| Name | Reco Date | Reco price | Target | Prospero Rating | Report Date* |

| Igarashi Motor | 31Dec2013 | Rs. 81.55 | Rs. 160 - Rs. 190 | 7 / 10 | 31Dec2013 |

A) Company background:

Igarashi Motors India Limited was established in 1993 and specializes in manufacturing small-sized DC motors used mainly in the automotive sector and other non-automotive applications. The company has sold 43 crores motors since its inception and 3.3 crores motors in FY13.

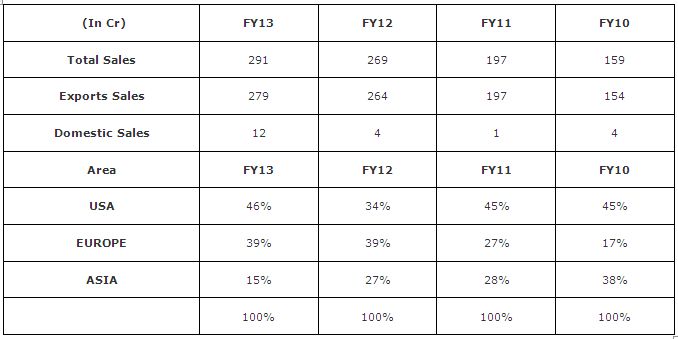

B) Revenue segmentation:

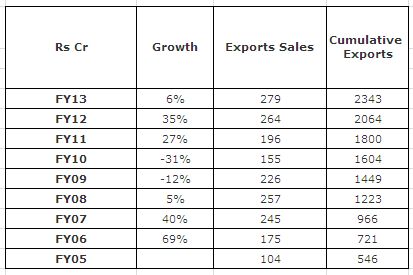

Igarashi is almost a 100% export oriented unit with the highest sales coming from the USA. Over the last 3 years, the major shift has been increasing business from Europe where its revenue share increased from 17% of total sales in FY10 to 39% of total sales in FY13.

C) Financials:

D) Investments arguments:

1. Strong promoter: Currently the company is jointly owned by Blackstone private equity (through Agile Electric) and Mr. P. Mukund (MD). The entry of Blackstone private equity with 35% (open offer pending) will help Igarashi achieve strong financial discipline; it will act as a strategic advisor to the company. At the same time, the company is co-owned by Mr. P Mukund, Managing Director of Igarashi, who is with the company since 1994. He has infused Rs. 60cr in the company through optionally convertible debentures at Rs. 65 per share. The ownership attitude of the Managing Director is positive. Igarashi Hong Kong and Japan holds 16% in the company as a strategic shareholder and holds two berths on the Board of the company.

2. Scalability: The world produces 6.5-7 crores cars every year and it is estimated that world car production will reach 10 crores cars by 2020. On an average, each car requires 30 to 60 motors for various functions with luxury cars having as high as 120 motors in them. The DC motors are used for various functions such as Blower motors, Headlamp leveling motor, Wiper motors, Pedal adjuster motor, Washer pump motors, Side Mirror motors, Seat Adjustment motors, Power Window Motors, Wipers motos, Antenna motor, Sunroof motor, Exhaust gas recirculation fan motor, Power steering motor and many other functions that are now basic features in all economy cars. The number of electric motors in automotive applications is increasing rapidly as new technologies, such as electrically-assisted steering systems, active suspension and brake systems permeate vehicle segments

The current market size for DC motors across the globe is pegged at atleast 230cr motors indicating a large untapped market for Igarashi Motors. At the current level, Igarashi sells around 3.2 crores Motors per year indicating a market share of less than 2% in the DC Motors market.

