| Name | Reco Date | Reco price | Target | Prospero Rating | Report Date* |

| Axis Bank | 21Sep2012 | Rs. 1050 | Rs. 2030 | 8 / 10 | 21Sep2012 |

Our view - Business Fundamentals

Axis Bank is the 3rd largest private sector bank and has a strong presence in the corporate and retail lending space. Over the past five years, the company has reported strong performance across parameters - branch network expansion, well-entrenched liability profile, stable margins, fee generation capabilities and no major asset quality deterioration.

Despite a slowdown in corporate segment, the bank has ample growth opportunities due to its strong retail presence while best-in-class liability profile will ensure stable margins over FY12-15E. In our opinion, the bank remains well-poised to grow its banking business and deliver steady return to its investors despite the near-term challenges.

Our view - stock price, returns potential and investment strategy

While the stocks returns have been in-line with the Bank Nifty’s performance over the past 15 months, it has heavily under-performed its private sector peers like HDFC Bank, IndusInd bank and Yes Bank. This has happened despite the bank posting strong set of quarterly results over the said time frame due to

1) Perception that its large exposure to under-construction power projects could turn into non-performing loans once the projects come on-stream over FY13-15, and

2) Technical pressure arising from the possibility of SUUTI divesting its large stake. We believe these concerns will abate with time and its strong business performance will drive the stock price higher.

At the current market price of Rs1050, it trades at FY13E adjusted BV of 1.6x, well below the fair value for a bank with such strong earnings profile. The stock should be accumulated within the Rs950-Rs1,100 range with a 3 year perspective and a price target of Rs2,030. The tough macro environment has a sentimental as well as business impact on banks and can result in near term volatility in the stock price, which will give you an opportunity to accumulate the stock.

A) Introduction:

Company Background

Axis Bank was the first of the new private banks to have begun operations in 1994, after the government of India allowed new private banks to be established. The bank was originally known as UTI Bank. Axis Bank is the third-largest private sector bank in India in terms of asset size, with a balance sheet of ~ Rs240000Cr. It has a network of over 1,622 branches across the country. It has overseas branches in Singapore, Hong Kong and Dubai. The recent acquisition of Enam’s equity market businesses is viewed as a stepping stone towards becoming a financial powerhouse.

Management

Shikha Sharma was appointed as the MD & CEO in Apr ’09. Prior to joining Axis Bank, she headed ICICI Prudential Life Insurance. She began her career in 1980 with ICICI and helped set up their investment banking business. She is a graduate from the University of Delhi and completed her post graduation in management from the Indian Institute of Management, Ahmedabad.

S K Chakrabarti was appointed as Deputy Managing Director of AXIS Bank Limited since September 1, 2010. Prior to that, he has served as Executive Director of Retail Banking, SME and Agri.

Shareholding Pattern

Administrator of the Specified Undertaking of the Unit Trust of India (SUUTI) is the principal shareholder, holding 23.7% of the total equity capital. SUUTI, which was carved out of the erstwhile Unit Trust of India in 2003, was scheduled to wind up in Jan ’08. However, the government has been extending the time line of liquidation of SUUTI. The current time line is till Jul ’14 by which time SUUTI will have to liquidate its state liabilities. The SUUTI stake is an overhang for Axis Bank as SUUTI will have to liquidate within the next five years but there is no immediate talk of SUUTI selling its stake in Axis Bank.

B) Revenue segmentation:

Axis bank has pre-dominantly been a corporate focused bank with large and mid corporate segment contributing ~54% of the total loan book as on March 2012. Retail and SME space contributes 22% and 14% of the loan book respectively. Within the corporate segment, infrastructure loans form the biggest chunk and constitute 8.8% of the bank’s total fund based exposure as of March 2012, while exposure to other sensitive sectors such as metals, textiles and commercial real estate remains low at 2.7%, 1.8% and 2.8% as of FY12.

Advances Profile - shifting gears towards retail

Infrastructure exposure grew at CAGR of 58% vs 33% growth experienced in the overall loan book during FY08-11. As a result, the share of infrastructure loans increased from 5.5% in FY08 to 9.3% in FY11. Within the infrastructure space, power exposure grew at a CAGR of 88% over the same period. Un-funded exposure to the infra space has grown even faster at CAGR of 94%. Given the concerns surrounding the infrastructure space, the bank slowed its lending activity to this space and infra loans grew only 6.4% in FY12.

