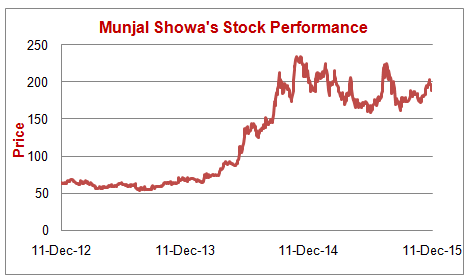

We first recommended Munjal Showa at Rs. 94 on 16th May 2014. Here is the report on the same: Munjal Showa Ltd: Riding the Hero & Honda wave. Though the initial target of Rs. 180-200 was met, we think there is more room for appreciation over the next 1-2 years.

Here are some updates on the same:

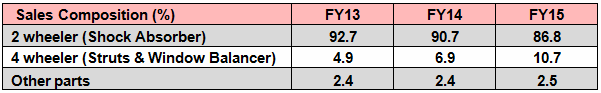

- Established Diversified Revenue Base: Munjal Showa, a Hero group company, manufactures shock absorbers, struts and window balancers for 2 & 4-wheelers. Over the last 3 years, Munjal Showa has been successfully able to decrease its dependence from a single client (Hero Motocorp) to multiple clients in both 2 & 4 wheeler industry. Revenue from 4 wheeler OEMs contributed nearly 11% in FY15 as compared to 5% in FY13. As per the management, 4 wheeler OEMs will contribute nearly 20% revenues in FY16.

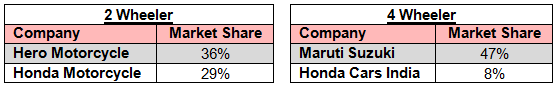

- Association with Industry Leaders: In the auto ancillary industry, if the company happens to be with the leaders who are winning, than it is bound to do well. Munjal Showa has put the above statement in practice by becoming a trusted supplier to Industry leaders like Hero Motocorp, Honda Motorcycle, and Maruti among others. This has also helped Munjal to diversify its revenue base as explained below.

- Growth of Munjal Showa linked to the Growth of OEMs: Munjal Showa's growth is dependent on its clients in the 2-wheeler and 4-wheeler industry. There are multiple reasons where the industry is well poised for growth:

1. New launches to aid growth: Automobile industry has seen a series of new launches in the 2 and 4 wheeler spaces.

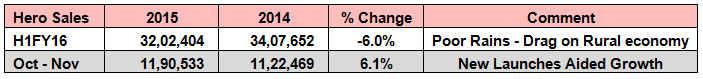

Hero Motorcorp launched 2 new scooters - Hero Maestro Edge and Hero Duet in the month of October 2015 which has led to 6% growth in Oct-Nov 2015 after 6 months of de-growth due to poor rains and lower rural demand as seen below.

Similarly, in the 4-wheeler space, Maruti Suzuki launched new Baleno and it received a bumper response with 40,000 bookings in a span of just 2 months.

2. Pay Commission led Hike: The recommendation of pay hike for Government Employees will increase their purchasing power and thereby lead to an increase in demand for 2 wheelers & 4 wheelers.

3. Capacity Expansion: Increase in production capacity by Hero Motorcorp, Maruti Suzuki and Honda Scooters will further increase the demand for Munjal Showa’s products.

Valuations: At a current market price of Rs. 190, Munjal Showa has a market cap of Rs. 750 cr with a trailing price to earnings multiple of 10x. Based on the management, the coming quarter will see improvement in earnings as compared to what was seen in 1HFY16. The company's ability to diversify its revenue base and its strong correlation with the demand from the automobile industry leaders, suggests for good times ahead.

Historical Price

Dhruvesh Sanghvi is a Research Analyst registered with SEBI having registration No: INH000000875.

Definitions of Rating system:

- Fresh Recommendation Reports: These reports are first-time initiation reports on the concerned stock. Usually these reports are followed by updates on the same.

- Update Reports: These reports include result update, event updates, annual report analysis and/or any other information that may be useful for the investor in relation to the concerned stock. Most of these update reports will have our current view on the same.

- Buy: This means buying the concerned stock at current market price.

- Buy on Dips: This means buying the concerned stock on the explained fall in price.

- Hold: This means holding the concerned stock until further update.

- Sell Partial: This means selling half of the existing position in the concerned stock.

- Exit: This means completely exiting the concerned stock.

4. Explanation of Indicative Target Price: Achievement of Target Price does not imply Exit / Sell Partial. We will explicitly release Exit/ Sell Partial Report at an appropriate time. If required, Indicative Target Price could be revised based upon business performance, market environment or any other important event.

DISCLOSURES by RESEARCH ANALYST UNDER SEBI (RESEARCH ANALYSTS) REGULATIONS, 2014 is as under:

• Introduction: Prospero Tree Financial Services is an independent equity research proprietorship firm of Mr Dhruvesh Sanghvi.

• Business Activity: Prospero Tree Financial Services is committed in providing honest views, opinions and recommendations on financial markets opportunities.

• Report Written by: Dhruvesh Sanghvi

• Disciplinary History: None

• Terms & Conditions: https://www.prosperotree.com/termsofuse

• Details of Associates: Not Applicable

• Disclosure with regards to ownership and Material Conflicts of Interest:

1. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services, its associates, its Research analysts hold any position in the subject company.

2. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services, its associates, Research Analysts, nor its relatives, have more than 1% ownership of the subject company at the end of the month immediately preceding the date of publication of this report.

3. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services, its associates, Research Analyst nor its relatives, has any other material conflict of interest at the time of publication of the research report or at the time of public appearance.

• Disclosure with regards to Receipt of Compensation:

1. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services or its associates, or Research Analyst has received any compensation or other benefits from the subject company or the third party in connection with the research report in past twelve months.

2. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services or its associates, or Research Analyst have managed or co-managed public offering or securities for the subject company in past twelve months.

• Other Disclosures:

1. The Research Analyst has not served as an officer, director, or employee of the subject company.

2. The Research Analyst is not engaged in market making activity for the subject company.