Name Sasken Communication Technologies

Type of Report First Recommendation

Report Date Nov 20, 2016

Price on Report Date Rs. 394

Current Market Cap Rs. 697 crores

View Buy

Indicative Target Price* Rs. 650

Company Background: Sasken provides product engineering services for hardware and software to tier1 customers in verticals like Semiconductors, Consumer Electronics, Smart Devices, and Automotive Electronics & Network Equipment among others. Within product engineering, Sasken is known to have deep expertise in communication and media processing hardware and software.

Investment Arguments

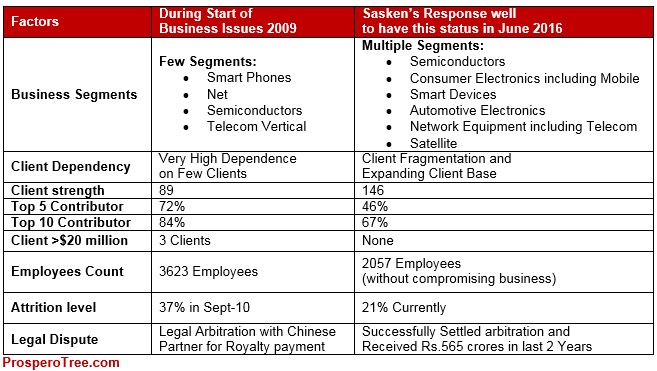

1. Gaining Stability Again: Post FY09, Sasken faced multiple business issues to be dealt with. Sasken had a very high client concentration with top 5 clients including Nokia, Nortel and Motorola contributing 72% of its revenues in FY09. Smart phone market had a major overhaul in 2011-12 when most smart phone manufacturers shifted their operating systems from Symbian to Android, IOS and Windows. As a result, Sasken lost out its major revenues from Nokia and Motorola when they switched away from Symbian to Android and Windows. Sasken also lost revenue from Nortel in the networking space due to Nortel’s own financial mess. .The loss of main clients was coupled with extremely high attrition level of around 37% in FY11.

However, Sasken successfully came out from these turbulent times by reducing client concentration, adding new clients, reducing attrition levels, building expertise in various operating systems (Android, Windows) and broadening its services offerings to multiple business verticals. The same can be seen in the table above.

2. Addressing to Markets with Strong Growth: Until 2010, Sasken was catering to very few segments with nearly all its revenues coming from telecom, mobile devices and semiconductors industry. However, since 2011, Sasken invested heavily in building expertise in adjacent domains where it could provide its engineering services. These adjacent domains include verticals like satellite communication, automotive infotainment systems and consumer electronics which were added in 2012. In 2014, Sasken further increased its thrust towards enterprise mobility to clients in the retail segment and field testing services to its clients in smart phones and tablet segment. Leveraging its expertise in the communication and media hardware and software design, Sasken is also offering its services in exponentially growing sector of Internet of Things (IoT). The application of IoT has humongous scope and Sasken is already servicing in sectors like building energy management, Home Automation, Consumer & Wearables, Automotive & Transportation, Insurance and Retail.

3. Marquee Client Names -a testimony of its expertise: Sasken has a long list of marquee clients in every field that it is working. In total, Sasken is currently working with more than 150 clients with market leaders like Intel (semiconductors design), Texas Instrument, JBL (audio), Honeywell (Home Automation), Qualcomm (Telecom), British Telecom (Telecom), Sony (Devices), Motorola (Devices) and many other such industry leaders. Within the semi-conductors industry, Sasken is partner to 6 out of top 10 vendors who represent more than 50% of revenues for the industry. In the rugged devices, Sasken customer portfolio includes the top 2-3 largest players in the industry having more than 50% market share in their categories. In all Sasken has been a partner in launching of more than 100 breakthrough products globally. Sasken has been able to secure repeat business from most of its clients. This quality enables Sasken to bring incremental business in future as well. For example, Nokia plans to re-enter in smart phones market based on Android operating system opens doors for Sasken for business in future.

All this is testimony of Sasken's reputation of being a dependable partner in providing product engineering services which has resulted in receipt of repeated orders thereby providing strong stability in earning.

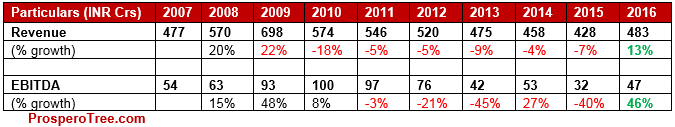

4. Base Established; Any Growth Will Boost Earnings: Its initiatives since 2010 to increase the service offerings for various industries and to increase capabilities by not being dependent on single operating system like Symbian has helped Sasken to create a very strong base for itself. Based on the client addition and market opportunity, Sasken seems to be at a cusp of substantial growth over the next few years. If numbers provide any hint then after a long period of de-growth in revenues, Sasken was able to grow by 13% in FY16 and post modest growth in 1HFY17. The efforts of Sasken are now looking to yield good results in form of decent growth over the next 2-3 years.

5. Balance Sheet cleaned by writing down investment in subsidiaries: In its good times, Sasken invested heavily in building base by acquiring and setting up subsidiaries in countries like USA, Finland, Mexico and Shanghai. However, as explained the business dynamics changed and the company slowly wrote off its entire investments made in these subsidiaries. In all, Sasken completely cleaned its balance sheet as it wrote off aggregate amounts of Rs. 242 crores in the form of diminishing value of investment and goodwill write-off in the last 6 years. As of FY16 the total investments in various subsidiaries just remains at Rs. 37 crores.

