|

Name |

Rashtriya Chemical Fertilizer (RCF) |

|

Type of Report |

Fresh Recommendation |

|

Report Date |

Mar 5, 2016 |

|

Price on Report Date |

Rs. 39 |

|

Current Market Cap |

Rs. 2100 cr |

|

View |

Buy |

|

Indicative Target Price* |

Rs. 65-70 |

Company Background: RCF is engaged in business of Fertilizer and mainly producing urea and NPK fertilizers. RCF has two major manufacturing plants in Trombay (Chembur Mumbai) and Thal (Mahahrashtra)

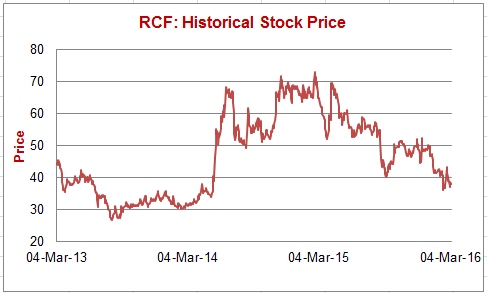

In May2014, we suggested to Buy RCF (under Trading Idea) at Rs. 37 in the report named: RCF -Undervalued Disinvestment Play. The trading target of Rs. 60-65 was achieved within 6 months by Nov2014. Here we present the RCF's case from an investment standpoint with reasons as follows.

Investment Arguments:

1. Brownfield Project and Equity Participation in FCIL: In line with Government's emphasis on MAKE IN INDIA and to reduce the import of Urea, RCF has announced a brown field project for new urea plant having a capacity of 1.27 million tons per annum besides its existing plant at Thal (Maharashtra). It is to be setup at an estimated cost of Rs.5500 crores subjects to approval of Central Government Cabinet comittee. There is enough land for such an expansion as RCF owns 958 acres of land in THAL.

In addition to setting up of new urea plant, RCF has also taken the board approval for buying 11% stake in Sindri Unit of Food Corporation of India (FCIL). The other 89% stake will be bought by other Public Sector Enterprise like Coal India, GAIL and FCIL. It is estimated that FCIL Sindri unit will require Rs. 8000 crores for revival.

RCF will require substantial funds to set-up the new urea project as well as to fund the equity participation in FCIL Sindri Unit.

2. Funding Requirement may unlock value from Mumbai Land: RCF requires the funds for expansion and for equity participation in FCIL. However its current balance sheet cannot support such large projects. The Central Government is holding 80% stake in RCF but is unlikely to fund these projects at a time when the Government itself has its divestment agenda. In such a situation the government may encourage RCF to raise resources through selling of surplus Land in Mumbai. RCFs Mumbai plant is spread across 785 acre of land. Recent deals in and around Mumbai have taken place at valuation of around Rs 50 crores per acre. If we were to assume a similar valuation, this land is worth Rs 40000 crores.

3. Government in favor of selling Non-core Assets: In the recent budget, Government has stated that, "We have to leverage the assets of CPSEs for generation of resources for investment in new projects. We will encourage CPSEs to divest individual assets like land, manufacturing unit to release their asset value for making investments in new projects". This suggests that RCF may be allowed to sell the land and raise resources for new projects.

4. Direct Distribution of Fertilizer Subsidy on cards: Direct subsidy transfer for fertilizer to farmers will substantially reduce the interest burden of the company. Currently RCF has to take a lot of working capital debt due to delay of subsidy receipts from government and thereby pay substantial interest outgo. To facilitate the direct payment of fertilizer to farmers the Government is introducing the ADHAR BILL as money bill in the parliament. The Government has also started a pilot project for payment of subsidy in few districts and plans to start the same on Pan India basis. The financial performance of oil marketing companies like IOC,HPCL and BPCL have improved dramatically as they don’t have wait for the petrol and diesel subsidy from Government.

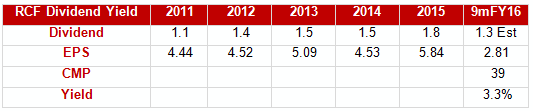

5. Valuation Cushion: At the CMP of Rs 39, the market cap for RCF is at Rs 2,100 crores. The average profit after tax for the company in the last 5 years has been around 250 cr. And the company has been continuously paying decent dividend and yielding around 4% at the CMP. RCF’s enterprise value Rs 3400 crores (MCAP = Rs 2100 crores + Debt = Rs. 1300 crores) in comparison to its Rs 250 crores earnings capacity and land value (>50000 cr) is extremely lower and therefore provides very good cushion on downside at the current market price. At the same time, any signs on value unlocking of its Land will greatly add to the returns of the company. Considering the discounted valuation and triggers as explained, we suggest a BUY on RCF at CMP of Rs. 39.

Dhruvesh Sanghvi is a Research Analyst registered with SEBI having registration No: INH000000875.

Definitions of Rating system:

1. Explanation of Type of Report

-

Fresh Recommendation Reports: These reports are first-time initiation reports on the concerned stock. Usually these reports are followed by updates on the same.

-

Update Reports: These reports include result update, event updates, annual report analysis and/or any other information that may be useful for the investor in relation to the concerned stock. Most of these update reports will have our current view on the same.

2. Explanation of Time Horizon: All the Fresh Recommendation reports in the investing section have a view of 3-5 years.

3. Explanation of Views: Views can be any one among these - Buy, Buy on Dips, Hold, Sell Partial, Exit

-

Buy: This means buying the concerned stock at current market price.

-

Buy on Dips: This means buying the concerned stock on the explained fall in price.

-

Hold: This means holding the concerned stock until further update.

-

Sell Partial: This means selling half of the existing position in the concerned stock.

-

Exit: This means completely exiting the concerned stock.

4. Explanation of Indicative Target Price: Achievement of Target Price does not imply Exit / Sell Partial. We will explicitly release Exit/ Sell Partial Report at an appropriate time. If required, Indicative Target Price could be revised based upon business performance, market environment or any other important event.

DISCLOSURES by RESEARCH ANALYST UNDER SEBI (RESEARCH ANALYSTS) REGULATIONS, 2014 is as under:

• Introduction: Prospero Tree Financial Services is an independent equity research proprietorship firm of Mr Dhruvesh Sanghvi.

• Business Activity: Prospero Tree Financial Services is committed in providing honest views, opinions and recommendations on financial markets opportunities.

• Report Written by: Dhruvesh Sanghvi

• Disciplinary History: None

• Terms & Conditions: https://www.prosperotree.com/termsofuse

• Details of Associates: Not Applicable

• Disclosure with regards to ownership and Material Conflicts of Interest:

1. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services, its associates, its Research analysts hold any position in the subject company.

2. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services, its associates, Research Analysts, nor its relatives, have more than 1% ownership of the subject company at the end of the month immediately preceding the date of publication of this report.

3. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services, its associates, Research Analyst nor its relatives, has any other material conflict of interest at the time of publication of the research report or at the time of public appearance.

• Disclosure with regards to Receipt of Compensation:

1. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services or its associates, or Research Analyst has received any compensation or other benefits from the subject company or the third party in connection with the research report in past twelve months.

2. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services or its associates, or Research Analyst have managed or co-managed public offering or securities for the subject company in past twelve months.

• Other Disclosures:

1. The Research Analyst has not served as an officer, director, or employee of the subject company.

2. The Research Analyst is not engaged in market making activity for the subject company.