|

Name |

Dishman Pharmaceuticals |

|

Type of Report |

First Recommendation |

|

Report Date |

Jan 20, 2017 |

|

Price on Report Date |

Rs. 231 |

|

Current Market Cap |

Rs. 3712 crores |

|

View |

Buy |

|

Indicative Target Price* |

Rs. 400 |

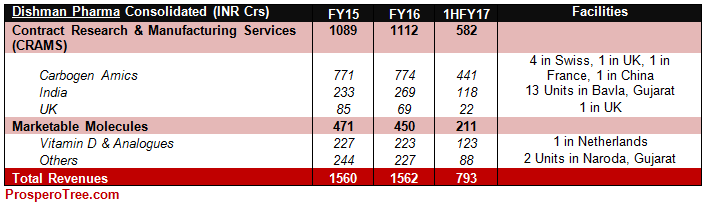

Company Background: Dishman Pharma is an outsourcing partner for the global pharmaceutical companies offering a portfolio of services for development, scale-up, and manufacturing of Active Pharma Ingredient (API). Dishman Pharma operates its business through two main segments of Contract Research and Manufacturing Services (CRAMS) and Marketable Molecules. A large portion of its CRAMS business comes from its subsidiary, Carbogen Amics, which was acquired by Dishman in 2006.

Dishman helps improve its customers' businesses by providing its services through its multi-location facilities in Switzerland, UK, India and China. In India, its facilities located in Gujarat -Bavla (13 units, most for CRAMS, 10 USFDA approved) and Naroda (Marketable Molecules, 2 units, 1 USFDA approved).

Investment Arguments:

1. Strong Foundations in CRAMS: Under the CRAMS segment, Dishman tie-up with innovator pharma companies to provide development, scale-up, and manufacturing of API. The projects that Dishman undertakes can broadly be categorized as Pre-clinical services, Clinical services (Phase I, II, III), and Commercialisation of API.

Dishman begin its first such CRAMS tie-up in 2001 with Solvay for supplying Eprosartan API. By 2005, Dishman has commercialized 5 APIs for its clients. Over the last decade, there are many notable achievements under Dishman that helped itself build a very strong foundation in CRAMs business.

-

Acquisition of Carbogen Amics in 2006, a leading CRAMS player in Europe with 4 facilities

-

18 APIs commercialized for pharma companies in last 15 years; All APIs continue to provide consistent long-term revenues to the company.

-

Superior trust gained among clients with 9 out of top 10 global pharma companies being their clients

-

Business de-risking achieved by broadening client base, increasing product offerings and executing through facilities at multiple locations

-

Moving up the value chain by taking projects of complex molecules with higher margins

2. Outsourcing Trend to help CRAMS business grow: In order to reduce the huge timelines of new drug discovery, innovator pharma companies are increasingly looking to outsource their research work. Further faced by near-term patent expiries of existing drugs and potential loss in revenues, these global pharmaceutical companies are focussed on reducing cost and improving productivity. This is further helping the trend to outsource work as it helps to achieve cost reduction and improve productivity.

Dishman, with its multi-location facilities, experience in complex molecules and an experienced global team, is well positioned to tap this outsourcing trend and provide reasonable growth from its base business without factoring large gains from new products being commercialized.

To equip this growth in base business and as its European facilities are running at full utilization, Carbogen Amics (Dishman subsidiary) has recently acquired a new facility in Bobenderf, Switzerland. This should be fully operational by Q4FY17.

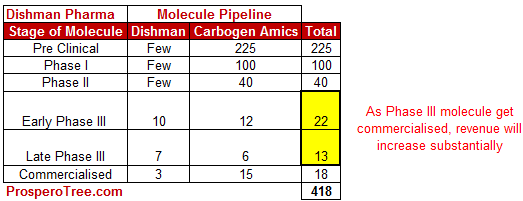

3. Excellent Pipeline of Late Stage Molecules: Dishman India and Carbogen Amics are currently working on more than 400 molecules at various stage of the pipeline. Out of these molecules, there are 18 API molecules that have already been commercialized for its clients. This commercialisation of API molecules for its innovator pharmaceutical clients has been achieved over 15 years.

Additionally, there are 35 molecules in Phase III clinical trials giving it a very strong pipeline of products that may enter into being commercialized. Most of these 35 molecules in Phase III clinical trials are high-value products with a large portion of them in the Oncology segment. Most of these molecules have a large revenue potential if they reach the commercialisation stage.

For instance, one of the molecules that Dishman is currently working on is for ovarian cancer where Dishman is the first source of supply and has a long-term agreement with its client. There are ~22000 patients in USA and ~65000 patients in Europe that are diagnosed with ovarian cancer making the size of the opportunity too huge for this molecule alone. Dishman’s client has already filed for final regulatory approvals for the product to be commercialized. In case if this product is commercialized, this should give sizable revenue to Dishman in the next 2-3 years, as the product acceptance increases in the regulated markets. Due to this, it is expected that within next 2 months USFDA team will visit Dishman Bavla Unit 9 facility for inspection.

Though, it is difficult to predict when and which molecule will be commercialized, Dishman has a strong basket of products near commercialisation that can give strong positive outcome to its financials apart from the existing business.

4. Positioning of India & China Facilities to Shift business from Switzerland: Dishman has continued to operate under two separate brands named -Carbogen Amics and Dishman. However, with the new CEO joining since 2014, the group is now positioning itself as Dishman Carbogen Amics as a common entity. The strategy is to convert clients for scaling up API requirement from facilities in Europe to facilities in India and China. In FY16, the Chinese (Shanghai) facility reached a cash breakeven point for the first time after being operational. Similarly, in India, most facilities are now running at decent utilization except for its most critical unit (HIPO facility, unit 9) running at comparatively lower utilization.

