|

Name |

Puravankara Ltd |

|

Type of Report |

First Recommendation |

|

Report Date |

Nov 12, 2017 |

|

Price on Report Date |

Rs. 97.6 |

|

Current Market Cap |

Rs. 2316 crores |

|

View |

Buy |

|

Indicative Target Price* |

Rs. 200 |

Company Background: Based in Bengaluru, Puravankara is a real estate player having a strong presence in south India. Puravankara primarily focusses on building and marketing real estate projects under its two distinct brands namely Puravankara and Provident. Apart from the Indian market, they have a small presence in overseas market at Colombo, Sri Lanka and Dubai, UAE.

Investment Argument:

1. Multi-location Housing Provider for all type of Customers: Though Puravankara is thought as a Bengaluru based player, it actually has a very diverse and large foot print across various cities in India. Apart from Bengaluru, it now has presence in Hyderabad, Chennai, Coimbatore, Kochi, Mangalore, Kolkata, Goa, Pune and more recently Navi Mumbai.

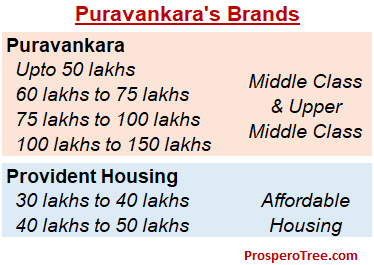

Puravankara has created two distinct brands that caters to different customer segments. Its flagship brand, Puravankara, focusses on building houses that costs anywhere between Rs. 40 lakh to Rs. 1.5 crores and is targeted towards the middle class and upper middle class families. Since 2009, the company added one more brand named Provident to cater to the rising needs in the affordable housing category where unit costs are in the range of Rs. 25 lakh to Rs. 50 lakhs.

Puravankara started its operations from 1975 and has continuously grown from single location single building player to multi-location multi-brand player focusing at a wide spectrum of projects catering to large set of customer segments. This can be seen from its past track record having more than 14500 families staying in projects built by Puravankara. Since FY13, it has delivered around 20 msqft of constructed space.

2. Large Player in Affordable Segment: Puravankara identified affordable housing opportunity much ahead of time. Around 2009, it floated a separate fully owned subsidiary, Provident Housing, to focus on affordable housing segment. Since its establishment, Provident Housing has scaled well and its revenues are now hovering in the range of Rs. 300-400 crores. Provident, nearly a fourth of Puravankara’s total revenues, has a separate operating structure with specialized and separate teams in place. With an operating history of nearly 10 years, Provident is now gearing for the next leap of growth in light of strong demand and tax benefits announced for this sector.

3. Right Ingredients to be Successful on a Pan India Basis: Apart from its home city, Purvankara has proved its successful entry into cities like Hyderabad, Kochi, Chennai and Pune among others. This is achieved on back of its strong brand recall backed by excellent execution capability build over the last few decades. The company has been able to put in place separate teams for the two brands (Puravankara and Provident) in each city where it operates. Today, Puravankara is able to attract large number of land owners looking to tie-up for developing their land even in the cities where Puravankara does not have a historical base.

Within its organization, Puravankara has been able to create an environment of customer service; which is rare in this industry. It has also been able to build a strong culture that focusses on processes, speedy execution, construction cost optimization which is quite generally quite difficult for smaller organizations to achieve.

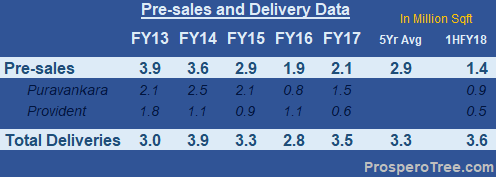

4. Strong Pre-sales Backed by Huge Deliveries in Tough Times: Over the last 5 years, Puravankara has achieved an average pre-sales of 2.9 msqft having a peak of 4 msqft in FY13. This was in spite of the real estate market passing through a very tough phase with industry volumes de-growing substantially and price being stagnated.

