| Name | 1st Reco Date | 1st Reco price | Target | Prospero Rating | Report Date* |

| Orient Paper | 23Dec2013 | Rs. 11.75 | Rs. 24 - Rs. 25 | 7 / 10 | 23Dec2013 |

A) Company background: Orient Paper Industries belongs to C K Birla group and operates primarily into business of electrical accessories (Fans, Lighting & Home Appliances) and also manufacturer’s paper. However the company originally started in 1936 with a single paper machine and draws its name of Orient Paper Industries from that legacy.

The company’s product Orinet Fan is the best brand in India and has a market share of nearly 30% in India. The company has a paper plant at Amlai, MP and the electrical manufacturing plants are located at Faridabad (Haryana) and Kolkata (West Bengal)

B) Revenue segmentation:

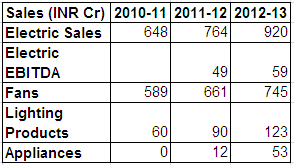

Electricals: The Company primarily gets its revenue from Electricals segments. With Rs 1230 crores of total sales in FY13, the electrical segment contributes Rs 920 crores, 75% of total revenues. Electricals has shown a growth of 20% CAGR growth for last two years. In FY13, the growth in Fans business was at 10% and lighting business grew by 36%. Appliance business recorded Rs 53 crores and was the first full year of operations. The company is confident of having an accelerated growth in the Lighting products and Appliances business.

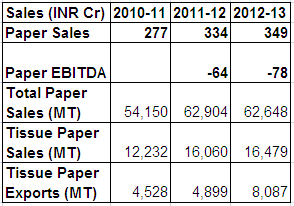

Paper Business: Within the paper business, the company focuses mainly in Tissues manufacturing as it gives a comparatively higher margin than writing paper. However due to the Power Supply and Water Shortage in the last few years, the company had major plant shutdowns leading to huge losses in the last 2-3 years. FY13 was the worst year for paper business with losses amounting to Rs 78 crores for the year.

As the paper plant at Amlai is very old, the practical maximum production capacity is at 85000 MT against the mentioned 110000 MT capacity. In FY13, Orient produced nearly 65000 MT of paper, nearly 76% capacity utilization.

C) Investments arguments:

1. Strong Growth from Electricals Business: Electricals business for Orient continues to do well with Orient Fans increasing its market share with a 12% growth in fans against a de-growth in fans industry in FY13. The company also consolidated its position in energy-efficient lighting and appliances. The company intends to grow in an accelerated manner from the electrical business through its pan-India presence. Orient Fans are available in 75000 retail outlets in India and this existing network of dealers and retailers will help the company to grow its lighting and appliance business quickly.

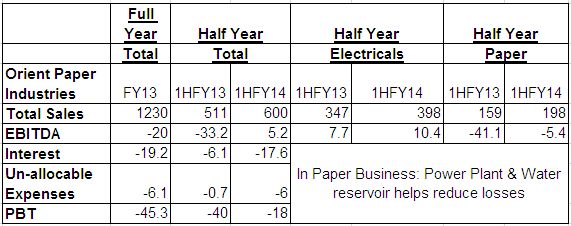

2. Reduction in Losses from Paper Business: The company had problems in functioning of its aging Captive Power Plant. Due to this, a new 55 MW power plant was commissioned in December, 2012 in the Company’s paper plant at Amlai, M.P. The power cost in 1HFY14 has seen a significant fall thereafter. Other major problem was of water shortage during summer. The company has resolved this by building a 250 mn gallon water reservoir which is fully operational now and the production has stabilized. Due to the said initiatives, the losses in the 1HFY14 reduced from Rs 41 crores to Rs 5 crores.

3. Increasing Paper Sale Price in India: Orient has now been successful in getting rid of internal problems of high power costs and water shortage. This has led to a sharp reduction in losses in paper business. However the external problem of increasing cost of Pulpwood and coal over last 2 years has made it difficult for the company to turn into green. To counter the same, the company has recently taken a hike in sale price of its paper products. We see a similar trend across the industry and thereby not directly affecting the demand.

4. Shift to Tissues Manufacturing: The Company is trying to better its margin profile with appropriate shift to tissue manufacturing. The tissues production is currently at 26% of total paper production with tissue paper exports increasing by 82% in FY13.

5. Valuations: At the CMP of Rs 11.75, the company is trading at a market cap of Rs 240 crores. Electrical business will be a key growth driver for Orient giving sales of Rs 1400 crores and EBITDA of Rs 85-90 crores in next 2-3 years. We value this business with a strong brand, good ROEs coupled with decent growth potential at a minimum of Rs 500-600 crores.

Paper Business is however a drag making losses with a capital employed of Rs 453 crores. Out of this 453 cr, the recently constructed 55 MW power plant was constructed at the cost of Rs 175 crores. We value this business at 225 crores, 0.5x its capital employed. At the same time we also note that the worst for the paper business is over and it can turn positive at operating levels in near future.

Entire Business Value = 550 cr (Electrical) + 225 cr (0.5x Paper) – 300 (Short Term Debt) = 475 cr.

Considering the current market cap of the company at Rs 240 crores, we think there is substantial upside and recommend to Buy between Rs 10.5 to Rs. 12. Please note that this is a long term call.

We also suggest that client who have low prices companies which have not been performing too well can convert their holding to this company.

D) Key risks:

1. Losses from Paper Business: Now that the power cost and water problems are over, the biggest problem can surface from the rising prices of Pulpwood. In the last 2 years, the pulpwood prices have increased substantially leading to losses for many paper producers. Orient Paper is no exception to this and any further raw material (pulp) price rise can drag the profits earned by the electrical business.

2. Competitive Nature in Electric Business: Though Orient is a very established name in Fan business, it is trying to expand its operations in other electrical accessories where competitors like Havells, Crompton Greaves and Bajaj Electricals are present.

3. Contingent Liabilities: The Company has shown a contingent liability of Rs 300 crores in its balance sheet with respect to the water tax dispute with MP government. We have not taken this into consideration while determining the value for the company. However, we have also not considered Orient’s investment in listed equities and rented property worth Rs 125 – 175 crores.

E) Financials:

*Report Date may sometimes be different from Recommended Date as drafting of reports can take time.