| Name | Man Infraconstruction |

| Type of Report | Fresh Recommendation |

| Report Date | 11-Sep-2015 |

| Price on Report Date | Rs. 33 |

| Current Market Cap | Rs. 820 cr |

| View | Buy |

| Indicative Target Price* | Rs. 60 |

Company Background: Mumbai based Man Infraconstruction (Man Infra) started its journey by providing contracting services (EPC) for infrastructure projects and has executed construction of 5 private ports and residential, industrial and commercial real estate projects of approx 2.5 cr sq. ft. To capitalise on such vast experience in the real estate sector, it started focussing in Real Estate projects in Mumbai.

Investment Arguments:

1. Asset Light Real Estate Operations: As against the general real estate model of purchasing land with upfront cash payments, Man Infra has built a 50 lakh sq. ft. project pipeline in Mumbai by partnering with existing land owners / redevelopment projects. We think this is the best strategy in Mumbai real estate model where the Land Cost forms a significantly higher proportion of the total cost of project.

2. Debt Free Cash Surplus Real Estate Company: Man Infra is one of the few companies in the sector with zero debt at standalone level. In fact it has a cash and cash equivalents worth Rs. 220 cr on its balance sheet against its market cap of Rs. 786 cr. However, one of the subsidiaries Manaj Tollway, where Man Infra holds 63% has a debt of Rs. 77 cr.

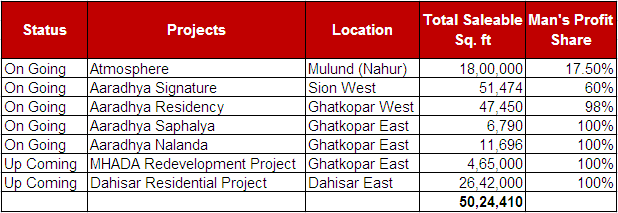

3. Robust Project Pipeline: Based on its existing projects, Man Infra along with its partners / JVs have a pipeline of almost 50 lakhs sq. ft. of projects to be executed over next 5-7 years. This provides tremendous visibility of sales and profits for 5-7 years. All its projects are in residential space as follows:

Highlights on Main projects:

a) Mulund Project: 'Atmosphere', a real estate project in Mulund, is being developed in joint venture with Wadhwa and Chandak Realtors, with an approximate saleable area of 1.8 million sq. ft. Within a few days of the launch of the project, 40% of phase I was sold indicating strong demand. For this project, 100% contracting work is awarded to Man Infra where it will also earn a contracting (EPC) margin.

b) MHADA Development Project at Ghatkopar, Mumbai: Man Infra has already signed MoU for redeveloping 12 MHADA colony buildings. As a part of the deal, Man has to provide residential accommodation to existing tenants of MHADA and in return it will be able to construct and sell 4.65 lakh sq. ft of residential apartments. We believe this project will be a very rewarding project for Man Infra and should be completed in next 3-4 years.

c) Dahisar Project: Through Man Vastucon LLP (where Man holds 99.9%), Man Infra has obtained development rights to develop 59700 sq. meters plot which will convert into approx 26.4 lakh sq. feet of saleable area at Dahisar. Man Vastucon LLP will undertake the development of the property. The other JV partner will be compensated by sharing 35% of gross sales realization as land cost. This project is in continuation to Man’s asset light policy, where in the company will save huge upfront investment cost and minimize the investment risk.

d) Multiple Other Projects: There are multiple individual building projects like Aaradhya Residency, Aaradhya Saphalya, Aaradhya Nalanda, Aaradhya Signature in and around Central Mumbai.

4. Perfect Project Location: We believe that location of the project for a real estate company is of supreme importance. With respect to Man Infra, all its existing projects are located in popular and densely populated areas of Mumbai – Mulund, Ghatkopar, Sion and Dahisar. Owing to a strong demand in these areas, the price correction (if at all) is very limited. Eventually this should translate in better sales realisation and margins for Man Infra as and when projects start.

5. Good Reputation as a Builder: Real estate buyers always look for some trusted brand or name on which they can rely upon. Man Infra has lived up to the brand by providing quality construction and timely delivery of its projects. In March 2015, the company completed one of its residential projects at Ghatkopar East in Mumbai where it has also obtained Occupation Certificate ahead of scheduled delivery of the project by 6 months. Its past execution as EPC provider to companies like Godrej, Wadhwa and Tata among others is further testimony to its execution skills. We believe that all of this will help the company to sell better than the competition.

