic break-up

Product break-up

Revenue (Rs. Cr)

89.6

Revenue (Rs. Cr)

89.6

Domestic

30%

Pumps

45%

Exports

70%

Spares

55%

B) Investments Arguments

1) Presence in industrial pumps segment, a technologically challenging area: Roto Pumps has an expertise at developing single screw (progressive cavity), twin screw and three screw pumps which are used to transfer viscous liquid through a pipe. Viscous liquids are ones which are usually thicker and requires more pressure for its movement. Roto pumps are used in all industries mainly oil & gas, waste-water treatment, paints, fertilizers, sugar and paper industries. Unlike water pumps which are simple to design, the pumps used by these industries are designed to handle highly viscous liquids and are hence more complex. Also, there is large degree of customization in every pump sold in the industrial segment which leads to enhanced pricing power too. This is visible in the best-in-class gross margins enjoyed by Roto Pumps.

Company

Gross margins

Comments

Roto Pumps

65%

Presence in industrial pumps

WPIL Ltd

47%

Only 33% revenue from industrial pumps

Shakti Pumps

55%

100% presence in water based pump

2) Spare parts business provides huge stability to overall revenues: Roto Pumps manufactures spare parts for their own pumps as well as other brands and it accounts for 55% of the total revenue. A pump has a useful life of 8 to 10 years and the need for spares arises from the end of 3rd year of installation. This generates a recession-proof demand for spare parts and lends immense stability to revenues of Roto Pumps. Also, the margins enjoyed in this segment are high.

3) Strong brand name in India, growing presence in over 70 countries: Over the past 40 years, Roto has established a strong brand name among the Indian PSU customers and gained 40% market share in the organized market in its category. In fact, the PSU tender’s official documents refer the type of single screw pumps and twin screw pumps as "Roto Pump". Outside India, it has direct / indirect registrations in the 70 countries that it operates. The registrations are taken with respective administrative authorities and due to its time consuming nature, it forms a significant entry barrier for a small new entrant. It is also trying to enter South Africa and Germany in a big way. The fact that Roto Pumps are accepted by clients across so many countries speaks about the high quality standards of its products.

4) Recent capacity expansion lays foundations for strong future growth: The Company has recently commissioned a new plant and incurred a capex of Rs. 40cr on the same. This plant is situated in NOIDA SEZ and the land for this plant was bought 5 years back. However, as the NOIDA SEZ itself did not get the approvals in time, the plant building got delayed. Today, NOIDA SEZ land is officially cleared and the value of this land itself should be around Rs. 30 crores. With this new capacity, the company will now be able to participate into larger sized pumps tenders which it could not produce in the previous plant. The current plant has enough capacity to grow and can give revenues of 3x (Rs.300cr) at its full utilisation without the need for any large capex. This improved capacity coupled with Roto’s focussed efforts on the mining, shipping and ports industry augurs well for future revenue growth.

5) Robust balance-sheet management, reasonable valuations: Historically, Roto has maintained debt-to-equity below 0.7x while its RoCEs have been in excess of 20%, indicating sound balance sheet management. It is the technologically intensive nature and pricing power of Roto’s business that allows it to generate high returns on the deployed capital.

Debt / Equity

Return on Capital Employed

Roto Pumps 0.6x >Roto Pumps

23%

WPIL Ltd 1.2x WPIL Ltd

22%

Shakti Pumps 0.9x Shakti Pumps

17%

While the trailing P/E ratio at 22x looks expensive, the future growth potential for Roto Pumps remains very large. Considering the opportunity size against its sales, Roto can easily grow at a very healthy rate over the next 5 years. The company-level efforts to grow the revenue are quite encouraging with respect to expanding into new markets and deeper penetration in existing countries. At the same time, the domestic macro factors have also turned benign with the Clean Ganga campaign that will bring huge demand for sewage pumps and overall Capex revival across sectors that may add to the domestic demand.

We therefore recommend a Buy in Roto Pumps at CMP of Rs. 136 with a 3-5 years view. We would suggest adding further in case if the stock corrects by 20%.

C) Key Risks

- Inability to scale up revenue due to overall weak global pump demand.

- The sharp fall in oil prices could result in lower capex in energy exploration sector. This could impact future orders for Roto Pumps from Oil and Exploration industry. However, Roto has a very well-diversified revenue base and this should not be a long term concern.

D) Financials

FY11 FY12 FY13 FY14

Sales (Rs.cr) 59.5 76.3 88.7 89.6

Profits (Rs.cr) 5.4 7.3 8.1 9.6

EPS (Rs) 3.5 4.7 5.2 6.2

Dividend (Rs) 0.5 0.5 0.5 0.6

Debt (Rs.cr) 16.3 17.0 21.1 27.9

RoCE (%) 22.2 22.8 23.4 25.0

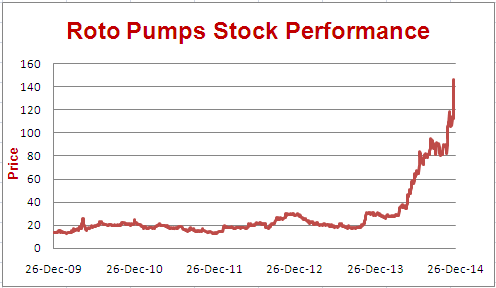

E) Stock Performance

*Achievement of Target Price does not imply Sell. We will explicitly release a Exit/Partial Sell Report at an appropriate time.

DISCLOSURES by RESEARCH ANALYST UNDER SEBI (RESEARCH ANALYSTS) REGULATIONS, 2014 is as under:

• Introduction: Prospero Tree Financial Services is an independent equity research proprietorship firm of Mr Dhruvesh Sanghvi.

• Business Activity: Prospero Tree Financial Services is committed in providing honest views, opinions and recommendations on financial markets opportunities.

• Report Written by: Dhruvesh Sanghvi

• Disciplinary History: None

• Terms & Conditions: https://www.prosperotree.com/termsofuse

• Details of Associates: Not Applicable

• Disclosure with regards to ownership and Material Conflicts of Interest:

1. Neither Mr Dhruvesh Sanghvi, Prospero Tree Financial Services, its associates, nor its Research analysts have any position in the subject company. However, his relatives holds the shares of Balaji Telefilms.

2. Neither Prospero Tree Financial Services, its associates, Research Analysts, nor its relatives, have more than 1% ownership of the subject company at the end of the month immediately preceding the date of publication of this report.

3. Neither Prospero Tree Financial Services, its associates, Research Analyst nor its relatives, has any other material conflict of interest at the time of publication of the research report or at the time of public appearance.

• Disclosure with regards to Receipt of Compensation:

1. Neither Prospero Tree Financial Services or its associates, or Research Analyst has received any compensation or other benefits from the subject company or the third party in connection with the research report in past twelve months.

2. Neither Prospero Tree Financial Services or its associates, or Research Analyst have managed or co-managed public offering or securities for the subject company in past twelve months.

• Other Disclosures:

1. The Research Analyst has not served as an officer, director, or employee of the subject company.

2. The Research Analyst is not engaged in market making activity for the subject company.