|

Name |

Deepak Nitrite |

|

Type of Report |

First Recommendation |

|

Report Date |

Dec 29, 2016 |

|

Price on Report Date |

Rs. 87 |

|

Current Market Cap |

Rs. 1000 crores |

|

View |

Buy |

|

Indicative Target Price* |

Rs. 160 |

Company Background: Incorporated in 1970, Deepak Nitrite mainly manufactures bulk and speciality chemicals and categories them into –Basic Chemicals, Fine & Speciality Chemicals and Performance Chemicals. Deepak Nitrite has expertise in multiple chemistries with focus on nitration and alkylation among others having manufacturing plants in Nandesari (Vadodara), Telangana and its largest plant in Dahej (near Bharuch). Deepak Nitrite started with manufacturing of Sodium Nitrite and now has a basket of more than 30 products across various categories.

Investment Arguments:

1. Consistent Expansion of Basic Chemicals Business: DNL started with the production of basic chemicals like Sodium Nitrite and consistently increased its capacities which finds its applications in Dyes, Pigments, Pharma Intermediaries, Food Colors, and Colourants among others. Over time, DNL added other products like Nitro Toluenes and Fuel Additives in this division that find application in Colourants, rubber chemicals, pharma, explosives, DASDA, agro chemicals and petroleum products.

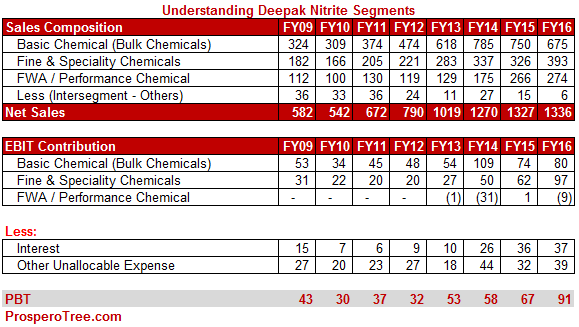

With vast experience in production and improvement in processes, the company has been able to create a cost leadership in these basic chemicals. Today DNL has the highest market share in Sodium Nitrite, Sodium Nitrate and Nitro Toluenes in India. DNL has been able to continuously expand the basic chemicals business from Rs. 309 crores in FY10 to Rs. 675 crores in FY16 with its operating profit increasing from Rs. 34 crores in FY 10 to Rs. 80 crores in FY16.

2. Changing mix towards Fine and Speciality Chemicals: Deepak Nitrite has come a long way from being a pure commodity chemical player (basic chemicals) to have 30% of revenue and 57% of operating profit coming from Fine & Speciality Chemicals. This segment mainly includes:

-

Xylidines -Pigment, Fuel, Agrochemicals, Pharma

-

Oximes - Agrochemicals

-

Cumidines - Agrochemicals

Today, DNL is among the top three global suppliers for products like Cumidines and Oximes and caters to diverse set of global players in colourants and agrochemicals space. This segment provides the company with much better margins due to the customised nature of these chemicals.

To further steer growth in fine and speciality chemicals, DNL is now focussing on increasing product basket for pharma and personal care where the company sees large potential that can nearly double the revenue of this division with sustained increase in margins. As of now, Pharma and Personal Care gives revenue of Rs. 30.87 crores out of the total revenues of Rs. 393 crores in FY16.

3. Potential Improvement in Optical Brightening Agents (OBA) Business: As a part of forward integration exercise, DNL constructed a new OBA plant with a capex of Rs. 300 crores (including hit on foreign currency loan) that was operational in FY14. This plant used DNLs DASDA as an input to produce OBA and has been planned to cater to the international end-user markets of Paper, Detergents and Textiles.

The ramp up of this plant did not happen the way it was envisaged as a result of increased competition, falling industry demand and high switching costs for the potential clients. In FY16, the performance chemicals division did a total sales of Rs. 274 crores with OBA sales at Rs. 172 crores and DASDA sales Rs. 102 crores. The management is now more confident about turning the OBA into positive and we should see the same happening over FY18. On the positive side, though a little far, this division can give sales of more than Rs. 450 crores at full capacity utilisation.

4. Mega-expansion of import substitutes –Phenol and Acetone: DNL has created a wholly owned subsidiary named, Deepak Phenolic Limited to through which the company is going through a green field expansion of Rs. 1200 crores for the production of 200,000 MT Phenol and 120,000 MT of co-product Acetone. This expansion is planned to be funded as follows:

-

Rs 80 crores = Jan2016 QIP done @ Rs 70.9 with 10% Dilution

-

Rs 80 crores = Apr2016 Land Sale

-

Rs 720 crores = Term Debt Already Tied Up for a period of 13 years

-

Rs 120 crores = Second QIP Planned

-

Rs 200 crores = Estimated Internal Accrual of DNL in FY17 and FY18

The company has purchased the process technology from KBR Inc. of USA which is a leading global player in petrochemical technology and has vast experience in phenol/acetone process and design technologies. The company already has the environmental clearance in place for the plant to be constructed in Dahej. The project has a target of commercial operation by Jan2018.

