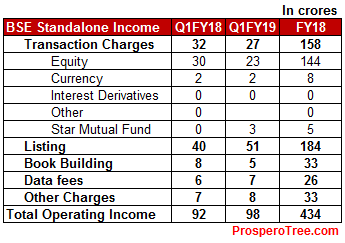

BSE has recently announced its Q1FY19 results. Here is a short summary of the same.

Comments:

1) The income from transaction charges and book building charges are related to the stock market activity. Both these incomes have decreased on the YoY basis. However, a new source of income has started from BSE Star Mutual Fund platform, offsetting the fall partially.

2) The listing fees income, which is fixed and recurring in nature, has grown substantially as expected and will help meet the shortfall in transaction charges income.

3) The income growth for BSE looks quite muted mainly because of substantial fall in its investment income from Rs 65 crores in Q1FY18 to Rs 38 crores in Q1FY19.

Buy Back Update: In the recently concluded open market buyback program, BSE bought back 2019170 shares against the proposed buyback of 1509090 shares as they succeed to buyback at an average rate of Rs. 822 against the proposed maximum buyback price of Rs. 1100.

Dividend: BSE has further distributed a final dividend of Rs. 31 per share after the completion of buyback of shares.

Valuation: At the current price of Rs. 760, its market cap is Rs. 3926 crores. Considering the value of CDSL stake and the cash held by BSE, the market is valuing BSE at 1750 crores only as shown below.

Dhruvesh Sanghvi is a Research Analyst registered with SEBI having registration No: INH000000875. Definitions of Rating system: 1. Explanation of Type of Report

- Fresh Recommendation Reports: These reports are first-time initiation reports on the concerned stock. Usually, these reports are followed by updates on the same.

- Update Reports: These reports include result update, event updates, annual report analysis and/or any other information that may be useful for the investor in relation to the concerned stock. Most of these update reports will have our current view on the same.

2. Explanation of Time Horizon: All the Fresh Recommendation reports in the investing section have a view of 3-5 years. 3. Explanation of Views: Views can be anyone among these - Buy, Buy on Dips, Hold, Sell Partial, Exit

- Buy: This means buying the concerned stock at current market price.

- Buy on Dips: This means buying the concerned stock on the explained fall in price.

- Hold: This means holding the concerned stock until further update.

- Sell Partial: This means selling half of the existing position in the concerned stock.

- Exit: This means completely exiting the concerned stock.

4. Explanation of Indicative Target Price: Achievement of Target Price does not imply Exit / Sell Partial. We will explicitly release Exit/ Sell Partial Report at an appropriate time. If required, Indicative Target Price could be revised based upon business performance, market environment or any other important event. DISCLOSURES by RESEARCH ANALYST UNDER SEBI (RESEARCH ANALYSTS) REGULATIONS, 2014 is as under: • Introduction: Prospero Tree Financial Services is an independent equity research proprietorship firm of Mr Dhruvesh Sanghvi. • Business Activity: Prospero Tree Financial Services is committed to providing honest views, opinions, and recommendations on financial markets opportunities. • Report Written by: Dhruvesh Sanghvi • Disciplinary History: None • Terms & Conditions: https://www.prosperotree.com/termsofuse • Details of Associates: Not Applicable • Disclosure with regards to ownership and Material Conflicts of Interest: 1. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services, its associates, its Research analysts hold any position in the subject company. 2. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services, its associates, Research Analysts, nor its relatives, have more than 1% ownership of the subject company at the end of the month immediately preceding the date of publication of this report. 3. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services, its associates, Research Analyst nor its relatives, has any other material conflict of interest at the time of publication of the research report or at the time of public appearance. • Disclosure with regards to Receipt of Compensation: 1. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services or its associates, or Research Analyst has received any compensation or other benefits from the subject company or the third party in connection with the research report in past twelve months. 2. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services or its associates, or Research Analyst have managed or co-managed public offering or securities for the subject company in past twelve months. • Other Disclosures: 1. The Research Analyst has not served as an officer, director, or employee of the subject company. 2. The Research Analyst is not engaged in market making activity for the subject company.