On the execution side, Puravankara made excellent progress in the tough times by keeping its construction pace consistent while delivering an average of 3.3 msqft per year for the last 5 years. On the construction front, Puravankara spent a huge sum of Rs. 2900 crores on construction activities in three years ending FY17. All-in-all, the consistent pre-sales backed by higher deliveries of projects has assisted Puravankara to navigate the bad weather and form a strong base for future growth.

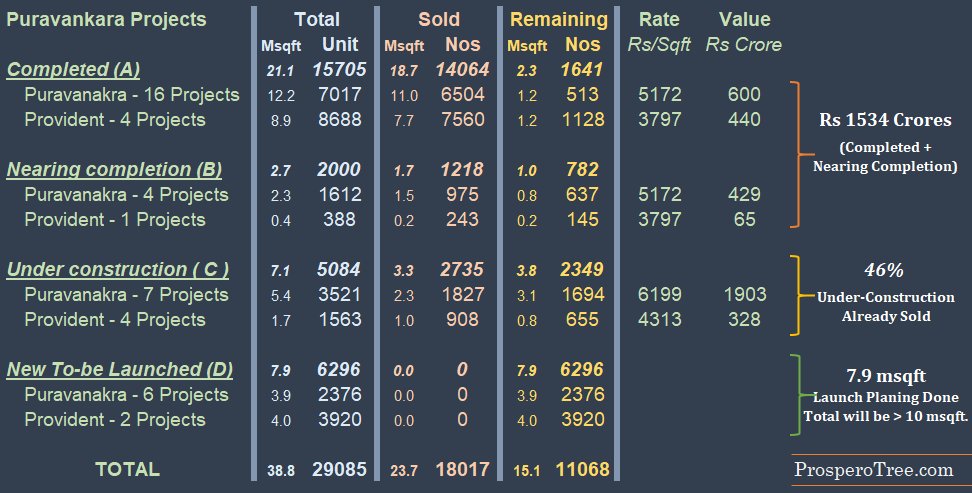

5. Strong Inventory to Aid Cash Flows: Puravankara has a large real estate portfolio spread across multiple cities. In the last 3 years ending Mar-17, the company focused intensively to complete existing projects and spent approximately Rs. 2900 crores on construction activities. As on Sep2017 (Q2FY18), Puravankara has an inventory valued at Rs. 1534 crores which comprises of completed projects (finished goods) and near completion projects (minor work pending) across 25 projects across India. It is promising to note that in all the completed projects, the inventory is less than approximately 20% of the size of respective project, indicating the sale of these apartments should not be an issue.

Even in the under-construction category, they have already sold around 46% of the total projects which gives confidence that the company may continue to see sales traction as the projects progresses in terms of construction.

The sale of the completed projects inventory and nearing completion projects inventory will directly aid the cash flow as there is hardly any cost remaining to be spent on them. In case of under construction projects, the receivables from the existing customers will largely take care of the cash flow requirement of those projects.

6. Aggressive New Launches Planned: The company consistently sold an average of 2.9 msqft over the last 5 years from FY13-17. At the same time, the company was consistently launching new projects worth 2-3 msqft per year. However, post demonetization, GST and RERA horrors now being the past, Puravankara has now embarked on a massive expansion drive with new launches being planned for more than 10 msqft in FY18 / FY19.

The aggressive new launch pipeline is quite remarkable as:

-

The new project launches are approximately 2-3 times its past yearly launches

-

They are happening at a time when new launches in the industry have taken a steep fall

-

They would not drain the balance sheet as they are backed by robust cash flows coming from the sale of finished inventory and pending receivables from undergoing projects

7. Reducing Leverage and Improving Cash Flow: As of Q2FY18, Puravankara has net worth of approximately Rs. 2450 crores and net debt of around Rs. 2000 crores in Q2FY18. From its peak of 1.4 times debt to equity, the leverage has now decreased to below 0.8 times. The company is confident to further decrease the leverage considering substantial cash inflow coming from ready inventory where the construction spending are now done with.

Additionally, the cost of borrowing has been continuously reducing from 12.5% before two years to approximately 10.7% in Q2FY18. The fruits of the reduction in cost of debt will flow to the income statement over the next 4-6 quarters due to the lag at which capitalized interest cost start getting recognized to the income statement.