3. Interest reduction: In FY13, Igarashi had a total debt of Rs 76cr and paid Rs 10.1cr as interest costs. We estimate the interest burden to reduce drastically due to the following reasons:

a. Issuance of Optionally Convertible Debentures worth Rs 60cr was done to the MD of the company at Rs 65 per share in Aug2013. The total liabilities as per 1HFY14 looks higher at Rs 133 crores as the optionally convertible debentures are right now shown as liabilities on balance sheet.

b. Sale of investment in Holding Company (Agile Electric Sub-Assembly): Igarashi sold its investments in its holding company for a consideration of Rs 15.67 crores and thereby received consideration to that extent.

c. Return of investment in ICDs: Igarashi is expected to get refunds from investment in ICDs of the parent company. The investment in these ICDs stands at Rs 18 crores.

In all the company will get Rs 93.67 crores (part of which has already been received). Due to this, we think the interest costs should reduce substantially going forward. Recent results also suggest the same with interest cost falling from Rs 5 crores in 1HFY13 to Rs 3.5 crores in 1HFY14.

4. Natural hedge from currency: Igarashi’s ~100% sales and ~90% of raw materials are from foreign markets. This provides a natural hedge to its profitability.

5. Increase in realizations: In FY13, the realization per motor improved by 6% from Rs 81 in FY12 to Rs 85 in FY13. At the same time, the raw material costs did not increase in similar fashion and the gross margins improved substantially from 31% to 34.4%. Though the volume growth was flattish in FY13, improved gross margins indicate better performance ahead.

6. Grossly undervalued: At the current market price band of Rs 75 – 83, the company is trading at a market cap of Rs 240 crores on a fully diluted basis. We estimate the company to clock revenue of Rs 325-350 crores in FY14E with a PBT of Rs 38-40 crores and PAT of Rs 20-22 crores. This means that the company is trading at 6x current year earnings. Igarashi has a clean balance sheet with very less net debt and a potential to grow its business at a healthy rate. Its return ratios are now 20%+ with enough room to grow. The book value of the company also stands at Rs 60. We therefore think that Igarashi is grossly under-valued and investors should look to invest in it with a long term view in the current range of Rs 76-83.

7. Investments gives further cushion: As on 29.3.2012, Igarashi has a 49% stake in Bosch Electrical Drives India Private Limited. In FY13, due to dilution in this (Bosch Electric) entity, Igarashi’s stake has decreased. At the time of investments in Bosch Electric, Igarashi had invested Rs 22 crores for 49% stake. Not considering any increase in the value of this investment, it still acts as a great cushion on the balance sheet.

Igarashi’s relationship with Bosch has also helped Igarashi to grow in Europe with Bosch being one of its main customers. Though we have not assigned any higher value to the Bosch-Igarashi JV, we think that this investment could be worth lot more than its original investment of Rs 22 crores.

8. Dividend may resume: Due to large financial losses in FY09, the company had to stop paying its dividends. Over the last 4 years, the company has been barely able to earn enough to recoup the losses of FY09. Now that the same is done, there is a very high likelihood of dividends to resume in FY14. Igarashi has paid dividend in all years from FY02-FY08.

E) Key risks:

1. Highly dependent on global auto industry: As Igarashi is majorly depending on global auto industry, major slowdown in the auto industry can affect the performance of the company.

2. Imported raw materials: More than 85% of raw materials are imported and any major change in the currency can affect the cost price of these raw materials and affect the margins. However, this is mostly offset as the major sales is in the foreign country.

3. Dependence on OEMs: Igarashi is majorly depending on OEM suppliers and has yet not diversified itself into the replacement market where the margins could be higher and the portfolio could be more diversified in terms of clients.

4. Lower price to earnings ratio for many auto ancillary companies: Most auto ancillary companies are largely dependent on 1-2 major OEMs for their work. However, Igarashi, supplies to 15-16 major companies globally. Its sales are also divided into 3 continents – USA, Europe & Asia. We think that P/E ratio is more dependent on the earnings growth and its sustainability. With entry of Blackstone and recent balance sheet changes, we think the earning momentum in Igarashi can continue and so will the valuations improve.

*Report Date may sometimes be different from Recommended Date.