| Name | Financial Technologies |

| Type of Report | Fresh Recommendation |

| Report Date | 28Sep2014 |

| Price on Report Date | Rs. 217 |

| View | Buy |

| Indicative Target Price* | Rs. 300 - 350 |

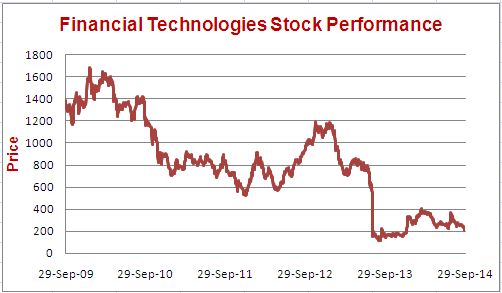

Why this title? A similar report was written on MCX after the problems at NSEL surfaced. The title of that article was: "MCX: Perception Risk, Real Value". MCX was trading in the range of Rs. 250-300.

A) Company background: Financial Technologies (FT) started its operations in 1988 with development of technology products that helped ease operations in financial markets. FT is popularly known for its software named ODIN. When ODIN was launched, it was the only software that aggregated the data feeds from BSE as well as NSE on a single screen and is therefore still a market leader in this area.

The technical and business know-how that FT acquired by developing technology products for financial markets, helped them to venture into building Multi Commodity Exchange (MCX) of India (subsidiary of FT). More than 80% of the total commodity exchange turnover in India is done on MCX.

FT also has another subsidiary named National Spot Exchange of India (NSEL) where a major scam was unearthed last year. The scam had a humongous impact on FT - regulatory authorities asked FT to cut its stake in MCX to less than 2% from current 26%. FT and MCX (FT’s subsidiary) has been founded by Mr. Jignesh Shah.

B) Investments arguments:

1. No privity of contract between FT and NSEL scam affected parties: As mentioned before, NSEL is a wholly owned subsidiary of FT. Though the crisis struck NSEL, a lot of law-suits are filed against FT (Parent Holding Company). We believe that FT and NSEL are both legally different entities and therefore there is no privity of contract between FTIL and the affected parties under the NSEL scam. This basically means that FT is not liable to pay to the affected parties of NSEL. The company also believes that any legal claims against it will not be sustainable in the court.

2. Cleaning of Books due after NSEL episode: On the conservative basis, FT has made a provision for the following:

- Original Equity investment in NSEL written off: Rs. 45crores

- Loans given to NSEL for settling with small investors written off: Rs. 180 crores

- All Bank Guarantees utilised for NSEL written off: Rs. 30 cr (Now no more bank guarantees given)

- Total: Rs.255 crores of funds written off by 31-Mar-2014.

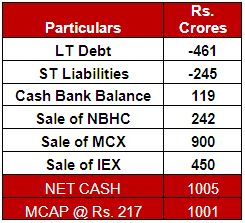

3. Sale of Singapore Mercantile Exchange: In Nov 2013, FT sold its 100% stake in Singapore Mercantile Exchange for $150 million (around Rs. 890 crores). These funds were used to repay the debt on the books of Financial Technologies. As on Mar2014, FT has a total debt of ~Rs. 700 crores.

4. Sale of NBHC: In June 2014, FT sold its stake in NBHC, a warehousing service provider, for Rs. 242 crores.

5. Sale of MCX stake: FT held 26% stake in MCX before the NSEL crisis struck. After the NSEL crisis, the promoter of MCX (i.e. FT) was declared unfit by FMC (commodities market regulator). Due to this, FT was directed to bring down its stake in MCX from 26% to 2%. In the past few months, FT sold 11% stake of MCX in open market where large investors including Rakesh Jhunjhunwala were the buyers. It’s been decided to sell the remaining 15% stake to Kotak; realisation of which is yet to come. All in all, FT will get a total of Rs. 900 crores from its MCX stake sale.

6. Potential Sale of Indian Energy Exchange: FT has recently appointed bankers to sell its stake in Indian Energy Exchange (IEX) where FT holds 25%. Based on the latest deal data, Aditya Birla bought 8% stake in IEX from IDFC; the 25% stake in IEX can be valued at Rs. 450 crores.

7. Continuation of MCX - FT relationship: The boards of MCX and FT have approved the continuation of relationships for existing technology service that FT provides to MCX. FT stands to earn a fixed service income and a variable income that is linked to MCX transactional income. The variable fee that used to be around 12.5% of transactional income has now been decreased to 10.5%. There was a fear in the market that FT's income from MCX would drastically reduce; however, with the pricing of contracts now in place, the fear has now been addressed.

8. Property at Andheri, Mumbai: FT owns a large building on the western express way in Andheri, Mumbai. The value of this land and building should be quite high. Before the NSEL fiasco, the business operations required large team; however, it will make sense for FT team to move into a small office and earn a reasonable rent income from the high valued Andheri property. Though this is a little futuristic, the point is that the property has a good value.

9. Valuations: At the CMP of Rs. 217, the market cap of FT is Rs. 1,001 crores against its net cash of Rs. 1,005 crores.

This means that FT’s technology business, controlling interest in various foreign exchanges and Andheri property are all available for free to the investors who buy FT at current market price. There is also a high probability that FT will now focus more on building more technology products and increasing its service basket. This can lead to resumption of growth for FT in coming years.

Isn’t it a classic case of "Heads, I Win; Tails, I don’t lose"?

C) Key risks:

1. Promoters unwillingness to distribute the profits.

2. Legal costs may continue to be high due to the lawsuits arising out of NSEL crisis.

D) Stock Performance:

*Achievement of Target Price does not imply Sell. We will explicitly release a Exit/Partial Sell Report at an appropriate time