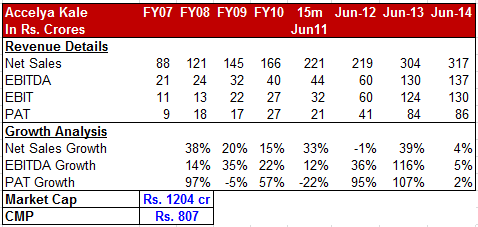

We recommended Accelya Kale Solutions Ltd at Rs. 350-400 range in May2013. Since then Accelya has given a dividend of Rs. 119 and the stock is quoting at a market price of Rs. 807, giving a total returns of Rs. 146% (2.46 times including dividends).

The detailed report for the same can be accessed here First Report on Accelya Kale: Fly High. At this stage, we recommend the investors to HOLD the stock as it still provides significant potential upside if the company is able to get more orders. The penalty for investors here could be temporary under-performance.

The key aspects to be monitored are:

1. Incremental Orders: After the company lost its major client from Middle East in FY13, Accelya was successful in making up for the loss with acquisition of new clients. Inspite of the loss of this major customer, the company was able to grow its sales by 4% y-o-y. Though the company has been putting a lot of efforts for getting new orders, it is very difficult to predict the timing of new orders.

2. Valuations not cheap: Currently, Accelya is trading at a 13x its earnings and has a dividend yield of around 5%. However, if the orders do not start to flow in the next 6 months, Accelya story may not be able to sustain its current valuation.

3. Potential Change of Ownership: Accelya Kale is promoted by Accelya group which is ultimately owned by Chequers Capital, a private equity firm. As per our sources, Chequers Capital was in close negotiations with Silver Lake private equity for the sale of Accelya group; however, the deal did not go through. The same was also reported in media in a scattered manner. However, according to us, the sale talk will be re-initiated once the company has more orders so that the company can get better valuations.

We recommend HOLD at Rs. 807 with gains of 146% (2.46 times including dividends) in nearly 1.5 years. The only risk is more client loss for Accelya’s existing clients and orders being taken in other group subsidiaries instead of Accelya Kale Solutions (India).