We had first recommended to Buy Lloyd Electric at Rs. 115 on 25-Jul-2014. The first report can be accessed here Lloyd First Report. We again came out with a further detailed report on Lloyd here – Lloyd Second Report at Rs. 152 with a target price of Rs. 275 – Rs. 300.

Here are the highlights of the results:

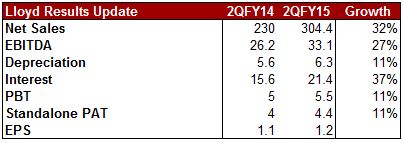

1. Overall Sales: Lloyd has clocked revenue of Rs. 304 crores, showing a growth of 32% YoY.

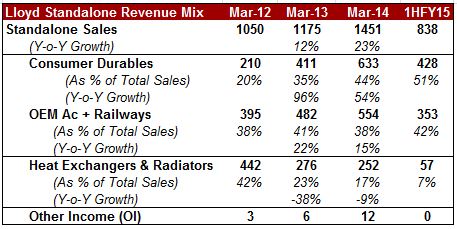

2. Sales from Consumer Division: In the half year, sales from consumer durables are 50% of the total sales and have grown by 40-50% YoY. We think that the current 'Push' strategy for the company is working very well as seen by the aggressive sales growth from the Consumer Division. In the 1HFY15, the sales growth of Consumer Division (Own Brand) is much higher than other division.

The important point to note is that the company has laid a substantial thrust on its consumer durables business. From nearly NIL revenues from its consumer durables in 2005, the segment is now contributing 51% of standalone sales in 1HFY15.

3. Operating Margins: For last 2 years, the operating margins for Lloyd Electric are at 12% with margins from the second half being better than that of the first half. In-spite of such a good growth in sales, the margins have not increased owning to large increase in sales promotion and advertisement costs. In FY15, Lloyd is going to spend on advertisement in a big way and therefore we expect that operating margins in FY15 will be slightly lower than in FY14 but on much higher sales.

4. Interest Cost: As the working capital of the company has seen a rise, we expect that the interest costwill be at Rs. 100 croresin FY15 as compared to Rs. 85 crores in FY14.

5. Profit Expectations: Based on the above assumptions, we think that Lloyd should be able to do profit before tax (PBT) of Rs. 82 crores in FY15 as against a PBT of Rs. 70 crores in FY14, indicating a growth of 17% YoY on operating numbers.This is without any one-offs or any other non-operating income. In addition, we expect the subsidiaries to contribute another Rs. 10 crores in profits.

6. Summary: We think that once Lloyd branded sales reach a critical mass, there could be significant savings coming from improvement in working capital cycle. Though this may take some time, the way to participate in the Lloyd story is by making it a small part of your portfolio and wait for the story to unfold.

We Recommend to Hold at CMP of Rs. 147