Name Tata Metaliks

Type of Report First Recommendation

Report Date Jul 19, 2016

Price on Report Date Rs. 355

Current Market Cap Rs. 895 Cr

View Buy

Indicative Target Price* Rs. 550

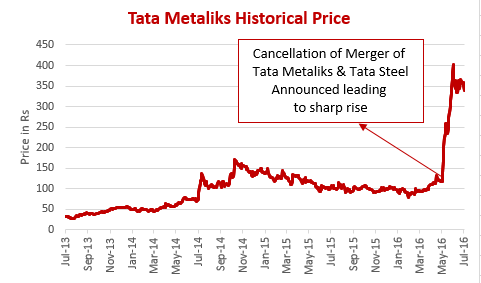

Company Background: Tata Metaliks (TML), a subsidiary of Tata Steel, is one of the leading manufacturers of Pig Iron and Ductile Iron Pipes (DI Pipes). Tata Metaliks has a capacity of 4 lakh tons of Pig Iron and nearly 2 lakh tons capacity for DI Pipes. Since last 3 years, the process of merging Tata Metaliks with Tata Steel was going on; however, on 17May16, it was finally decided by the board of both companies to cancel the merger of Tata Metaliks into Tata Steel. This led to a meteorological rise in the stock price of Tata Metaliks from Rs. 130 to current levels of Rs. 355 in a short span of time. In spite of this price increase, we still think that the stock offers significant upside due to the improved fundamentals and positive industry trend. Below are the investment arguments for the same.

Investment Arguments:

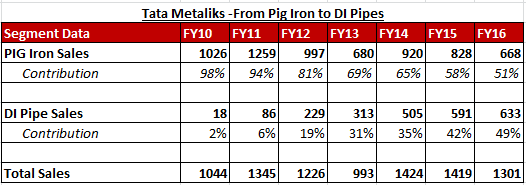

1. Moving up value chain -from pure Pig Iron to DI Pipe Player: Prior to FY10, TML was primarily involved in manufacturing of Pig Iron. Since FY11, as a part of forward integration, TML started using its own Pig Iron to manufacture DI Pipe. As seen from the table below, it has been able to consistently increase its share from DI Pipes from 2% to 49% in FY16. TML further plans to increase its revenue share from DI Pipes business.

2. Strong Industry Trends in DI Pipes: The DI Pipes industry is witnessing a strong growth of 10-15% annually over last 5 years. The strong government impetus for providing better drinking water and sanitation facilities is loud and clear in form of higher budgetary allocation, building of smart cities, AMRUT scheme of central government and building of new state of Telangana. This will ensure that the industry keeps growing at a healthy pace for a foreseeable future. As a testimony, the domestic market for DI Pipes increased by 18% YoY in FY16 to 13 lakh tons. TML is well placed to capture this opportunity and should be able to increase its market share from current 10%.

3. DI Pipe Capacity to double in FY17 (this year): TML has a DI Pipe capacity of 1.1 lakh tons; however, considering a strong demand, TML was able to run its plant at 120% capacity utilisation producing nearly 1.33 lakhs tons of DI Pipes in FY16. TML has undergone a capex that will double its capacity in DI Pipes from 1.1 lakh tons to 2.0 lakh tons in FY17 (by Aug2016). With the increased capacities and corresponding increase in utilisation, TML is looking to increase its market share from current 10% to 12% in an industry that is growing at 10-15%. The long term plan of TML is to further increase its capacity for which TML has already received required approvals. The subsequent capacity addition can happen at a comparatively faster pace and should be with lower incremental costs

4. Margins Improvement through Increasing Efficiency and Better Product Mix: TML's consolidated operating margins have consistently increased from -2% (negative) in FY12 to 14% in FY16. This is at the time when Pig Iron (51% of consolidated sales) realisations has fallen from Rs. 33000 per ton in FY12 to Rs. 21800 per ton in FY16. Though there have been benefits from raw material price fall of Iron Ore and Coke, the improvement in margins is mainly driven by better product mix and operating efficiency coming from measures taken over the past:

- Increased sale from a comparatively higher-margin segment of DI Pipes

- Better working capital management while procurement of raw materials

- Up-gradation of its blast furnace (MBF#2)

- Setting up of Rs. 120 crores sinter plant to use ore fines instead of lump ore

- Setting up of heat recovery plant

Additionally, TML further capital expenditure can see more efficiencies coming due to:

- Improvement in product mix by nearly doubling its capacity 1.1 lakh tons to 2 lakh tons for DI Pipes

- Setting up of 7 MW captive power plant that will use internally produced waste gas

- Cost-saving coming from coke ovens BOOT project (convert coking coal into coke)

- Coal dust injection project that will use coal powder

- Capacity enhancement of its blast furnace (MBF#1) to produce more molten metal

- Tax and corporate expense savings from merging DI Pipe subsidiary with TML standalone

Currently, even though the industry dynamics are not very encouraging for Pig Iron industry, TML will be able to navigate through this quite peacefully due to its increasing share from DI Pipes and the efficiencies it brings from the above projects.

