Name Sunteck Realty

Type of Report First Recommendation

Report Date Dec 22, 2016

Price on Report Date Rs. 222 (Post Split Price Rs. 111)

Current Market Cap Rs. 1390 crores

View Buy

Indicative Target Price* Rs. 350

Company Background: Sunteck Realty is a Mumbai based Real Estate developer catering to the ultra-luxury, luxury and middle class residential segment. Primarily a residential player, Sunteck also has few commercial projects in Mumbai. It has a total developmental portfolio of more than 1 crores square feet in Mumbai in the form of completed, on-going and yet-to-start projects. Apart from Mumbai, Sunteck has tie-up with land owners at two other locations -Dubai (10 lakh sqft) and Jaipur (85 lakh sqft) that are categorized as yet-to-start projects.

Investment Arguments

1. Most Resilient Real Estate Market of India: Over last many decades, Mumbai real estate has been the most resilient real estate market in India. There are host of reasons that explains the same:

- Busy Port: Mumbai is the commercial capital of India and has the most busiest ports of India

- Population Migration: Continuous migration seen from other parts of India to Mumbai due to employment opportunities, studying opportunities and attractive center of art/cinema. This has made Mumbai to be the most densely populated city of the world having a population of more than 2 crores residents.

- Rich and Wealthy: Mumbai accommodates highest number of millionaires and billionaires in India

- Less Availability of New Land Parcels: Over the last few decades, the available free land has become quite scarce making the cost of land quite expensive in Mumbai.

- Mumbai is locked by Sea on 3 Sides: As seen in the above chart, Mumbai is locked by sea from 3 sides, making it almost impossible for a city to expand.

Like any other asset class, real estate to has its own share of over-valuation periods. However, based on the factors described coupled with strong inherent demand in Mumbai, it has proven to be the most resilient real estate market in India and to an extent in the world.

2. Strategic Land Parcels At Excellent Location: With the leadership of Mr Kamal Khetan, Sunteck has been able to buy land at attractive prices at very good locations in Mumbai. Taking a bet on upcoming areas like Bandra Kurla Complex (BKC) and Oshiwara Development Centre (Goregaon), Sunteck bought land parcels in these areas from 2006 to 2010 as below.

- BKC Land: The BKC Land Purchase was done in three rounds of 2 Acre in 2006, 1 Acre in 2009 and 1 Acre in 2010. Together this 4 Acre continuous land parcel was used to develop an ultra-luxury residential project in the Heart of BKC. The total cost paid by Sunteck for this 4 Acre land parcel is just Rs. 620 crores and is worth a lot more today.

- Goregaon Land: In a similar manner, Sunteck bought a total of 23 Acres (7 + 16) land in Goregaon for the sum of Rs. 425 crores to construct residential projects catering to Mumbai sub-urban middle class. The Goregaon land is just located outside the new railway station at Oshiwara (Ram Mandir Station) that is expected to start in the next few weeks. The Goregaon property has one of the best connectivity in terms of access to railways, airport, and highway having a strong social infrastructure in the nearby vicinity.

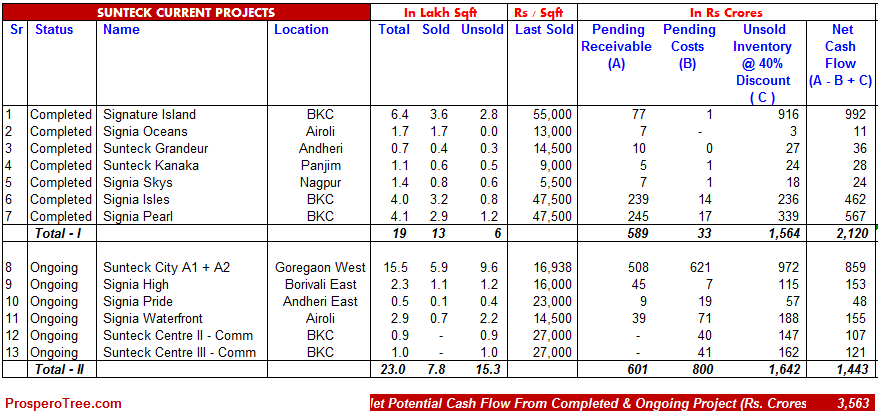

3. Large Inventory of 'Completed but Unsold' to be Monetized Over Time: As of Sep2016, Sunteck has 7 completed projects with 6 lakh square feet of unsold inventory. The project mainly includes three iconic in BKC named Signature Island, Signia Isle and Signia Pearl that belong to ultra-luxury segment having a unit size between 3000 square feet to 11500 square feet. If we value all these projects at the price of last unit sold, the total unsold finished inventory can be valued at Rs. 2606 crores. Even if these projects are valued at an unreasonable steep discount of 40% to the last unit sale price, the unsold finished inventory would be valued at Rs. 1564 crores. Similarly, if the on-going projects unsold inventory is valued at a 40% discount to the sale price of last unit, the on-going projects unsold inventory would be valued at Rs. 1642 crore.

Even based on such conservative calculations, the potential net cash inflow after all the pending expenses for completion of the above 13 projects would be Rs. 3563 crores -a very substantial number for a company like Sunteck. The entire exercise with a 40% discount is just to get a sense of the potential contribution out of just 13 projects. We, however, think that the inventory will command a much better rate and should not see more than a 10% discount.

