|

Name |

Heritage Foods Ltd. (HFL) |

|

Type of Report |

First Recommendation |

|

Report Date |

Nov 07, 2016 |

|

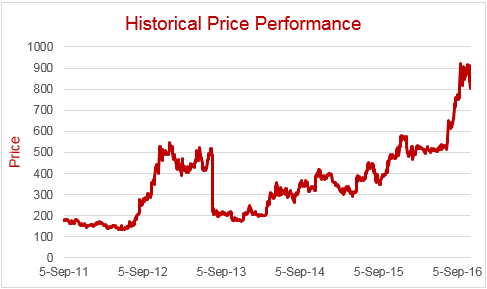

Price on Report Date |

Rs. 845 (Post Spilt Price = Rs. 422) |

|

Current Market Cap |

Rs. 1,959 crores |

|

View |

Buy |

|

Indicative Target Price* |

Rs. 1,200 |

Company Background

Heritage Foods Limited (HFL) was founded by Chandrababu Naidu as a dairy company in 1992 with a vision to provide remunerative prices to dairy farmers for their milk. Today, HFL has 72% of its revenues coming from dairy business which is involved in procuring raw milk and processing it into consumer products like pouch milk, curd, buttermilk, ice-cream, paneer, flavored milk, etc. Its dairy products are sold across 10 states in India with a dominant presence in Andhra Pradesh & Telangana. The other part of the revenues come from the retail division having 123 stores in Hyderabad, Bangalore and Chennai which sell essential household items like fruits, vegetables, grocery, general merchandise, etc. This division was started in 2006 as a logical extension to dairy business but continues to be a loss making division since its inception.

Investment Arguments

1. Structural Trends to ensure Strong Growth Prospects: Industry estimates suggest that the share of organized dairy market is a mere 20% which is expected to rise to 25% by 2020E (Source: IMARC report) indicating 20% cagr. This growth will be driven by burgeoning urbanization, nuclearization of families, changing dietary patterns, shift to branded packaged foods with a preference for hygienic products.

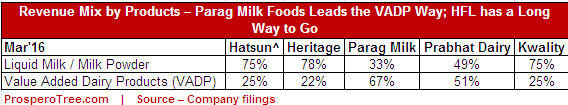

Value added products like curd, buttermilk, cheese, ice-creams, paneer, etc command higher selling prices/ margins vs. plain pouch milk/ milk powders. The market share of VADP is expected to increase from 21% in FY13 to 31% in FY20 (Source: Rabobank 2013) on the back of favorable demographics. As more women join the workforce, the hitherto trend of preparing curd, ghee, buttermilk, shrikhand, paneer, etc at home will decline, for want of time and convenience.

Heritage Foods can be a big beneficiary of this shift from ‘Unorganized’ to ‘Organized’ Dairy Market and from ‘Plain Milk’ to ‘Value-Added Dairy Products’.

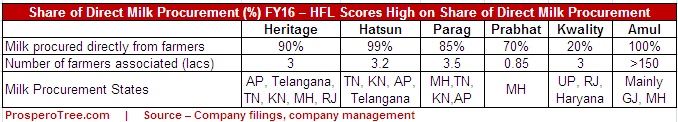

2. Robust Milk Procurement Supply Chain: Raw Milk procurement is the most critical element in the dairy industry. Companies which procure milk directly from farmers witness steady raw milk supply and greater consistency in milk quality (vital for manufacturing value added products) vs. those companies that source milk through middlemen/ agents. Establishing relationships with farmers for direct sourcing may take years and is a painstaking and slow process.

It is a constant endeavor of B2C aspiring companies to have a larger share of direct milk procurement - At 90%, HFL scores high on this metric compared to most of its listed peers. As on FY16, HFL procures raw milk of 11.3 lac litres per day supported by processing capacity of 15.3 lac litres per day, packaging capacity 10.6 lakh litres per day across 14 processing units. Over the years, HFL has developed a robust milk procurement backend infrastructure and established relationships with farmers.

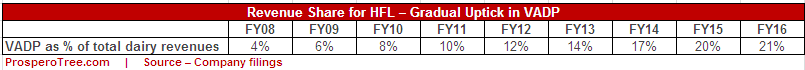

3. Shifting Gears towards Value Added Dairy Products: Heritage's contribution from high market value added products is expected to improve substantially over the next few years as seen from the efforts by the management in the past. Since the EBITDA margins of value added products are twice that of plain liquid milk, the company launched the same in 2007 and has increased its contribution to dairy revenues from 6% in FY09 to 21% in FY16. As on FY16, curd contributes to ~77% of total value added products revenue followed by ice cream, paneer, flavored milk & sweets. The company has outlined its ambition the same substantially over the next few years.

HFL has also been vocal about its intention to partner with a European Dairy to launch value added products like cheese, yogurt, energy drinks which if fructifies, can help HFL penetrate other high margin products too.

4. Heritage -A Strong Brand now entering other states: HFL's dairy products are sold under the brand name of "Heritage" across 10 states in India through 5,900 distributors, ~1,455 "Heritage Parlours" (quasi-kirana stores) and 1.13 lac retail outlets which provide a reach of 11.4 lac households on a daily basis as on FY16. ~80% of its dairy revenues are recorded from South India where it enjoys strong brand loyalty. The company aims to further penetrate South India markets by targeting its Tier - II & Tier - III towns. After South market, the company is trying to make inroads in North and West India markets which are one of the largest markets for cheese and other value added products. HFL had recently entered NCR Delhi & Maharashtra markets and is setting up its milk procurement infrastructure and capacities there. Since the "Heritage" brand is virtually unknown outside South, it will be critical to monitor the company’s ability to establish a brand name in these non-South markets.

