Name Unichem Labs

Type of Report First Recommendation

Report Date May 24, 2017

Price on Report Date Rs. 249

Current Market Cap Rs. 2263 crores

View Buy

Indicative Target Price* Rs. 380

Introduction: Unichem Laboratories is a 20 years old pharmaceutical company with more than half of its revenues coming from the domestic formulation markets. Unichem is ranked 29th in terms of formulation sales in India. It has a very high market share in certain therapeutic areas / categories like Cardiology where it sells formulation under the umbrella of LOSAR brands. Apart from catering to the domestic market, Unichem also has presence in the developed markets of US and Europe.

Investment Arguments:

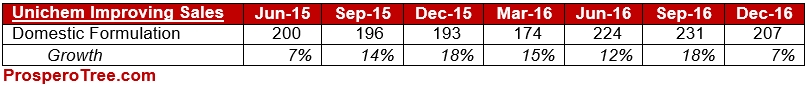

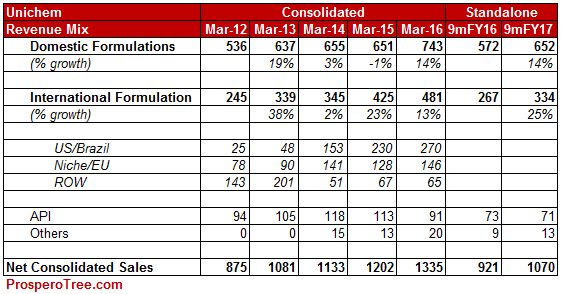

1. Domestic Formulation Business to Grow Adequately: Unichem has a strong domestic product portfolio with nearly 60% of its total revenues coming from India. Unichem is well present in acute as well as chronic segments and specialises in therapeutic areas like gastroenterology, cardiology, diabetology, psychiatry, neurology, anti-bacterial, and anti-infective and pain management. In the last two years, Unichem added 5 new marketing divisions over its existing 7 marketing divisions and re-arranged the entire field force of 2600 employees. The new structure has 12 divisions out of which 6 divisions are focussing on acute portfolio having 40% of its field force. The other 6 divisions has 60% of field force and focusses on chronic portfolio.

The company has been slowly introducing new products with recent ones being in Dermatology and Diabetic areas. In order to leverage its wide distribution network across India Unichem has also decided to in-licence certain products. The first such in-licencing tie-up is with Glenmark where Unichem sells Teneligliptin as its own brand.

The fruits of field force expansion, introduction of new products, and re-organising marketing divisions has started showing up. Barring demonetisation quarter, the last 5 quarters have shown a higher double digit year on year growth in sales for the domestic formulation business. Based on the focussed approach on the chronic as well as acute portfolio, there is a reasonable chance for Unichem being able to achieve a double digit growth in domestic portfolio over next few years.

2. OTC Business Foray carries a strong upside option: In April 2017, the company launched a wellness division to tap opportunities in the OTC market. As a start, the company has started positioning its lead prescription based gastroentrology product named Unienzyme as an OTC product. Under the prescription sales, Unienzyme has a revenues of ~Rs. 60 crores. The company is betting on it being a first company to entire into a gastro market dominated by Ayurvedic brands with moderate competition. As a part of marketing strategy, it also got tied-up with an MNC having expertise in the OTC market who helped them launch a Unienzyme TV commercial with a tagline Freedom from Indigestion. Due to this, the company saw large advertising and promotion cost of around Rs. 20 crores being spent in FY17 for OTC product. However, the rewards for the same should be seen only over the next few 1-2 year. Based on the success and learnings of the maiden OTC product, the company has plans to introduce a couple of more OTC products in gastroenterology and skin care segments. Depending upon its success, the OTC foray can provide a significant option value for the company.

3. Likely Improvement in Gross Margins due to LOSAR Group coming out of NLEM: In second half of FY14, 20-25% of Unichem’s portfolio came under government regulated pricing mechanism known as NLEM. Due to this, large brands of company like LOSAR, Telsar and Trica had to take price cuts of 20-30% impacting company’s profitability. These products having reached a mature phase of life cycle were also growing only at lower single digit. In spite of these issues, Unichem managed to increase its domestic revenues with the help of higher than market growth for its other products. In addition to this, the company also maintained its gross margins at 66% through better manufacturing efficiencies, better procurement and lower raw material prices.

Since April2017, after nearly three and a half years, most products under the LOSAR brands are coming out of NLEM and are eligible for certain price hikes every year. Having a very high market share in the segment where LOSAR operates, Unichem will be able to take benefit of maximum hike and should directly increase gross margins for the company. With LOSAR group of products coming out of absolute price control, the company would now just have 12-15% of its sales under NLEM.

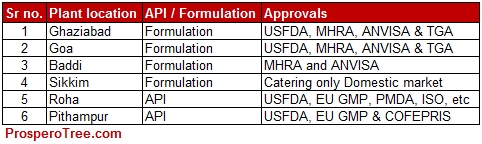

4. Export Formulation to grow with help of US: Unichem has been a late entrant in the US market and decided to focus in the off-patent products in the US market. Unichem has applied for 38 ANDA in the US market and has received approvals for 21 ANDA. Though most of these products have high competition in terms of number of players, Unichem is already selling 15 products in the US due to its strong cost leadership coming from its fully backward integrated USFDA approved API plants. In addition to its existing strategy of entering time tested off-patent products, Unichem has been selectively expanding its R&D capabilities and has started filing ANDAs for some complex molecules.

Over the last few years, US contribution has increased from 3% in FY12 to 22% in 9mFY17 and is expected to deliver strongly over the next few years.