Why Phenol & Acetone Projects Makes Sense? India currently exports the raw materials, Benzene and Propylene and imports Phenol and Acetone. As of today, more than 80% of the current demand for both products is fulfilled by imports. There are only 2 players in India that have small production units for Phenol and Acetone and both these companies do not want to expand mainly because of stretched balance sheet and / or management willingness to focus into this space. If properly implemented, there is a substantial scope of sustained long term profits from this project.

5. Strong Cash Flow Generation From Existing Business: Over the last 5 years, DNL saw its cash flows increase from Rs. 45 crores in FY11 to Rs. 102 crores in FY16 on back of sustained improvement in business of basic chemicals and fine & speciality chemicals. If not for the small fire incident at one of the DNL plants, the cash flow for FY17 would have been much better than that of FY16. With the help of these cash flows, Deepak Nitrite has been continuously able to expand its plants and has invested heavily over last few years. It is the same cash flows in future that will help the company to invest in the much larger project of Phenol and Acetone.

Valuation: At the CMP of Rs. 87, Deepak Nitrite is trading at a market cap of Rs. 1000 crores with Rs. 375 crores of borrowings at standalone level as on 1HFY17. Adding another Rs. 720 crores of term loans for the phenol project, the peak debt will be in the range of Rs. 1100-1200 crores by FY18. Against this its current business is generating more than Rs. 65 crores of profits and Rs. 102 crores of cash flows as per FY16 and the timely success of phenol project will add considerable cash flows to this existing stable pool of cash flows.

Considering the stability from Basic Chemicals business, growth in Fine & Speciality division and potential turnaround in Performance Chemicals business, along with the success of Phenol and Acetone project that is expected to start its commercial production by Jan2018 will can help company to have quantum leap in its profits making the current market price quite attractive. We therefore suggest a Buy on Deepak Nitrite Ltd at current market price.

Key Risk:

-

Extreme competition in Basic Chemicals that can see deterioration in market share

-

Unable to improve utilization of Optical Brightening Agents

-

Delay in Phenol + Acetone project and global oversupply in Phenol leading to unviable discounting

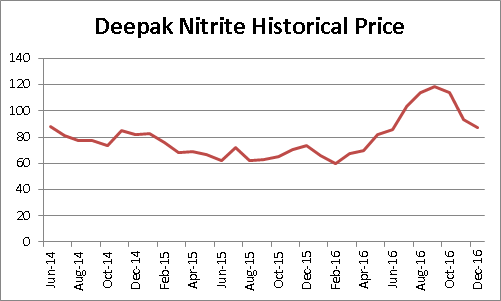

Historical Price Chart

Dhruvesh Sanghvi is a Research Analyst registered with SEBI having registration No: INH000000875.

Definitions of Rating system:

1. Explanation of Type of Report

-

Fresh Recommendation Reports: These reports are first-time initiation reports on the concerned stock. Usually these reports are followed by updates on the same.

-

Update Reports: These reports include result update, event updates, annual report analysis and/or any other information that may be useful for the investor in relation to the concerned stock. Most of these update reports will have our current view on the same.

2. Explanation of Time Horizon: All the Fresh Recommendation reports in the investing section have a view of 3-5 years.

3. Explanation of Views: Views can be any one among these - Buy, Buy on Dips, Hold, Sell Partial, Exit

-

Buy: This means buying the concerned stock at current market price.

-

Buy on Dips: This means buying the concerned stock on the explained fall in price.

-

Hold: This means holding the concerned stock until further update.

-

Sell Partial: This means selling half of the existing position in the concerned stock.

-

Exit: This means completely exiting the concerned stock.

4. Explanation of Indicative Target Price: Achievement of Target Price does not imply Exit / Sell Partial. We will explicitly release Exit/ Sell Partial Report at an appropriate time. If required, Indicative Target Price could be revised based upon business performance, market environment or any other important event.

DISCLOSURES by RESEARCH ANALYST UNDER SEBI (RESEARCH ANALYSTS) REGULATIONS, 2014 is as under:

• Introduction: Prospero Tree Financial Services is an independent equity research proprietorship firm of Mr Dhruvesh Sanghvi.

• Business Activity: Prospero Tree Financial Services is committed in providing honest views, opinions and recommendations on financial markets opportunities.

• Report Written by: Dhruvesh Sanghvi

• Disciplinary History: None

• Terms & Conditions: https://www.prosperotree.com/termsofuse

• Details of Associates: Not Applicable

• Disclosure with regards to ownership and Material Conflicts of Interest:

1. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services, its associates, its Research analysts hold any position in the subject company.

2. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services, its associates, Research Analysts, nor its relatives, have more than 1% ownership of the subject company at the end of the month immediately preceding the date of publication of this report.

3. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services, its associates, Research Analyst nor its relatives, has any other material conflict of interest at the time of publication of the research report or at the time of public appearance.

• Disclosure with regards to Receipt of Compensation:

1. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services or its associates, or Research Analyst has received any compensation or other benefits from the subject company or the third party in connection with the research report in past twelve months.

2. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services or its associates, or Research Analyst have managed or co-managed public offering or securities for the subject company in past twelve months.

• Other Disclosures:

1. The Research Analyst has not served as an officer, director, or employee of the subject company.

2. The Research Analyst is not engaged in market making activity for the subject company.