Going ahead, corporate demand is expected to remain weak, given the weak macro outlook. However, loan growth outlook for Axis Bank remains healthy as the bank has immense opportunities to grow in the retail space. Its retail portfolio is relatively small compared to its peers – 55% for HDFC Bank and 38% of ICICI Bank’s total loan book. Along with a strong branch network of 1,622 branches, the bank has a well established credit delivery mechanism through its network of retail asset centers (RAC) which will enable the bank to continue its strong growth in the retail space. We are already seeing signs of shift in strategy – corporate growth slowed to 20% while retail loan growth increased to 35% for FY12. The bank aims to grow its loan book by 20-22% for FY13E.

Deposit Profile - Jewel in its crown

The bank had an enviable growth in its low-cost deposits from FY02-FY05 when the share of its CASA deposits increased from 15% in FY02 to 40% in FY06. Since then, the bank has been able to maintain its CASA ratio above 40% despite strong overall growth in deposits and a higher base effect. This is a source of sustainable competitive advantage for the bank as it enables the bank to maintain lower cost of deposits.

Over the past few years, its CASA proportion has declined from highs of 45% in FY08 to 42% in FY12. The decline was almost entirely on account of slower growth in current account deposits. Savings account deposit, which is the less volatile component of CASA, grew smartly at CAGR of 27% vs an overall deposit growth of 26%. This is in contrast to most other banks, which have witnessed slower growth in their savings deposits as well.

Going ahead, we expect liability profile to remain healthy as 1) Declining interest rates will arrest migration of CASA deposits to term deposits 2) The bank has opened 587 branches or 36% of its total branches over the past two years – these branches will soon start contributing meaningfully to CASA growth.

Margin Profile - consistent always

Along with the improvement in its CASA proportion, the banks margins too improved drastically from an average of 2.5% over FY02-07 to 3.5% over FY08-12. While lower cost of deposits was a major contributor to margin improvement, improving C/D ratio too contributed to it. Its C/D ratio improved from 43% in FY03 to 77% in FY12. It should be noted that yields on loans are always better than yields on cash or investments. Better C/D ratio implies that the bank is able to deploy a larger proportion of its deposits towards lending activity. Going ahead, we expect declining cost of deposits to aid the bank in maintaining margins in the range of 3.25% to 3.50%.

Income Profile

Axis Bank has one of the best fee income profiles in the industry, with core fee income contributing to ~33% of total income. PSU banks have ~15% contribution from fee income while private banks have ~25% of their total income coming from fees. The bank has multiple fee income sources - client based merchant foreign exchange trade, service charges from account maintenance, transaction banking (including cash management services), syndication and placement fees, processing fees from loans and commission on non-funded products (such as letters of credit and bank guarantees), inter-change fees on ATM-sharing arrangements and fee income from the distribution of third-party personal investment products. As a result core fee income grew at a CAGR of 34.7% over FY08-12 vs its loan book growth of 31% (generally, fee income growth track loan growth. Axis Bank is one of the few banks that have some amount of de-coupling from loan growth). Enam acquisition is a good strategic fit and should lead to synergistic benefits as Enam’s equity market capabilities would compliment Axis bank’s dominant position in debt market. Going ahead, fee income growth is expected to remain healthy for Axis Bank.

Business Efficiency

The bank has a branch network of 1,622 branches and 9,924 ATMs as of March 2012. Productivity ratios are extremely robust, again, amongst the best in the industry. Its cost-to-income ratio stands at 44.6% as on March 2012 and is expected to trend even lower as branches opened in the past two years start to mature and contribute more to business. Amongst the large private banks, Axis Bank has the highest scope for network expansion - it has 1,622 branches vs _and _ branches of ICICI Bank and HDFC Bank.

Asset Quality - the potential concern

The bank has been able to maintain robust asset quality over years, with GNPAs averaging 1% over FY07-12. Restructured assets (loans that have deviated from the previously agreed schedule) constitute 1.6% of total advances. However, the stock has underperformed over the past twelve months over asset quality concerns, especially in its corporate portfolio. Axis Bank’s power portfolio had grown 88% CAGR over FY08-11 and this is the sector that is facing multiple issues – coal shortage, execution delay, unviable power purchase agreement and declining power procurement by state boards.

