|

Name |

Vimta Labs |

|

Type of Report |

First Recommendation |

|

Report Date |

Sep 9, 2016 |

|

Price on Report Date |

Rs. 95 |

|

Current Market Cap |

Rs. 210 Cr |

|

View |

Buy |

|

Indicative Target Price* |

Rs. 150 |

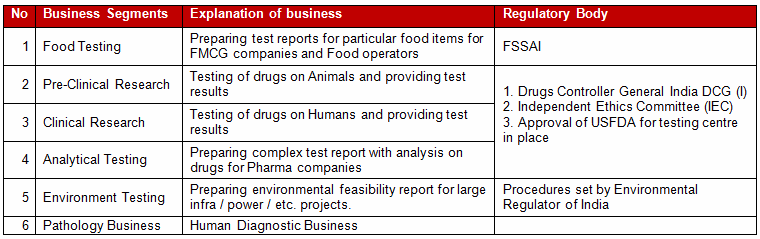

Company Background: Vimta Labs is a Hyderabad based company in the field of Testing and Pharma Contract Research. The below table will briefly explain its business profile.

Investment Arguments:

1. Not just a Clinical Trials Player; Other High Potential Segments: In the past, Vimta’s major revenue contribution used to come from the Clinical Research and Pre-clinical research segments carrying 2 million tests per year. However, with the regulatory bottlenecks in clinical research since 2012, Vimta has put thrust into providing testing services for various other categories that include Pharma Testing, Food Testing and Environmental Testing. It is one of the very few players who could survive the downturn caused by the loss of Clinical Research business due to regulatory change and hurdle in India. The business of Clinical research has bounced back since then however now remains a very small portion of the overall revenues.

2. Food Testing -New Frontier of Business: The Food Safety standards and its enforcement are increasing for all the food manufacturers and food operators which can be seen from the activism shown by FSSAI in regulating the food sector. At the same time, the awareness about quality standards is increasing and will create an economic need for the food companies to improve the food quality standards. Due to this, food companies are relying on third party testing services for their raw material and final products. This will create huge opportunity for players like Vimta as it has been already serving the Food Testing market which contributes nearly 10-15% of its current revenues.

In the recent problems that Nestle faced for its Maggie Noodles, the Bombay High Court has selected Vimta as one of the 3 testing laboratories for testing various Maggie sample. This speaks a lot about the credentials of Vimta as a brand in food testing space.

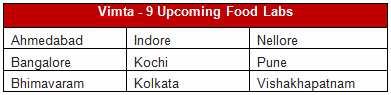

3. Setting up of 9 Additional Food Testing Labs Across India: In order to capture the strong demand for third party food testing on a pan India basis, Vimta decided to setup 9 Food Testing Laboratories across different cities at a cost of approximately Rs. 35 crore in FY15.

Three out of these nine labs will become commercial by Q3FY17 and the work for other labs is going in full swing. Over the next 3 years, Food testing will emerge as a major revenue contributor for Vimta. A point to note is that Dr. S P Vasireddi (Executive Chairman of Vimta Labs) has been a key member of Advisory committee to FSSAI for the last 6 years and therefore makes Vimta better placed to seize this opportunity.

4. Strong Support of Analytical Testing: Vimta has a very strong presence in India for providing analytical services related that caters to the needs of pharma companies, medical device companies, biotech companies and animal health industries across the globe. The contribution from this business stands at around 40-50% of sales and provides strong stability to Vimta’s business. In addition to analytical testing for Pharma companies, Vimta has added new services for Biosimilar manufacturers. Over the next 2 years, this segment should also bring in additional revenues for the company and aid in the growth of the company.

5. Strong Operation Leverage Possible: Apart from its large infrastructure of 3 Lakh Square Feet, Vimta has been continuously investing in its human capital and building a strong team. Even without any major increase in revenues in the past, the company has increased its employee from 679 in FY12 to 908 employees in FY16. With the revenues increasing from its food testing business and Pharma / Biosimilar analytical testing business, the company may see its profitability rising much faster than its costs.