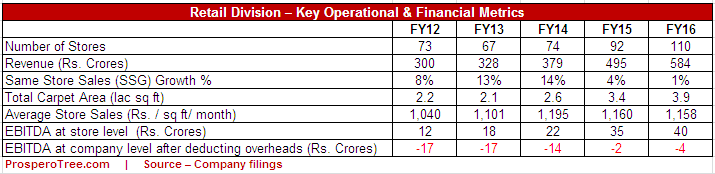

5. Potential Restructuring of Retail Division: The supermarket / hypermarket chains in India have a long history of losses owing to long gestation periods, high rentals and intense competition in food/ grocery categories. HFL's Retail division has been no exception to this rule - It has been loss making since its inception in 2006. The management has re-iterated its stance of bringing in some other player in the retail division and thereby unlocking value. It is very difficult to estimate when and / or whether it will happen. At the same time, the management is trying hard to make a potential turnaround out of same.

Currently, the Retail Business is a drag on HFL. In case, the Retail business becomes profitable or gets acquired by someone, then it could lead to meaningful re-rating of the company. Media reports as well as management commentary highlight that they are in talks with Future Retail for a possible sale of the Retail division.

6. Inorganic Acquisition to Increase Presence: Recently, HFL also announced its intention to acquire Reliance Dairy. While the negotiations are still on and the company is yet to provide full details, below will be the advantages for HFL if it fructifies:

-

Milk Procurement - HFL's direct milk procurement from farmers will increase by 22% across 10 states with benefit of access to Northern states where HFL hitherto has immaterial presence.

-

Wider Reach - HFL’s products will find shelf space in 600 outlets of Reliance Fresh for 3 years.

-

No Additional Debt on Balance Sheet - Reliance Dairy is a debt free entity and HFL will only use internal accruals to acquire it, indicating that transaction pricing could be reasonable.

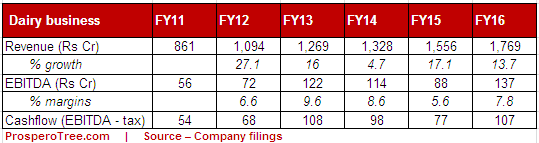

Valuations: Given the loss making nature of most retail businesses, we assign zero value to the HFL's retail business despite the prospect of it breaking even next year. Sale of the retail business could reduce the drag on margins as well as cash flows. On the contrary, its dairy business has all the characteristics of a B2C business - low working capital requirement, high asset turnover, strong revenue predictability and return ratios is excess of 20%. We believe that the dairy business is currently generating free cash flows in excess of Rs. 100 crorers. Considering the current market cap of Rs. 1959 crores, it looks like a good long term play. We therefore suggest to BUY at Rs. 850.

Key Risks

-

Delay in Turnaround of Retail Division - This coupled with inability to sell the Retail division could continue to be a drag on the profitability.

-

Inability to establish brand recall & reach outside the home territory of South India

-

Intensifying Competition - Existing regional players, entry of large Indian corporates & MNCs in dairy

-

Political Connection - The promoters of the company are family members of Chandrababu Naidu, CM, Andhra Pradesh who in turn is the founder of the company.

Historical Performance:

Dhruvesh Sanghvi is a Research Analyst registered with SEBI having registration No: INH000000875.

Definitions of Rating system:

1. Explanation of Type of Report

-

Fresh Recommendation Reports: These reports are first-time initiation reports on the concerned stock. Usually these reports are followed by updates on the same.

-

Update Reports: These reports include result update, event updates, annual report analysis and/or any other information that may be useful for the investor in relation to the concerned stock. Most of these update reports will have our current view on the same.

2. Explanation of Time Horizon: All the Fresh Recommendation reports in the investing section have a view of 3-5 years.

3. Explanation of Views: Views can be any one among these - Buy, Buy on Dips, Hold, Sell Partial, Exit

-

Buy: This means buying the concerned stock at current market price.

-

Buy on Dips: This means buying the concerned stock on the explained fall in price.

-

Hold: This means holding the concerned stock until further update.

-

Sell Partial: This means selling half of the existing position in the concerned stock.

-

Exit: This means completely exiting the concerned stock.

4. Explanation of Indicative Target Price: Achievement of Target Price does not imply Exit / Sell Partial. We will explicitly release Exit/ Sell Partial Report at an appropriate time. If required, Indicative Target Price could be revised based upon business performance, market environment or any other important event.

DISCLOSURES by RESEARCH ANALYST UNDER SEBI (RESEARCH ANALYSTS) REGULATIONS, 2014 is as under:

• Introduction: Prospero Tree Financial Services is an independent equity research proprietorship firm of Mr Dhruvesh Sanghvi.

• Business Activity: Prospero Tree Financial Services is committed in providing honest views, opinions and recommendations on financial markets opportunities.

• Report Written by: Dhruvesh Sanghvi

• Disciplinary History: None

• Terms & Conditions: https://www.prosperotree.com/termsofuse

• Details of Associates: Not Applicable

• Disclosure with regards to ownership and Material Conflicts of Interest:

1. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services, its associates, its Research analysts hold any position in the subject company.

2. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services, its associates, Research Analysts, nor its relatives, have more than 1% ownership of the subject company at the end of the month immediately preceding the date of publication of this report.

3. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services, its associates, Research Analyst nor its relatives, has any other material conflict of interest at the time of publication of the research report or at the time of public appearance.

• Disclosure with regards to Receipt of Compensation:

1. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services or its associates, or Research Analyst has received any compensation or other benefits from the subject company or the third party in connection with the research report in past twelve months.

2. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services or its associates, or Research Analyst have managed or co-managed public offering or securities for the subject company in past twelve months.

• Other Disclosures:

1. The Research Analyst has not served as an officer, director, or employee of the subject company.

2. The Research Analyst is not engaged in market making activity for the subject company.