For Axis Bank, most of the power projects that it has funded are under construction and will commence operations over FY13-16. The fear that is built in the market is that some of its projects will not commence on time and some of them will not be able to service their debt obligations even after becoming operational. While some of these concerns are valid, it is difficult to believe that the entire power sector will not be able to resolve the current issues and move ahead. The stock could see a significant re-rating once the situation in power sector improves.

Return Ratios

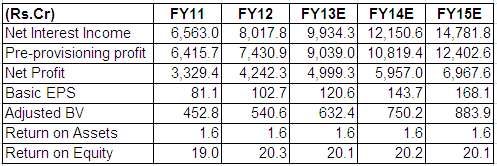

Strong loan book growth, robust margins, best-in-class fee income profile and healthy asset quality has enabled the bank to post strong return ratios. Average RoA's and RoEs over FY08-12 have been healthy at 1.5% and 19.0% respectively and this has resulted in strong trading multiples (over 2x forward price-to-book) for the stock. Capital adequacy at 9.45% is well above the regulator requirement. We expect some capital raising towards end of FY13E.

C) Investments arguments:

Positive Arguments

1) Diversified loan book provides ample growth opportunities: Although the bank’s loan book has been dominated by corporate segment, it has a strong touch points in retail segment as well. Despite the weak macro environment, retail segment have been relatively resilient and Axis Bank aims to tap these customers especially for home loans and car loans over FY13E. This will help offset the impact of slower loan demand from the corporate segment and result is loan book growth of 20-22% over FY13E.

2) Best-in-class deposit profile provides sustainable cost advantage: The bank has one of the best CASA profile in the industry. It is one of the few banks that improved its CASA proportion (41% in FY12 to 42% in FY12) in FY12, despite savings rate de-regulation and higher term deposit rates through the year. Such a deposit base is a source of sustainable competitive advantage in the form of lower deposit costs and better margins. We expect the deposit profile to remain healthy as branches opened in past 24 months start contributing.

3) Margin maintained across cycles: Margins have been maintained at ~3.5% over FY08-12

- Lower deposit costs compared to peers

- Large proportion of floating rate loans. Going ahead, yield on loans could moderate as the bank focuses on secured, retail loans. However, we expect cost of deposits to decline and aid margins at ~3.5% for FY13E.

- Best-in-class fee income profile and branch network: Fee income contributes ~35% to the banks total income, one of the best in the industry. A large portion of the fees come from its highly productive branch network – strong technology, well trained employee base and superior product suit allows the bank to cross sell through its 1,622 branches. The bank has the best productivity ratios, demonstrated through its lower cost-to-income ratio at 44%. Asset quality strong, concerns over power exposure overdone: Since the asset quality deterioration in FY09, the bank has been focusing on low risk lending – retail mortgages and secured SME loans. It has significantly improved its appraisal and monitoring standards - most SME loans are for cashflow generation projects and are backed by adequate collateral. As such, GNPAs have improved from a peak of 11.2% in Q2FY10 to 4.4% in Q4FY12. Also, the bank’s exposure to other stressed sectors such as micro-finance, aviation and textiles is minimal.

D) Key risks:

1) Large scale deterioration of asset quality: Infrastructure loans constitute 8.8% of the bank’s total fund based exposure as of March 2012, while exposure to other sensitive sectors such as metals, textiles and commercial real estate remains low at 2.7%, 1.8% and 2.8% as of FY12. A large proportion of infrastructure is towards power projects that are under construction. Given the issues faced by the power sector, there is a possibility that these projects could be delayed or would be unable to achieve break-even levels. Also, the tough macro environment could lead to stress in its other corporate accounts as well and strain earnings.

2) Price war in the retail segment: Given the slowdown in the corporate space, Axis Bank has recently shifted its strategy towards retail lending. This space has traditionally been the stronghold of private sector banks. However, the prolonged slowdown in corporate segment has coaxed PSU Banks to look at the relatively un-affected retail segment. PSU Banks will have to indulge in lending at lower rates to grab the retail pie. The resultant competition can moderate Axis Bank’s retail plans. However, given its strong foothold in retail space, the probability of such an event is low.

E) Financials:

*Report Date may sometimes be different from Recommended Date as drafting of reports can take time.