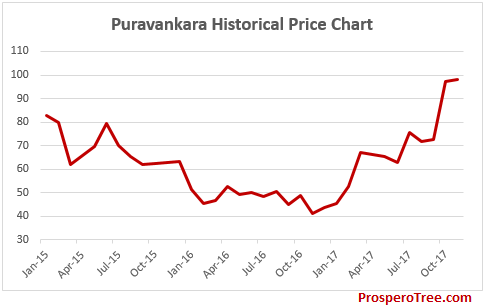

Valuations: Currently, Puravankara is trading at a price of Rs. 97-98 with the market cap of Rs. 2316 crores having a net debt of approximately Rs. 2000 crores as on Q2FY18. The company achieved sales of Rs. 1409 crores and net profit of Rs. 127 crores indicating a price to earnings multiple of 18 times based on FY17 earnings. Considering its brand strength, increasing traction in the affordable space, aggressive new launches along with cash flows from ready inventory, Puravankara will clearly have much better time ahead as compared to its past. We therefore suggest to Buy Puravankara at current levels.

Looking from a different perspective, Puravankara is available at an enterprise value (market cap + net debt) of Rs 4300 crores and has more than Rs. 4000 crores as inventory at cost on balance sheet. This means, the company is available at a substantial discount to its realizable sales value of entire inventory and the market price is currently not factoring in any value that Puravankara can reap in from the future.

Key Risks:

-

Dismal income growth in India for a sustained period of time

-

Large scale delay in launched projects especially in new territories

Historical Price Chart:

Dhruvesh Sanghvi is a Research Analyst registered with SEBI having registration No: INH000000875.

- Fresh Recommendation Reports: These reports are first-time initiation reports on the concerned stock. Usually these reports are followed by updates on the same.

- Update Reports: These reports include result update, event updates, annual report analysis and/or any other information that may be useful for the investor in relation to the concerned stock. Most of these update reports will have our current view on the same.

- Buy: This means buying the concerned stock at current market price.

- Buy on Dips: This means buying the concerned stock on the explained fall in price.

- Hold: This means holding the concerned stock until further update.

- Sell Partial: This means selling half of the existing position in the concerned stock.

- Exit: This means completely exiting the concerned stock.

4. Explanation of Indicative Target Price: Achievement of Target Price does not imply Exit / Sell Partial. We will explicitly release Exit/ Sell Partial Report at an appropriate time. If required, Indicative Target Price could be revised based upon business performance, market environment or any other important event.

DISCLOSURES by RESEARCH ANALYST UNDER SEBI (RESEARCH ANALYSTS) REGULATIONS, 2014 is as under:

• Introduction: Prospero Tree Financial Services is an independent equity research proprietorship firm of Mr Dhruvesh Sanghvi.

• Business Activity: Prospero Tree Financial Services is committed in providing honest views, opinions and recommendations on financial markets opportunities.

• Report Written by: Dhruvesh Sanghvi

• Disciplinary History: None

• Terms & Conditions: https://www.prosperotree.com/termsofuse

• Details of Associates: Not Applicable

• Disclosure with regards to ownership and Material Conflicts of Interest:

1. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services, its associates, its Research analysts hold any position in the subject company.

2. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services, its associates, Research Analysts, nor its relatives, have more than 1% ownership of the subject company at the end of the month immediately preceding the date of publication of this report.

3. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services, its associates, Research Analyst nor its relatives, has any other material conflict of interest at the time of publication of the research report or at the time of public appearance.

• Disclosure with regards to Receipt of Compensation:

1. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services or its associates, or Research Analyst has received any compensation or other benefits from the subject company or the third party in connection with the research report in past twelve months.

2. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services or its associates, or Research Analyst have managed or co-managed public offering or securities for the subject company in past twelve months.

• Other Disclosures:

1. The Research Analyst has not served as an officer, director, or employee of the subject company.

2. The Research Analyst is not engaged in market making activity for the subject company.