6. Strong Balance Sheet gives further comfort: It was mainly because of its strong and asset light balance sheet; Vimta was able to easily take the expansion of 9 Food Testing Labs. In FY16, Vimta’s debt stands at Rs. 26 crores against its net worth of Rs. 126 crores. The debt is mainly used for the recent capex done for setting up of 9 Food Testing Laboratories. As a policy, the management of Vimta is quite conservative in use of debt and would want to achieve debt free status as soon as possible.

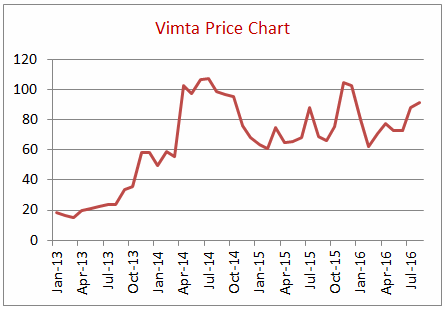

Valuation: Vimta lab is trading at Rs. 95 with current market cap of Rs. 210 crores with net profit of Rs. 6.43 crores (EPS Rs 3) in FY16. Considering the potential increase in earnings due to Food testing business, Pharma / Biosimilar Analytical business and strong balance sheet, we think that the stock price of Vimta provides substantial upside from its current level of Rs 95. We therefore suggest a BUY in Vimta Labs.

Key Risk:

1. Consolidation in Pharma industry global reduces the number of clients for Pharma Testing Industry

2. Increased competition in Food Testing Business

Historical Price:

Dhruvesh Sanghvi is a Research Analyst registered with SEBI having registration No: INH000000875.

- Fresh Recommendation Reports: These reports are first-time initiation reports on the concerned stock. Usually these reports are followed by updates on the same.

- Update Reports: These reports include result update, event updates, annual report analysis and/or any other information that may be useful for the investor in relation to the concerned stock. Most of these update reports will have our current view on the same.

- Buy: This means buying the concerned stock at current market price.

- Buy on Dips: This means buying the concerned stock on the explained fall in price.

- Hold: This means holding the concerned stock until further update.

- Sell Partial: This means selling half of the existing position in the concerned stock.

- Exit: This means completely exiting the concerned stock.

4. Explanation of Indicative Target Price: Achievement of Target Price does not imply Exit / Sell Partial. We will explicitly release Exit/ Sell Partial Report at an appropriate time. If required, Indicative Target Price could be revised based upon business performance, market environment or any other important event.

DISCLOSURES by RESEARCH ANALYST UNDER SEBI (RESEARCH ANALYSTS) REGULATIONS, 2014 is as under:

• Introduction: Prospero Tree Financial Services is an independent equity research proprietorship firm of Mr Dhruvesh Sanghvi.

• Business Activity: Prospero Tree Financial Services is committed in providing honest views, opinions and recommendations on financial markets opportunities.

• Report Written by: Dhruvesh Sanghvi

• Disciplinary History: None

• Terms & Conditions: https://www.prosperotree.com/termsofuse

• Details of Associates: Not Applicable

• Disclosure with regards to ownership and Material Conflicts of Interest:

1. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services, its associates, its Research analysts hold any position in the subject company.

2. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services, its associates, Research Analysts, nor its relatives, have more than 1% ownership of the subject company at the end of the month immediately preceding the date of publication of this report.

3. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services, its associates, Research Analyst nor its relatives, has any other material conflict of interest at the time of publication of the research report or at the time of public appearance.

• Disclosure with regards to Receipt of Compensation:

1. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services or its associates, or Research Analyst has received any compensation or other benefits from the subject company or the third party in connection with the research report in past twelve months.

2. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services or its associates, or Research Analyst have managed or co-managed public offering or securities for the subject company in past twelve months.

• Other Disclosures:

1. The Research Analyst has not served as an officer, director, or employee of the subject company.

2. The Research Analyst is not engaged in market making activity for the subject company.