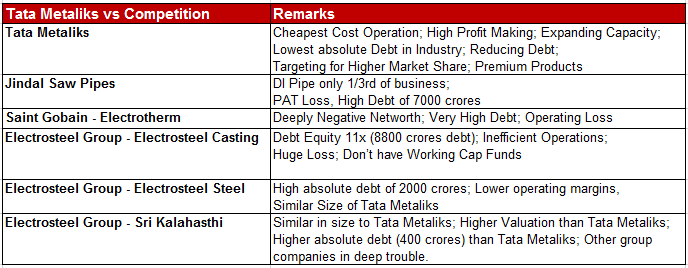

5. Better placed in comparison to its competitors: The below table clearly explains TML having much better competitive position in comparison to its competitors.

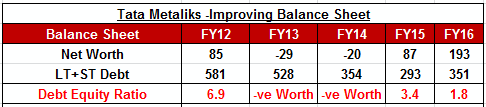

6. Improving Balance Sheet supported by solid Cash Flows: TML had done a large expansion between 2007 and 2009 for setting up the DI pipe plant. However, before it reached proper utilisation levels, the mining ban in India led to severe strain on availability of raw materials which led to a huge loss of Rs. 113 crores in FY12. TML had to close its Redi, Maharashtra plant and was impacted further due to the one-time VRS scheme offered to its employees in Redi plant. In FY12, TMLs debt stood at Rs. 581 crores having a debt to equity of 7 times.

TML has brought down this debt from 581 crores to 351 crores in FY16 with the help of massive improvement in working capital and cash generated from sale of Redi plant. Currently, the debt equity ratio has fallen from 7 times to 1.8 times. A point to note is that this reduction of leverage is after TML has spent nearly Rs 250 crore on the capital expenditure projects to improve efficiencies and production capacities that will show its results from FY17. Now that a majority of capital expenditure is completed, TML should see large debt reduction over the next 2 years and move towards a debt free balance sheet.

Valuation: At current market price of Rs.355 trading at market capital of Rs.895 crs having a net profit of Rs.123 crores in FY16 with very strong operating cash flows of around 150 crores. This indicates that Tata Metaliks is available at a price to earnings ratio of only 7.3 times. Considering its growth potential liked to DI Pipes industry, improving efficiencies, strengthening balance sheet, and strong parentage and brand of Tata, the stock of Tata Metaliks provides reasonable upside from its current levels of Rs. 355, suggesting a BUY on the same.

Key Risk: Sharp rise in raw materials without a corresponding rise in the sale price of its products

Historical Price:

Dhruvesh Sanghvi is a Research Analyst registered with SEBI having registration No: INH000000875.

Definitions of Rating system:

1. Explanation of Type of Report

Fresh Recommendation Reports: These reports are first-time initiation reports on the concerned stock. Usually these reports are followed by updates on the same.

Update Reports: These reports include result update, event updates, annual report analysis and/or any other information that may be useful for the investor in relation to the concerned stock. Most of these update reports will have our current view on the same.

2. Explanation of Time Horizon: All the Fresh Recommendation reports in the investing section have a view of 3-5 years.

3. Explanation of Views: Views can be any one among these - Buy, Buy on Dips, Hold, Sell Partial, Exit

Buy: This means buying the concerned stock at current market price.

Buy on Dips: This means buying the concerned stock on the explained fall in price.

Hold: This means holding the concerned stock until further update.

Sell Partial: This means selling half of the existing position in the concerned stock.

Exit: This means completely exiting the concerned stock.

4. Explanation of Indicative Target Price: Achievement of Target Price does not imply Exit / Sell Partial. We will explicitly release Exit/ Sell Partial Report at an appropriate time. If required, Indicative Target Price could be revised based upon business performance, market environment or any other important event.

DISCLOSURES by RESEARCH ANALYST UNDER SEBI (RESEARCH ANALYSTS) REGULATIONS, 2014 is as under:

• Introduction: Prospero Tree Financial Services is an independent equity research proprietorship firm of Mr Dhruvesh Sanghvi.

• Business Activity: Prospero Tree Financial Services is committed in providing honest views, opinions and recommendations on financial markets opportunities.

• Report Written by: Dhruvesh Sanghvi

• Disciplinary History: None

• Terms & Conditions: https://www.prosperotree.com/termsofuse

• Details of Associates: Not Applicable

• Disclosure with regards to ownership and Material Conflicts of Interest:

1. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services, its associates, its Research analysts hold any position in the subject company.

2. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services, its associates, Research Analysts, nor its relatives, have more than 1% ownership of the subject company at the end of the month immediately preceding the date of publication of this report.

3. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services, its associates, Research Analyst nor its relatives, has any other material conflict of interest at the time of publication of the research report or at the time of public appearance.

• Disclosure with regards to Receipt of Compensation:

1. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services or its associates, or Research Analyst has received any compensation or other benefits from the subject company or the third party in connection with the research report in past twelve months.

2. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services or its associates, or Research Analyst have managed or co-managed public offering or securities for the subject company in past twelve months.

• Other Disclosures:

1. The Research Analyst has not served as an officer, director, or employee of the subject company.

2. The Research Analyst is not engaged in market making activity for the subject company.