Name: Mayur Uniquoters Ltd

Type of Report: Fresh recommendation

Report Date: Aug 20, 2018

Price on Report Date: Rs. 401

Current Market Cap: Rs. 1794 crores

View: Buy

Indicative Target Price*: Rs. 650

Company Background: Based in Jaipur, Mayur Uniquoters produces one type of artificial leather known as PVC leather which finds applications in various industries like footwear, automobile seat covers, and furnishing among others. Along with a strong presence in the domestic market, the company has expanded its base to various export markets as well. Mayur is also setting up a new facility of PU leather, another type of artificial leather, at Gwalior in Madhya Pradesh to increase its product offerings.

Investment Arguments:

1. Catering to multiple segments having opportunities to scale: There are multiple and diversified business segments that Mayur is catering to. It includes Auto OEM, Auto replacement/secondary, footwear, exports OEM & others varied industries. The company is trying to tap each of these opportunities and plans to scale up well from all of these segments.

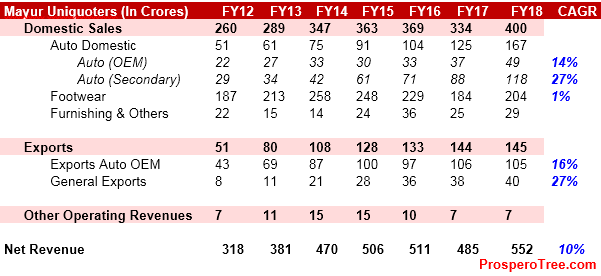

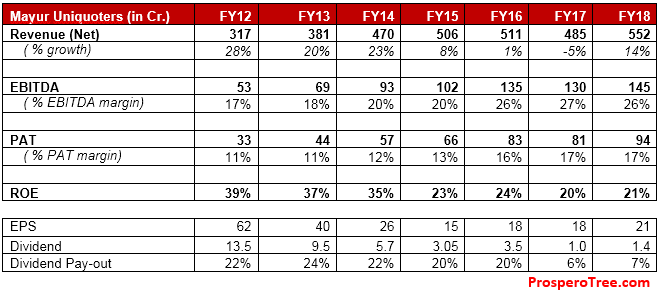

Over the last 6 years, Mayur Uniquoters revenue grew at a healthy 10% CAGR in-spite of footwear segment, a major contributor, growing at a very meager rate. Based on opportunities across its segments as discussed ahead, we think all segments including footwear sales should contribute to Mayur Uniquoters growth in future.

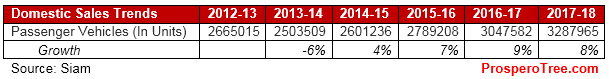

2. Robust domestic auto market to support consistent growth: The passenger vehicle sales in India has been growing at a healthy rate of 7-9% on a fairly large base for the past few years. In the domestic auto industry, Mayur sells PVC leather to Auto OEM and secondary market.

Both these segments have grown at a CAGR of 14% and 27% respectively for the last six years, indicating a strong out-performance to the industry growth. Apart from deepening relationships and adding new customers in the OEM segment, Mayur has established an even stronger network in the premium seat cover secondary market. In the secondary market, Mayur sells its artificial leather to the seat cover manufacturers who reaches the end customer through car accessories and retail shops/showrooms. Considering the existing large and growing base of passenger vehicles in India along with the unmatched quality and innovative design provided by Mayur, it should be able to consistently grow for a long duration.

3. Sales from Domestic footwear to show uptick: Since FY15, its domestic footwear business has seen relative stagnation due to few reasons. In a bid to de-risk its supplier base, its large customers decided to procure partially from other players stagnating Mayur’s growth. Furthermore, the footwear industry, being a cash industry, had suffered due to demonetization and pre-GST fears in FY17 leading to a substantial decline in footwear related sales for Mayur Uniquoters from FY15-FY17 period. These problems seem to be behind for the company and in FY18, the footwear sales started to show some signals of growth with footwear segment growing at 14% in FY18. All of this augurs well for Mayur and should lead to the resumption of growth from the footwear segment as well. Additionally, in order to cater its footwear customers in South India more efficiently, Mayur is planning to build another unit of PVC leather at Mysore, Karnataka. This additional capacity can be a key driver for its sales in South India as it would save time, achieve higher volume and save transportation cost in future.

4. Making inroads in the European market along with deepening presence with existing customers: Mayur Uniquoters began its sales to international OEM auto major since the last few years. Its revenues from Auto OEMs through exports increased by 16% CAGR for the last 6 years from Rs. 43 crores in FY12 to Rs. 106 crores in FY18. Today, Mayur Uniquoters is supplying to marquee clients like General Motors, Ford, and Chrysler in the US market. The relationship with GM started with supplying for limited models in the US market and is now further developing for supplying for their worldwide sales across multiple models. Similarly, Mayur Uniquoters (Mayur) also supplies to Ford and Chrysler in the USA and is expected to supply for their non-US sales as well. Mayur is also actively scouting for supplying to European car makers. Daimler, the maker of Mercedes, has already completed 3 audits over the last 2 years and Mayur is expected to receive final approval by Q4FY19. Once done, this could open up new frontiers for Mayur as it will set the stage for getting more customers from many European car manufacturers.