5. Brazil Operations Write-off Completed: Unichem entered Brazil through its wholly owned subsidiary to focus on the growing demand for generic products in the Brazilian pharmaceutical market. However, after a few years, its strategy in Brazil did not bear any fruits. Since the last 2 years, Unichem is making a provision for diminution in value for Brazilian subsidiary. As of Dec2017, out of the total investment of Rs. 57 crores in Brazil, the company has already written off the entire amount with Rs. 21 crores being provided in 9mFY17 itself. There may be some more clearing expenses that will be written off due to Brazilian operations in Q4FY17. However, by and large Brazil operations completely written off, the operating profit will see a natural jump in from FY18.

6. Cost Saving and Efficiency to Flow: FY17 saw a series of one time that will not repeat for the company from FY18. Some of them include:

- FY17 saw a marketing cost of Rs. 19 crores for Unienzyme entry as an OTC product. This should not be more than Rs 10 crores from FY18.

- FY17 also saw total write-off related to Brazil worth Rs. 21 crores. This will not be repeated in FY18.

- Ongoing change of distribution model towards the C&F model have nearly come to conclusion. It is expected that it will lead some efficiency gains over the next 4-8 quarters.

- The export consignments to the US and many other areas will now be sent via shipments instead of air transport. This too is expected to bring in additional efficiencies.

- With sales growth expected to be double-digit, there could be some operating efficiencies mainly coming from other expenses.

7. Continuous Capex along with Strong Balance Sheet: In the last 6 years, Unichem has spent more than 500 crores to increase and improve its manufacturing capacity while keeping its balance sheet nearly debt free. With the potential uptick in domestic business and improving US business, the balance sheet is set to strengthen further.

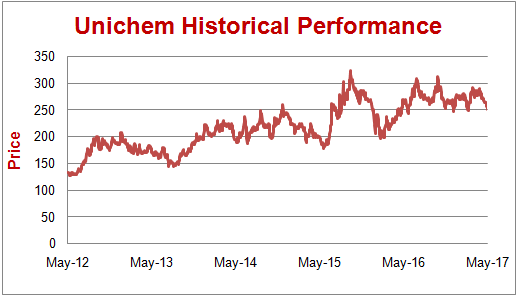

Valuations: At current price of Rs. 249, Unichem is trading at a market cap of Rs. 2263 crores, with FY16 profits at Rs. 108 crores. The profits for FY17 are also expected to be in the similar range making Unichem available at 21 times its trailing earnings. However, with double digit domestic formulation growth, healthy US market growth, reduction of one-off expenses and improving efficiencies, Unichem is set to grow significantly from its current levels. We therefore recommend to BUY Unichem at Rs. 249

Key Risks:

1. Inability to compete in the US market.

2. Inability to maintain more than 10% of of domestic segment growth.

3. Domestic regulatory changes affecting the pricing for the company.

Historical Share Price:

Dhruvesh Sanghvi is a Research Analyst registered with SEBI having registration No: INH000000875.

Definitions of Rating system:

1. Explanation of Type of Report

Fresh Recommendation Reports: These reports are first-time initiation reports on the concerned stock. Usually these reports are followed by updates on the same.

Update Reports: These reports include result update, event updates, annual report analysis and/or any other information that may be useful for the investor in relation to the concerned stock. Most of these update reports will have our current view on the same.

2. Explanation of Time Horizon: All the Fresh Recommendation reports in the investing section have a view of 3-5 years.

3. Explanation of Views: Views can be any one among these - Buy, Buy on Dips, Hold, Sell Partial, Exit

Buy: This means buying the concerned stock at current market price.

Buy on Dips: This means buying the concerned stock on the explained fall in price.

Hold: This means holding the concerned stock until further update.

Sell Partial: This means selling half of the existing position in the concerned stock.

Exit: This means completely exiting the concerned stock.

4. Explanation of Indicative Target Price: Achievement of Target Price does not imply Exit / Sell Partial. We will explicitly release Exit/ Sell Partial Report at an appropriate time. If required, Indicative Target Price could be revised based upon business performance, market environment or any other important event.

DISCLOSURES by RESEARCH ANALYST UNDER SEBI (RESEARCH ANALYSTS) REGULATIONS, 2014 is as under:

• Introduction: Prospero Tree Financial Services is an independent equity research proprietorship firm of Mr Dhruvesh Sanghvi.

• Business Activity: Prospero Tree Financial Services is committed in providing honest views, opinions and recommendations on financial markets opportunities.

• Report Written by: Dhruvesh Sanghvi

• Disciplinary History: None

• Terms & Conditions: https://www.prosperotree.com/termsofuse

• Details of Associates: Not Applicable

• Disclosure with regards to ownership and Material Conflicts of Interest:

1. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services, its associates, its Research analysts hold any position in the subject company.

2. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services, its associates, Research Analysts, nor its relatives, have more than 1% ownership of the subject company at the end of the month immediately preceding the date of publication of this report.

3. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services, its associates, Research Analyst nor its relatives, has any other material conflict of interest at the time of publication of the research report or at the time of public appearance.

• Disclosure with regards to Receipt of Compensation:

1. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services or its associates, or Research Analyst has received any compensation or other benefits from the subject company or the third party in connection with the research report in past twelve months.

2. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services or its associates, or Research Analyst have managed or co-managed public offering or securities for the subject company in past twelve months.

• Other Disclosures:

1. The Research Analyst has not served as an officer, director, or employee of the subject company.

2. The Research Analyst is not engaged in market making activity for the subject company.