6. EPC Business to Provide Additional Stream of Earnings: Currently pure EPC orders stands at Rs. 320 cr (on 30Jun2015) from Gujarat Pipavav Ports and various real estate players like Godrej. In addition to all the external orders, Man Infra will construct all its projects on its own amounting to 50 lakh sq. ft of saleable area of construction and will therefore also earn a contracting (EPC) margin. In the past, Man Infra has been able to achieve an EBITDA margin of 10-15% in construction contracts as shown below.

Valuation: At the current market price of Rs. 33, Man Infra is trading at a market cap of just Rs. 820 crores. The promoter strategy to shift from a pure EPC company to an asset light Real Estate Company has helped the company to create an extremely robust project pipeline. At the same time, it has spared Man Infra with much required resources that will be used for ramping up development, sales and marketing activities. All this should easily help Man Infra achieve excellent results over next few years.

In conclusion, Man Infra is a real estate company without any problems of the real estate sector having - Very low capital costs, Debt Free balance sheet, Focus in local market and having superior execution skills.

Key Risks:

- Blockage of Funds in Tollway Project: As the government of Maharashtra has not been able to provide necessary land for the implementation of road project, Manaj tollway (63% subsidiary company of Man Infra) has terminated the contract and claimed the cost incurred and compensation as per the agreement. The blocked funds are expected to be released; however the timeline is not certain.

- Regulatory Delay for Approval of Projects: As the company has a policy of starting projects only after all approvals are in place, any delay in regulatory approvals can lead to subsequent delay in project implementation.

Dhruvesh Sanghvi is a Research Analyst registered with SEBI having registration No: INH000000875.

Definitions of Rating system:

- Fresh Recommendation Reports: These reports are first-time initiation reports on the concerned stock. Usually these reports are followed by updates on the same.

- Update Reports: These reports include result update, event updates, annual report analysis and/or any other information that may be useful for the investor in relation to the concerned stock. Most of these update reports will have our current view on the same.

- Buy: This means buying the concerned stock at current market price.

- Buy on Dips: This means buying the concerned stock on the explained fall in price.

- Hold: This means holding the concerned stock until further update.

- Sell Partial: This means selling half of the existing position in the concerned stock.

- Exit: This means completely exiting the concerned stock.

4. Explanation of Indicative Target Price: Achievement of Target Price does not imply Exit / Sell Partial. We will explicitly release Exit/ Sell Partial Report at an appropriate time. If required, Indicative Target Price could be revised based upon business performance, market environment or any other important event.

DISCLOSURES by RESEARCH ANALYST UNDER SEBI (RESEARCH ANALYSTS) REGULATIONS, 2014 is as under:

• Introduction: Prospero Tree Financial Services is an independent equity research proprietorship firm of Mr Dhruvesh Sanghvi.

• Business Activity: Prospero Tree Financial Services is committed in providing honest views, opinions and recommendations on financial markets opportunities.

• Report Written by: Dhruvesh Sanghvi

• Disciplinary History: None

• Terms & Conditions: https://www.prosperotree.com/termsofuse

• Details of Associates: Not Applicable

• Disclosure with regards to ownership and Material Conflicts of Interest:

1. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services, its associates, its Research analysts hold any position in the subject company.

2. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services, its associates, Research Analysts, nor its relatives, have more than 1% ownership of the subject company at the end of the month immediately preceding the date of publication of this report.

3. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services, its associates, Research Analyst nor its relatives, has any other material conflict of interest at the time of publication of the research report or at the time of public appearance.

• Disclosure with regards to Receipt of Compensation:

1. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services or its associates, or Research Analyst has received any compensation or other benefits from the subject company or the third party in connection with the research report in past twelve months.

2. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services or its associates, or Research Analyst have managed or co-managed public offering or securities for the subject company in past twelve months.

• Other Disclosures:

1. The Research Analyst has not served as an officer, director, or employee of the subject company.

2. The Research Analyst is not engaged in market making activity for the subject company.