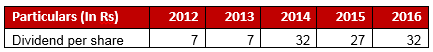

6. Strong Cash Position; Continuous Buybacks and Dividends: Sasken has a strong balance sheet with a cash surplus of Rs. 390 crores as of 1HFY17. Sasken has been continuously paying good dividends and is also rewarding shareholders with continuous buyback programs. The company has paid a dividend in the range of Rs. 7 per year. In the last 3 years, the company has paid a special dividend every year making the dividends in the range of Rs. 27-32 per share as seen below.

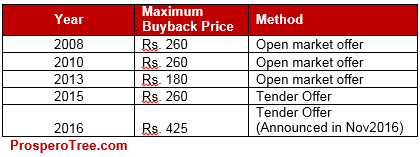

In a similar fashion, Sasken has also rewarded the shareholders with Rs. 211 crores over the last 4 buyback done since 2008. In Nov2016, the company announced an additional largest ever share buyback program of Rs.120 crores at maximum price of Rs. 425.

Valuation:

Against the current market cap of Rs. 697 crores, Sasken has cash and equivalent worth Rs. 390 crores and an operating profit before tax of around Rs. 50 crores. With sustained efforts Sasken has come a long way by de-risking its business that was once dependent on few customers in a single segment to large set of clients across various verticals. For the last 16 quarters Sasken’s revenues are hovering in the range of Rs. 120 crores per quarter and with the base now set, we think the business uptick for the company is not far away. The confidence also comes from the fact that the sectors where Sasken services is going through high growth phase and Sasken being a reputed name should be able to get its own share of pie. It is also important to note that in case if the recent buyback announced goes through, Sasken will have a much higher EPS growth as compared to PAT growth in future.

We therefore recommend Buying Sasken Communication Technologies Ltd at current market price of Rs. 394

Key Risks

- Technological Disruption: Any transition or major change in technology and delay in adapting new technological environment failure may hurt the growth of the company.

- Sasken generate 72% of its revenue from the export market. Any negative fluctuation in forex may hurt the profitability for the unhedged position.

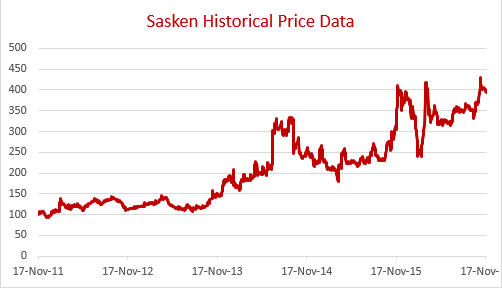

Historical Performance:

Dhruvesh Sanghvi is a Research Analyst registered with SEBI having registration No: INH000000875.

Definitions of Rating system:

1. Explanation of Type of Report

Fresh Recommendation Reports: These reports are first-time initiation reports on the concerned stock. Usually these reports are followed by updates on the same.

Update Reports: These reports include result update, event updates, annual report analysis and/or any other information that may be useful for the investor in relation to the concerned stock. Most of these update reports will have our current view on the same.

2. Explanation of Time Horizon: All the Fresh Recommendation reports in the investing section have a view of 3-5 years.

3. Explanation of Views: Views can be any one among these - Buy, Buy on Dips, Hold, Sell Partial, Exit

Buy: This means buying the concerned stock at current market price.

Buy on Dips: This means buying the concerned stock on the explained fall in price.

Hold: This means holding the concerned stock until further update.

Sell Partial: This means selling half of the existing position in the concerned stock.

Exit: This means completely exiting the concerned stock.

4. Explanation of Indicative Target Price: Achievement of Target Price does not imply Exit / Sell Partial. We will explicitly release Exit/ Sell Partial Report at an appropriate time. If required, Indicative Target Price could be revised based upon business performance, market environment or any other important event.

DISCLOSURES by RESEARCH ANALYST UNDER SEBI (RESEARCH ANALYSTS) REGULATIONS, 2014 is as under:

• Introduction: Prospero Tree Financial Services is an independent equity research proprietorship firm of Mr Dhruvesh Sanghvi.

• Business Activity: Prospero Tree Financial Services is committed in providing honest views, opinions and recommendations on financial markets opportunities.

• Report Written by: Dhruvesh Sanghvi

• Disciplinary History: None

• Terms & Conditions: https://www.prosperotree.com/termsofuse

• Details of Associates: Not Applicable

• Disclosure with regards to ownership and Material Conflicts of Interest:

1. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services, its associates, its Research analysts hold any position in the subject company.

2. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services, its associates, Research Analysts, nor its relatives, have more than 1% ownership of the subject company at the end of the month immediately preceding the date of publication of this report.

3. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services, its associates, Research Analyst nor its relatives, has any other material conflict of interest at the time of publication of the research report or at the time of public appearance.

• Disclosure with regards to Receipt of Compensation:

1. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services or its associates, or Research Analyst has received any compensation or other benefits from the subject company or the third party in connection with the research report in past twelve months.

2. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services or its associates, or Research Analyst have managed or co-managed public offering or securities for the subject company in past twelve months.

• Other Disclosures:

1. The Research Analyst has not served as an officer, director, or employee of the subject company.

2. The Research Analyst is not engaged in market making activity for the subject company.