| Name | Reco Date | Reco price | Target | Prospero Rating | Report Date* |

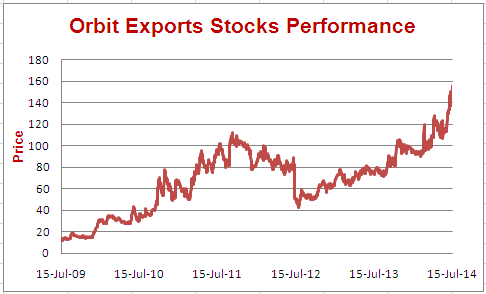

| Orbit Exports Ltd | 15July2014 | Rs. 150 | Rs. 250 - Rs. 300 | 8 / 10 | 23July2014 |

The negativity around the textile sector could make even Warren Buffet shy away from investing in stocks of fabric manufacturers. Most players in the textile space have to continuously upgrade their machines (large capex), deploy high working capital (debtor days and inventory), earn lower return ratios (low ROE) and most importantly - complete lack of pricing power.

However, we need not paint all textile companies with same brush. We were pleasantly surprised to see Orbit Exports meeting some of the best benchmarks of investing such as low capex requirements, high ROE for a sustained period, having substantial pricing power with minimal debt. At Rs 150 (first reco), Orbit was available at extremely cheap valuations however even at the CMP of Rs 190, Orbit is still available at attractive valuations esp when the company is set to expand its operations with increasing margins.

Read on to understand more on the company.

A) Company background:

Orbit Exports is into production of novelty fabrics that are sold to designers in 30 countries. The fabrics produced by Orbit Exports are mainly used to manufacture women apparels, Christmas crafts and other fashion related products. The company manufacturing products are excellent in design and quality making it possible for the company to get much higher realization than many of the mass market fabrics.

B) Revenue segmentation:

Currently exports constitute more than 61% of the total sales

Post-acquisition of Orbit Exports by current promoters, the revenues went up from Rs 9 crore in FY04 to Rs 137 cr in FY14. On the similar lines, company’s profit went from -4 cr (negative) in FY04 to Rs 20 cr in FY14.

Main Products

The company has very good products and can be described as:

1. Faux Silk: This is not silk but feels like Silk. These are used as affordable alternatives to luxury material.

2. Fashion Jaquards: These are fabrics that are used mainly in women fashion garments like one piece, bags, tops and pants. Apart from the apparels they are also used in many other fashion applications. Nearly 70% of the total Jaquards sold by Orbit are ultimately used for Apperal wear.

3. Christmas Crafts: These are pre-made Christmas decorations that include decorations such as decorative ribbons, Christmas stockings, tree skirts, and table runners, among others.

4. Carnival Related: Decorative home furnishing for Christmas / Carnival / Haloween / Easter Festivals.

C) Investments arguments:

1. Strong Marketing setup with well diversified client base: Orbit has been marketing its products in 30 countries having a very strong reach in USA, UK, Spain, Middle East countries and some other European countries. This distribution network has allowed the company to get in touch with large number of clients and thereby create a very well diversified client base. Orbit has a total of 600 active clients and no single client contributes more than Rs 6 cr of revenue per annum. Orbit clients attrition rate is comparatively much lower which speaks about its products. Out of the total revenues of Rs 137 crores, 62% revenues come from the exports market where margins are excellent.

2. Differentiable Products: We particularly liked company's products that are more focused to emotional touch points like festival sales, female fashion apparel and bridal wear where fabric design is of prime importance. The strength of the company lies in designing these fabrics and delivering them timely. To give you a perspective, the company never produces the same design again and maximum shelf life for a design is less than 6 months. Usually Orbit makes design samples based on which client places orders. In this case clients are more focused on quality and design of the product and therefore are not too sensitive to the milder price fluctuation. This helps the company to maintain reasonable pricing power. It is important to note that Orbit with its design team and increasing share of in-house manufacturing capacity is able to tailor make designs and maintain the quality & production timeliness.

3. Greater in-house manufacturing capacity to further improve business: The total sales for Orbit in FY14 were 1.04 crore meter. However, the in-house production capacity was much lower serving to only 30% of total requirement. Nearing end of FY14, the company more than doubled its capacity by spending Rs 30 crores at Surat plant and will now be able to cater nearly 50% of FY15 estimated requirement. This according to us will help the company grow its volume as well as margins. Orbit has also benefited due to the government schemes of interest subsidy, capital subsidy and power cost subsidy provided to the fabric manufacturers.

Volume growth expected: Through outsourcing, Orbit manufactures low margin products however the entire range of designer Jaquards is manufactured in-house. Orbit could not cater to the growing demand of Jaquard due to capacity constraints in the last 2 years. The recent capex has been done mainly to manufacture Jaquards and will therefore provide for good volume growth along with the realization growth.

Margin expansion expected: Greater in-house manufacturing will only lead to increased efficiencies. Even in the past, we have seen that with increasing in-house manufacturing, Orbit has been able to easily increase margins and the trend is expected to continue.

4. Efficient working capital cycle:The company required working capital of just Rs 30 crores in FY13 for the sale of Rs 120 crores. The working capital increase in FY14 to Rs 46 crores is only indicating a much higher sale in FY15 on back of the newly added capacity in Surat.

5. No Further Dilution: Orbit Exports was taken over by Mr Pankaj Seth when Orbit went into financial trouble. Mr Pankaj Seth further infused significant amount of funds in due course to expand the manufacturing capacity without taking debt leading to increase in his holdings from 42% to 52%.

Usually as a thumb rule most investors would not like equity dilution and will see it with a skeptic eye. Given the conservatism of the management in avoiding debt, the dilution did not surprise us as it was required to build the capacities. We took clarity on the same from the promoters and they have confirmed that the company is now on a self-sustainable path and promoters will not dilute further. This according to us is a big positive to change the perception of the investors.

6. Strong internal accruals and high dividend payout: Due to the recent capacity addition done at Surat plant, the company has a total Debt of Rs 40 crores. In spite of further capex planned in FY15, we are confident that the debt will come down substantially in FY15 due to strong internal accruals. The company confirmed that it is going to stick with its 25%-30% dividend payout policy making it a 3.5% dividend yield.

7. Attractive valuations: We think that this is quite attractive as Orbit’s profitability is set to double in next 30 months (2.5 years). At the current price of Rs 187, its market cap of Rs 267 crore can easily double given its growth potential, increasing margins, high ROEs, super-efficient working capital cycle, well diversified client base and good dividend payout.

8. Why Orbit Exports is not a typical textile company? Check some differences

Unlike the millions of typical fabric manufacturing units across India, Orbit Exports has a differentiated business model where intense focus on design & quality ensures that it has high realizations per square meter. Its strength lies in providing customizations and multiple designs to its high-end customers, a feat which most fabric manufacturers cannot emulate. Below are the key differences between Orbit Exports and other fabric manufacturers.

D) Key risks:

Sharp rupee appreciation can temporarily affect Orbits as 62% of sales come from Exports market.

E) Stock Performance:

*Report Date may sometimes be different from Recommended Date.