| Name | Muthoot Finance |

| Type of Report | Fresh Recommendation |

| Report Date | 26Oct2014 |

| Price on Report Date | Rs. 186 |

| View | Buy |

| Indicative Target Price* | Rs. 270-300 |

A) Company background:

Headquartered in Kerala, Muthoot Finance is the country’s largest gold loan company. It has a pan India network of 4,271 branches and a loan book of Rs 21,400 crore which is completely secured against gold ornaments. From being a predominantly South based player, it has diversified itself across the country. In contrast to 79% contribution in FY10, South India contributes to 58% of its total loan book in FY14.

B) Investment arguments:

Relatively unscathed through the sector crisis: The gold price volatility witnessed during Mar’13-Sep’13 and the tightening regulatory regime pushed the sector in a tizzy over the past five quarters. Large scale customer defaults, under recoveries in auctions and de-growth in loan portfolio were reported by most banks and NBFCs. Weak players like IIFL, SCUF, Magma, Cholamandalam, etc witnessed 20-40% decline in their gold loan portfolios. On the contrary, Muthoot Finance witnessed a mere 16% loan book de-growth, less than 1,500cr of auctions and minimum under-recoveries. The credit for this clearly rests with the Company’s conscious strategy to focus on small ticket loans and to keep LTVs low.

Consolidation phase over, growth to re-start: The Company’s loan book has declined 16% over the past five quarters owing to the gold price volatility and the subsequent turbulence. We believe that most of the bad loans and auctions are over and the company is ready to grow. For the first time, it is undertaking initiatives at the branch level so as to solicit business. It has also launched a customized product for financing digital devices. These initiatives coupled with a general revival in the economy will help the Company return on growth path.

Strong brand and huge branch network provides scope for diversification: Through its 4000+ strong branch network, Muthoot Finance has transacted with more than 1 crore customers over the past few years. The fact that customers have deposited gold ornaments in excess of 120 tons at various Muthoot branches speaks about the trust levels. Also, Muthoot Finance has the best-in-class branch network among peers – large, spacious and technologically equipped. This network can dole out synergistic benefits as and when Muthoot Finance decides to either diversify into other lending products or to convert into a small bank or a full-fledged bank.

Well capitalized for growth, compelling valuations: With tier 1 capital comfortably above 20%, the company remains well capitalizedfor future growth. Revival in loan book growth and strong operating leverage benefits will ensure RoEs in excess of 18%. It is the only NBFC which is available at attractive valuations of 1.2x FY16e book value despite the high return ratios. Fear of further decline in gold prices is the key reason for the stock’s underperformance and the lower trading multiple. However, we believe that Company’s capability to tide over such crisis and return to growth path will ensure a gradual re-rating.

C) Key risks:

Sharp decline in gold price remains a risk: Decline in gold prices results in customer defaults as well as lower loan book growth. Given the high fixed costs involved in the business, it could result in sharp decline of earnings. Our calculations suggest that earnings will decline from current levels if gold prices fall below Rs. 2,500/gram.

D) Financials:

|

FY11 |

FY12 |

FY13 |

FY14 |

|

| Loan book (Rs. cr) |

15,868 |

24,674 |

26,518 |

21,862 |

| Profits (Rs. cr) |

494 |

892 |

1,004 |

780 |

| EPS (Rs) |

15.4 |

24.0 |

27.0 |

21.0 |

| Book Value (Rs) |

41.7 |

78.7 |

100.5 |

114.7 |

| RoE (%) |

51.5 |

41.9 |

30.2 |

19.5 |

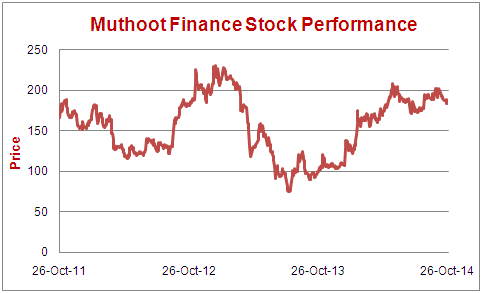

E) Historical Stock Price

*Achievement of Target Price does not imply Sell. We will explicitly release a Exit/Partial Sell Report at an appropriate time.

DISCLOSURES by RESEARCH ANALYST UNDER SEBI (RESEARCH ANALYSTS) REGULATIONS, 2014 is as under: