| Name | Hawkins Cookers Ltd. |

| Type of Report | First Recommendation |

| Report Date | Oct 6, 2016 |

| Price on Report Date | Rs. 2994 |

| Current Market Cap | Rs. 1583 Cr |

| View | Buy |

| Indicative Target Price* | Rs. 4500 |

Company Background: Established in 1959, Hawkins Cookers is one of the oldest and leading manufacturers of pressure cookers in India. Until FY16, Hawkins has sold over 7.2 crores pieces of pressure cookers and cookware worldwide. It is sold in some of the top departmental stores in Europe and America. The company also exports to Yugoslavia, Japan, Panama, Mexico, Finland and the Netherlands.

Investment Arguments:

1. Favourable Trends to help Branded Players: Trends like below are auguring well for a branded players like Hawkins that cater to Rs. 3000 crores cookers and non-stick cookware industry.

- Increasing nuclearization away from joint families,

- More than 1 crores marriages per year,

- Change of culture towards faster replacement,

- Rising rural incomes, and

- Government ambition of Housing for all and providing a gas connection

- Increasing brand conscious generation

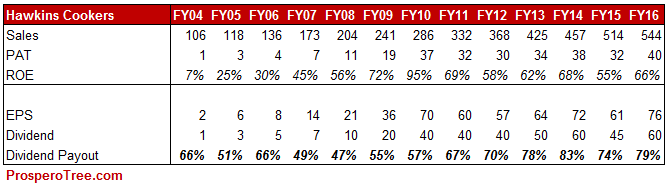

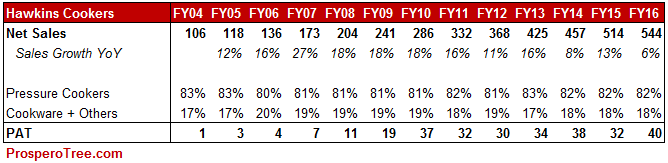

The historical long term trend for the company also complements the long term growth seen by Hawkins. Hawkins sales increased 5.4 times from Rs. 106 crores in FY04 to Rs. 544 crores in FY16. Based on the factors indicated above and considering the current market size of approximately 2 crores cookers being sold annually, Hawkins is well poised to achieve good growth in the future.

2. Increasing Product Basket: Hawkins started as a single product single model company in 1959. However, it has been continuously increasing its product basket to provide a wide range of cookers and cookware on a pan India basis. In the recent past, Hawkins has increased its cooker model from 45 models across 8 categories in FY11 to 73 models across 12 categories in FY16. All the cookers are primarily sold under its 4 major cooker brands �Hawkins, Contura, Futura, and Miss Mary. These categories of cookers are targeted to different customer segments like nuclear families, large families, restaurant usage, and canteen users and are further available in various sizes and colors.

In addition to cookers, Hawkins also manufactures a wide range of high quality cookware products (18% of revenues in FY16) under it's brand Futura which includes Dosa Tava, Frying Pans, Roti Tava, Idli Stands, Curry Pans, and Serving Pans among others.

3. Solid Brand Strength supported by Pricing Power: Hawkins has created a very strong brand across India and has sold a total of 7.3 crores pieces of cookers and cookware till FY16. Hawkins' products enjoy strong pricing power as seen by the premium against Prestige cookers and smaller regional brands.

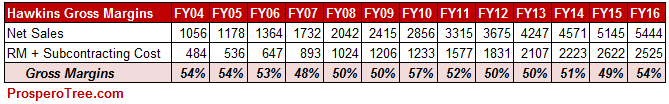

Its ability to maintain its gross margins of 50%+ for more than a decade comes from its ability to pass on cost increases to customers. Hawkins has been able to take price increases every year for a long time without affecting its sales signaling superior brand strength. In addition to this, the moderating raw material prices in FY16 have helped Hawkins to increase its gross margins. After many years, Hawkins has not taken a price hike in FY17 due to large cost benefits led by the benign raw material environment.

4. Increasing Distribution Network to Aid Volume growth: The company follows the direct-to-retailer model wherein goods are shipped from C&F agents to retailers directly. As of 2011, there were approximately 5,500 direct transacting dealers for Hawkins. The company has made significant inroads in increasing its penetration over the last few years. Though the company does not provide specific details, it seems that the direct transacting dealers have nearly doubled for Hawkins by FY16 when compared to FY11. In fact in FY16, Hawkins increased its number of dealers by 1500, more than double its highest every yearly increase. Hawkins has also stepped up its reach through large format stores and is also available on various e-commerce websites like Amazon, Flipkart among others. Broadly, the increasing penetration will lead to better sales growth for Hawkins in the coming times.

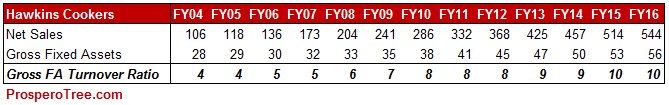

5. Hawkins -The Coke of Cookers: One specialty about Coke is that it does not produce most of Coca-Cola products by itself and yet it is difficult to replicate by others. Hawkins partially achieved the same by increasingly getting more components of the cooker outsourced without letting any single vendor make all of its components. In the vicinity of each of its three plants in Hoshiarpur, Jaunpur, and Thane, Hawkins has created a large ecosystem of vendors who supply Hawkins with various parts/process like pressing, stamping, buffing, whistle testing, handle making, among others which are ultimately assembled by Hawkins at its unit. This can be sensed from its gross asset turnover ratio that has increased from 4 times asset turns in FY04 to 10 times asset turns in FY16.

To understand the beauty of Hawkins model, it is important to draw the attention on its asset light model where the company increased its sales by 438 crores (~5 times) since FY04, whereas its gross block increased just by Rs. 30 crores.

6. Very High Dividend Payouts; Strong Balance Sheet Position and Conservative Promoters: Hawkins has been continuously paying high dividends for many years. Since FY04, Hawkins has maintained an average dividend pay-out of 70% and in recent years it has further increased. On the net cash basis, Hawkins also has a debt-free balance sheet speaking about the conservative and consistent nature of management.

Valuation: At CMP of Rs. 2994, Hawkins has a market cap of Rs. 1583 crores and a profit of Rs. 40 crores in FY16. Thought the valuation looks a little on the higher side, the recent strong quarterly results is possibly indicating for much better numbers in in the near future. Apart from the near term outlook, strong brand of Hawkins, increasing product basket, deepening of distribution supported by strong demographic makes Hawkins a strong case for investment over next few years. We therefore recommend a BUY in Hawkins at current levels.

Risk:

Loss of market share due to inability of management to manage business environment

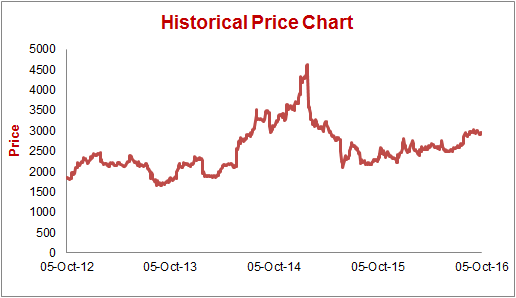

Historical prices:

Dhruvesh Sanghvi is a Research Analyst registered with SEBI having registration No: INH000000875.

- Fresh Recommendation Reports: These reports are first-time initiation reports on the concerned stock. Usually these reports are followed by updates on the same.

- Update Reports: These reports include result update, event updates, annual report analysis and/or any other information that may be useful for the investor in relation to the concerned stock. Most of these update reports will have our current view on the same.

- Buy: This means buying the concerned stock at current market price.

- Buy on Dips: This means buying the concerned stock on the explained fall in price.

- Hold: This means holding the concerned stock until further update.

- Sell Partial: This means selling half of the existing position in the concerned stock.

- Exit: This means completely exiting the concerned stock.

4. Explanation of Indicative Target Price: Achievement of Target Price does not imply Exit / Sell Partial. We will explicitly release Exit/ Sell Partial Report at an appropriate time. If required, Indicative Target Price could be revised based upon business performance, market environment or any other important event.

DISCLOSURES by RESEARCH ANALYST UNDER SEBI (RESEARCH ANALYSTS) REGULATIONS, 2014 is as under:

Introduction: Prospero Tree Financial Services is an independent equity research proprietorship firm of Mr Dhruvesh Sanghvi.

Business Activity: Prospero Tree Financial Services is committed in providing honest views, opinions and recommendations on financial markets opportunities.

Report Written by: Dhruvesh Sanghvi

Disciplinary History: None

Terms & Conditions: https://www.prosperotree.com/termsofuse

Details of Associates: Not Applicable

Disclosure with regards to ownership and Material Conflicts of Interest:

1. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services, its associates, its Research analysts hold any position in the subject company.

2. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services, its associates, Research Analysts, nor its relatives, have more than 1% ownership of the subject company at the end of the month immediately preceding the date of publication of this report.

3. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services, its associates, Research Analyst nor its relatives, has any other material conflict of interest at the time of publication of the research report or at the time of public appearance.

Disclosure with regards to Receipt of Compensation:

1. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services or its associates, or Research Analyst has received any compensation or other benefits from the subject company or the third party in connection with the research report in the past twelve months.

2. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services or its associates, or Research analysts have managed or co-managed public offering or securities for the subject company in the past twelve months.

Other Disclosures:

1. The Research Analyst has not served as an officer, director, or employee of the subject company.

2. The Research Analyst is not engaged in market making activity for the subject company.