Better positioning and utilization of both Asian facilities (India & China) will help the company increase margins sustainably.

5. Focus on High-Value Products in Marketable Molecules: The company manufacturers Vitamin D which is a part of Marketable Molecules segment at its Netherlands facility that was acquired before 2010. Since 2016, Dishman is focussing on high-value products of Vitamin D known as Vitamin D analogues and cholesterol. In addition to improvement in margins provided through high-value analogues, the company has also changed its marketing strategy from distributor channel to direct sales to end-customer. This has helped the company de-risking itself by increasing its customer base and brought in better predictability to the business. Partial fruits of the steps taken can be seen from the increase in margins from 19% in FY15 to 30% in FY16 in this segment. This renewed strategy should help the company improve the profitability margins further at Netherlands operation.

6. Plans to Reduce Debt and Improvement in Finance Cost: In FY16, Dishman had a profit of Rs. 170 crores along with a depreciation of Rs. 110 crores. With hardly any change in working capital needs and a yearly capex program of around Rs. 150 crores, the company is left with substantial of free cash available to decrease its debt. The management has indicated on the similar lines and we should see a decent amount of decrease in debt over next 2-3 years. Apart from debt reduction, the company has recently converted a portion of its rupee debt into foreign currency debt thereby bringing in saving from interest expense. The conversion of rupee debt into foreign debt does not carry a currency risk as it gets paid from the foreign currency income for the company.

Valuations: Dishman Pharma is trading at a price of Rs. 231 with a market cap of Rs. 3712 crores having a total debt of Rs. 781 crores. With profits of Rs. 200 crores in the last four quarter, Dishman is trading at a trailing price to earnings multiple of 18 times. Dishman with its strong CRAMS experience, large client base including 9 out of top 10 pharmaceutical companies, excellent product pipeline of 35 products in Phase III, and multi-location facilities is well poised to capture long-term growth in the field of CRAMS. In addition to this, its marketable molecules business mainly comprising of Vitamin D analogues can also help the company to increase margins and provide long term consistent cash flows.

Considering base business CRAMS growth, large potential from commercialization of few API molecules over the years along with consistent cash flows from Vitamin D business, we suggest buying Dishman at CMP of Rs. 231.

Key risks:

-

Large Currency Fluctuations can affect Dishman due to its large operations in Europe

-

Regulatory Risk in terms of disallowing Dishman’s plants for exports into specific countries can substantially dent the earnings.

-

Reversal of outsourcing trend among the global pharmaceutical companies.

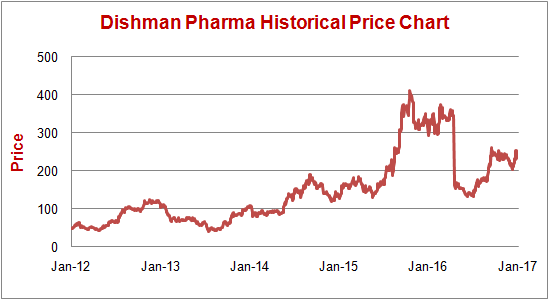

Historical Price Chart

Dhruvesh Sanghvi is a Research Analyst registered with SEBI having registration No: INH000000875.

Definitions of Rating system:

1. Explanation of Type of Report

-

Fresh Recommendation Reports: These reports are first-time initiation reports on the concerned stock. Usually these reports are followed by updates on the same.

-

Update Reports: These reports include result update, event updates, annual report analysis and/or any other information that may be useful for the investor in relation to the concerned stock. Most of these update reports will have our current view on the same.

2. Explanation of Time Horizon: All the Fresh Recommendation reports in the investing section have a view of 3-5 years.

3. Explanation of Views: Views can be any one among these - Buy, Buy on Dips, Hold, Sell Partial, Exit

-

Buy: This means buying the concerned stock at current market price.

-

Buy on Dips: This means buying the concerned stock on the explained fall in price.

-

Hold: This means holding the concerned stock until further update.

-

Sell Partial: This means selling half of the existing position in the concerned stock.

-

Exit: This means completely exiting the concerned stock.

4. Explanation of Indicative Target Price: Achievement of Target Price does not imply Exit / Sell Partial. We will explicitly release Exit/ Sell Partial Report at an appropriate time. If required, Indicative Target Price could be revised based upon business performance, market environment or any other important event.

DISCLOSURES by RESEARCH ANALYST UNDER SEBI (RESEARCH ANALYSTS) REGULATIONS, 2014 is as under:

• Introduction: Prospero Tree Financial Services is an independent equity research proprietorship firm of Mr Dhruvesh Sanghvi.

• Business Activity: Prospero Tree Financial Services is committed in providing honest views, opinions and recommendations on financial markets opportunities.

• Report Written by: Dhruvesh Sanghvi

• Disciplinary History: None

• Terms & Conditions: https://www.prosperotree.com/termsofuse

• Details of Associates: Not Applicable

• Disclosure with regards to ownership and Material Conflicts of Interest:

1. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services, its associates, its Research analysts hold any position in the subject company.

2. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services, its associates, Research Analysts, nor its relatives, have more than 1% ownership of the subject company at the end of the month immediately preceding the date of publication of this report.

3. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services, its associates, Research Analyst nor its relatives, has any other material conflict of interest at the time of publication of the research report or at the time of public appearance.

• Disclosure with regards to Receipt of Compensation:

1. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services or its associates, or Research Analyst has received any compensation or other benefits from the subject company or the third party in connection with the research report in past twelve months.

2. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services or its associates, or Research Analyst have managed or co-managed public offering or securities for the subject company in past twelve months.

• Other Disclosures:

1. The Research Analyst has not served as an officer, director, or employee of the subject company.

2. The Research Analyst is not engaged in market making activity for the subject company.