5. PU artificial leather can be a potential game-changer: Mayur is now diversifying from being a pure PVC leather company to an additional product segment called PU leather. The PU segment provides a large opportunity as India currently imports most of the ~24 crore meters per year demand. Mayur is setting up a new plant near Gwalior, MP in two phases having a capacity of 1.2 crores meters per year at a total cost of Rs. 140 crores. This will be funded mainly through internal accruals and partially by debt. This PU leather plant will help the company to cater premium segment in the domestic footwear market. In order to compete well with the Chinese, Mayur is setting up this plant with maximum possible backward integration to remain cost-effective. Mayur’s confidence for this project comes from the feedback from its customers demanding this product to be manufactured locally. Considering its experience in the premium artificial leather market, it is not unrealistic to assume that Mayur can do reasonably well in this new venture.

6. Strong Balance sheet along with Excellent Margin Profile: Without considering the small debt to be taken for setting up a new PU plant that is yet to contribute in terms of revenues, Mayur Uniquoters has a debt-free balance sheet. Additionally, very few companies in the manufacturing industry would have as high operating margins as that of Mayur’s. Its margins have consistently expanded from 17% in FY12 to 26% in FY18. Its PVC capacities are yet not fully utilized and provide room for operating leverage to that extent in coming years. Mayur has also judiciously utilized the cash generated for rewarding shareholders through consistent dividends in earlier years and more recently by buybacks in FY17 and FY18.

7. Finding New Avenues: PVC / PU leather also find applications in furnishing, purse, bags and other products. Mayur is already present in these market in India through a furnishing brand and in exports through the distribution model. These sales are booked under the category of Furnishing, Others, and General Exports. Within the exports channel, Mayur is exporting to the Middle East, Cyprus, UK, Russia, Sri Lanka, Nepal, UAE and Mexico among many other countries. Additionally, a lot of people prefer artificial leather rather than natural leather due to the high prices of natural leathers and increasing demand on the ban on slaughtering animals. Mayur stands to gain quite a bit from this trend due to its quality artificial leather.

Key Risks:

- The Company may not be able to pass any rapid increase in raw material prices which are typically crude linked

- Higher customer concentration in the footwear industry

- Regulatory risk coming from higher water requirement and potential tightening of norms for PVC

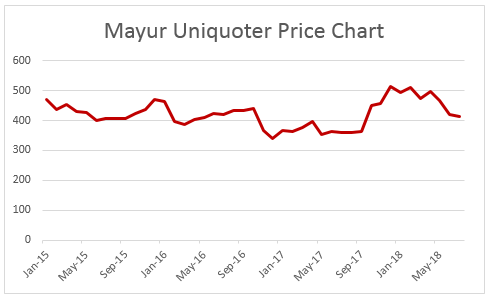

Valuation: At the CMP of Rs 401, Mayur is trading at market cap of Rs 1794 crores having FY18 profit at Rs. 94 crores, indicating a price to earnings multiple of 19 times. Considering a well-diversified revenue stream having different sensitivities and a strong possibility to scale along with additional plants and strong balance sheet makes Mayur a very interesting opportunity. We, therefore, suggest a BUY on Mayur Uniquoters at Rs. 418

Dhruvesh Sanghvi is a Research Analyst registered with SEBI having registration No: INH000000875. Definitions of Rating system:

1. Explanation of Type of Report Fresh Recommendation Reports: These reports are first-time initiation reports on the concerned stock. Usually, these reports are followed by updates on the same. Update Reports: These reports include result update, event updates, annual report analysis and/or any other information that may be useful for the investor in relation to the concerned stock. Most of these update reports will have our current view on the same.

2. Explanation of Time Horizon: All the Fresh Recommendation reports in the investing section have a view of 3-5 years.

3. Explanation of Views: Views can be anyone among these - Buy, Buy on Dips, Hold, Sell Partial, Exit Buy: This means buying the concerned stock at current market price. Buy on Dips: This means buying the concerned stock on the explained fall in price. Hold: This means holding the concerned stock until further update. Sell Partial: This means selling half of the existing position in the concerned stock. Exit: This means completely exiting the concerned stock.

4. Explanation of Indicative Target Price: Achievement of Target Price does not imply Exit / Sell Partial. We will explicitly release Exit/ Sell Partial Report at an appropriate time. If required, Indicative Target Price could be revised based upon business performance, market environment or any other important event.

DISCLOSURES by RESEARCH ANALYST UNDER SEBI (RESEARCH ANALYSTS) REGULATIONS, 2014 is as under:

Introduction: Prospero Tree Financial Services is an independent equity research proprietorship firm of Mr Dhruvesh Sanghvi.

Business Activity: Prospero Tree Financial Services is committed to providing honest views, opinions, and recommendations on financial markets opportunities.

Report Written by: Dhruvesh Sanghvi

Disciplinary History: None

Terms & Conditions: https://www.prosperotree.com/termsofuse

Details of Associates: Not Applicable

Disclosure with regards to ownership and Material Conflicts of Interest:

1. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services, its associates, its Research analysts hold any position in the subject company.

2. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services, its associates, Research Analysts, nor its relatives, have more than 1% ownership of the subject company at the end of the month immediately preceding the date of publication of this report.

3. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services, its associates, Research Analyst nor its relatives, has any other material conflict of interest at the time of publication of the research report or at the time of public appearance.

Disclosure with regards to Receipt of Compensation:

1. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services or its associates, or Research Analyst has received any compensation or other benefits from the subject company or the third party in connection with the research report in past twelve months.

2. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services or its associates, or Research Analyst have managed or co-managed public offering or securities for the subject company in past twelve months.

Other Disclosures:

1. The Research Analyst has not served as an officer, director, or employee of the subject company.

2. The Research Analyst is not engaged in market making activity for the subject company.