| Name | Reco Date | Reco price | Target | Prospero Rating | Report Date* |

| Munjal Showa | 16May2014 | Rs. 94 | Rs. 180 - Rs. 200 | 8 / 10 | 30Jul2014 |

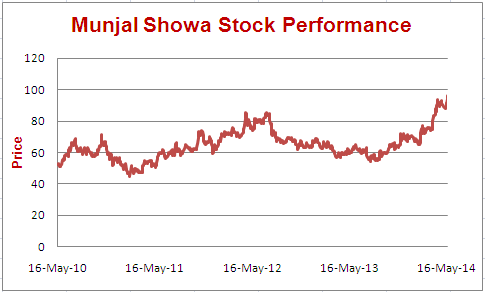

We first recommended Munjal Showa at Rs 94 on 16May2014. And in light of June2014 quarter result announcement, we once again recommend buying Munjal Showa in the range of Rs 130-140.

A) Company background:

Munjal Showa is a Hero group company and manufactures shock absorbers and struts for 2 & 4-wheelers.

Munjal Showa has a technical and financial collaboration with Showa Corporation, Japan (26% holder in Munjal). Munjal Showa is the market leader in these products and supplies to marque clients like Hero Motocorp and Honda Motorcycle in 2 wheelers segment. Along with that it also supplies to Maruti Motors and Honda Motors in 4 wheeler categories.

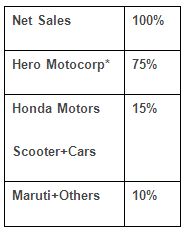

B) Revenue segmentation:

(Numbers Approximate)

*Munjal Showa is the sole supplier to Hero Motors for shock absorbers and struts.

C) Investments arguments:

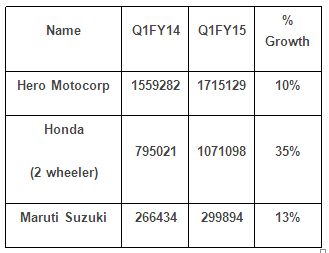

1. Growth to resume with growth in 2/4 wheelers: In the last few months with revival of the economic mood and expectation of clearance of logjam created by previous government, the 2-wheeler industry has already started showing traction. The recent data on 2-wheelers volume shows good growth for Here Motocorp and Honda 2-wheelers, both of which are Munjal’s main clients. At the same time, Maruti who is the biggest client for Munjal, has also shown good growth in car sales for the last 3 months as shown in the table below. In FY14, the growth for Munjal was significantly affected as the overall 2/4 wheelers volumes were adversely affected.

2. Massive expansion plans by Hero and Honda: Both Hero Motocorp and Honda Motors have aggressive expansion plans in India and are aiming for double digit growth in next few years. Hero Motocorp started its 4th manufacturing plant in Rajasthan, making its total capacity to go to 76 Lakh units per year. Honda has plans to start a new plant in Gujarat and we expect large part of this growth will be beneficial to Munjal Showa also.

3. With Volumes, Margins to see uptick: In FY12, Munjal operating margins peaked at 8%. However increased employee and fuel costs coupled with lack of growth in subsequent in FY13/FY14 led to a decline in margins to 6.5% in FY14. With growth coming back in, operating leverage will play leading to increasing in margins for Munjal Showa.

4. Debt Free Balance Sheet and Strong Promoter: With strong internal accruals, Munjal Showa has paid all its debt is now debt free leading to significant interest savings in future. The ROE has been in the range of 20%-25% for last 3 years in-spite of flattish growth and we expect the ROE to improve in coming future with the revival in growth. The strong parentage of Hero Group and Showa Corporation lends further credibility to the company in creating long term wealth.

5. Gross Under-valuation: We first recommended Munjal Showa at Rs 94 in May2014. We further recommend buying Munjal Showa in Rs 130-140 range. At this price, the company is valued at Rs 540 crores and a trailing price to earnings ratio of 7.7x. With the kind of growth opportunity with its clients (Hero, Honda, Maruti), potential profit growth, clean balance sheet, trustworthy parentage and good dividends, Munjal Showa is available at a reasonable discount to its fair price. We recommended buying with a target of Rs 180-200.

6. Relative Valuations: There are many auto ancillary companies that are trading at 10-15x multiple with comparatively lower Return ratios, inferior growth prospects and not-so-great managements. Though this is not the only argument for buying Munjal Showa, at the current market price, it surely is worth investing in.

D) Key risks:

- Two Wheelers & Four Wheelers growth getting affected

- Substantial increase in labor costs leading to decreasing in margins

E) Financials:

Due to completion of 5 years tax holiday at Haridwar plant in Apr14, the tax payment from current quarter has increased. Now the exemption is restricted to 30% from 100% previously. Due to this, the PAT will get adjusted by the same amount in FY15.

F) Stock Performance:

*Report Date may sometimes be different from Recommended Date.