4. Big Pipeline of Projects Gives Long Term Visibility: Apart from 7 completed and 6 on-going projects as mentioned previously, Sunteck has multiple other projects at early stage where either land buying or the JV / JDU model is already in place. This includes,

- 42 lakh sqft project on a 16 acre owned land in Goregaon which was bought in 2012 for Rs. 300 crores

- 85 lakh sqft project in Jaipur in a JV/JDU model

- 3 lakh sqft project in Dadar, Mahalaxmi, and Vileparle under JV/JDU model

- JDU project in Dubai and a commercial JDU project in Sion

It is difficult to assign values to these projects in the current economic environment; however, it is clear that there is tremendous value in terms of visibility that these projects bring for the company over a 5-10 year period.

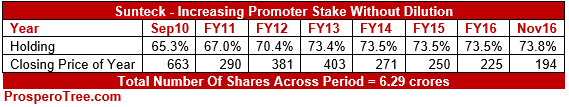

5. Increasing Promoter Stake: Sunteck promoter now holds around a 74% stake in the company without having any of the promoters shares pledged. Since FY11, the promoter increased his stake from 65% to 74% by purchasing the same from the open market at prices higher than the current market price.

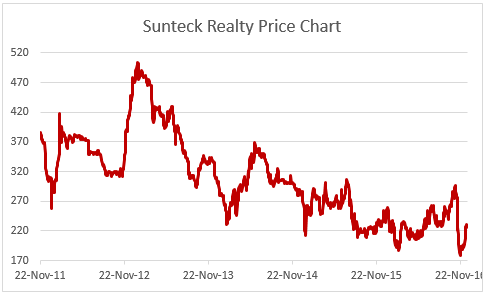

Valuations: Today, Sunteck Realty Ltd is trading at a price of Rs.222 with a market capital of Rs.1390 crs. As of FY16, the company has a net worth of Rs. 1634 crores and debt of approximately Rs. 850 crores giving it an enterprise value of nearly Rs. 2500 crores. Comparing this enterprise value of Rs. 2500 crores with inventory value, we get two very interesting observations that make Sunteck quite attractive:

- The Enterprise Value is far lower than the Unsold Finished Goods Inventory assuming recent prices. Even if we take a discount of 40% on recent unit sale price of unsold inventory, the enterprise price value is still substantially lower than the net cash flow of these projects.

- The Enterprise Value is far lower than the total inventory at cost on the balance sheet.

The real estate sector may be completely out of favor due to the weak sales and potential hit due to demonetization. However, at the current market price, we think that the risk to reward ratio is far in favor of the rewards with respect to Sunteck. We therefore suggest a BUY in Sunteck Realty at CMP of Rs. 222 with a view of 3-5 years.

Key risk:

- Domestic demand not picking up in-spite of price correction if any.

- Delay in execution of projects due to regulatory risks or large cost over-runs.

Historical Performance:

Dhruvesh Sanghvi is a Research Analyst registered with SEBI having registration No: INH000000875.

Definitions of Rating system:

1. Explanation of Type of Report

Fresh Recommendation Reports: These reports are first-time initiation reports on the concerned stock. Usually these reports are followed by updates on the same.

Update Reports: These reports include result update, event updates, annual report analysis and/or any other information that may be useful for the investor in relation to the concerned stock. Most of these update reports will have our current view on the same.

2. Explanation of Time Horizon: All the Fresh Recommendation reports in the investing section have a view of 3-5 years.

3. Explanation of Views: Views can be any one among these - Buy, Buy on Dips, Hold, Sell Partial, Exit

Buy: This means buying the concerned stock at current market price.

Buy on Dips: This means buying the concerned stock on the explained fall in price.

Hold: This means holding the concerned stock until further update.

Sell Partial: This means selling half of the existing position in the concerned stock.

Exit: This means completely exiting the concerned stock.

4. Explanation of Indicative Target Price: Achievement of Target Price does not imply Exit / Sell Partial. We will explicitly release Exit/ Sell Partial Report at an appropriate time. If required, Indicative Target Price could be revised based upon business performance, market environment or any other important event.

DISCLOSURES by RESEARCH ANALYST UNDER SEBI (RESEARCH ANALYSTS) REGULATIONS, 2014 is as under:

• Introduction: Prospero Tree Financial Services is an independent equity research proprietorship firm of Mr Dhruvesh Sanghvi.

• Business Activity: Prospero Tree Financial Services is committed in providing honest views, opinions and recommendations on financial markets opportunities.

• Report Written by: Dhruvesh Sanghvi

• Disciplinary History: None

• Terms & Conditions: https://www.prosperotree.com/termsofuse

• Details of Associates: Not Applicable

• Disclosure with regards to ownership and Material Conflicts of Interest:

1. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services, its associates, its Research analysts hold any position in the subject company.

2. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services, its associates, Research Analysts, nor its relatives, have more than 1% ownership of the subject company at the end of the month immediately preceding the date of publication of this report.

3. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services, its associates, Research Analyst nor its relatives, has any other material conflict of interest at the time of publication of the research report or at the time of public appearance.

• Disclosure with regards to receipt of Compensation:

1. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services or its associates, or Research Analyst has received any compensation or other benefits from the subject company or the third party in connection with the research report in past twelve months.

2. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services or its associates, or Research Analyst have managed or co-managed public offering or securities for the subject company in past twelve months.

• Other Disclosures:

1. The Research Analyst has not served as an officer, director, or employee of the subject company.

2. The Research Analyst is not engaged in market making activity for the subject company.