This stock recommendation is a part of our Investing section called -"The Timeless Leader Series"

| Name | Gruh Finance |

| Type of Report | Fresh Recommendation |

| Report Date | 7-Jul-2015 |

| Price on Report Date | Rs. 260 |

| View | Buy |

| Indicative Target Price* | Rs. 375-400 |

The aspiration of 25 crores families to live in their own homes gave birth to India’s housing boom in early 90s. A clear trend that emerged out of the housing boom of 1990-2010 is that it belonged to the urban affluent and working middle class. The non-affluent segment - the people employed in informal sector as well as self-employed individuals have participated only in a limited measure. As per National Housing Bank (NHB) study, key reasons for the lower participation of the non-affluent segment are the lack of affordability and availability of finance.

Today, there are more than 50 banks and 35 housing finance companies (HFCs) that provide home loans. However, the non-affluent class is largely unable to secure home loans due to difficulty in assessing their credit score that stems from unpredictable income patterns, little credit history and job security that cannot be taken for granted. It’s obviously risky to lend to such a segment and banks and most HFCs chose to lend to the affluent and salaried individuals only.

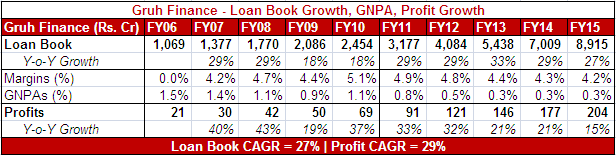

However, GRUH Finance was formed to take the road less traveled and built its business model around financing the non-affluent individuals. A quick glance at its 10-year performance tells a story that’s quiet different from what would be expected out of such ventures –strong growth, robust profitability and lowest NPAs!

In fact, GRUH Finance’s strong performance has recently attracted a lot of players in this space – Shriram Housing, Sundaram Housing, Mahindra Housing, etc. Despite the long period of GRUH’s strong performance, we believe that the story has a lot of steam left. Below are the arguments why we expect GRUH to deliver strong performance in future too.

Investment Arguments

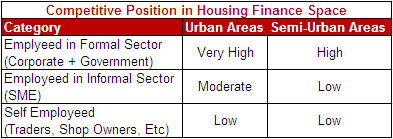

1) Moderate Levels of Competition in the Non-Affluent Segment: Banks and large HFCs have traditionally operated in urban areas and focused on the salaried segment. As an illustration, ~85% of SBI and HDFCs customers are employed in the formal sector. Given the difficulty in appraising the income levels, the self employed segment as well as those employed informally is not a big focus area for the banks even after years of presence in the housing finance space. As such the competition level in this segment is low and pricing power is high.

Approximately 40% of GRUH’s loan book consists of customers who are self employed. As for the remaining 60%, they are employed in the informal sector. Given the lower competition here, GRUH is able to charge 12-13% interest rate on its housing loans. Contrast that with 10-11% charged by most banks and HDFC.

2) Huge Opportunity Size & Scope for Geographic Expansion: Despite the 27% loan book CAGR over the past 10 years, GRUH has a minuscule market share of <2% in the Indian mortgage market. Add to it, the Government’s ambition of “Housing for all by 2022” and the subsequent focus on affordable housing. This leads us to believe that GRUH has a huge addressable market.

GRUH started operations in Gujarat in 1988 and later entered Maharashtra in 1996. Over the next 10 years, it continued to penetrate these two states, district by district. Later, it entered the states of Karnataka, MP, Rajasthan, Tamil Nadu and Chhattisgarh over 2002-08. It spent considerable time in understanding the local markets, appointing referral associates, recruiting & training local staff and is now prepared to accelerate growth in these states. Also, the geographic reach at taluka levels is present in only 50% in most of these states, implying huge penetration driven growth that can come for GRUH in future.

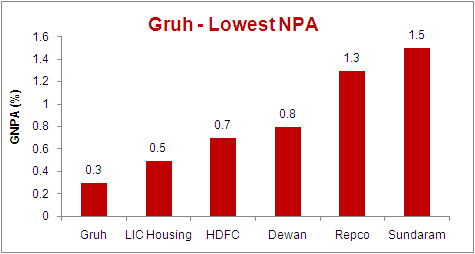

3) Strong Appraisal Skills Ensure Robust Asset Quality: Ability to assess the credit risk for its non-affluent customers is the cornerstone of GRUH's success. Some of the salient features of GRUH’s appraisal processes are:

- Appraisal, disbursement and monitoring is done by GRUH’s own employee

- Multiple visits to customers’ work / business premise to ascertain income levels

- Detailed back-ground checks in terms of life-style, family structure, etc

- Disbursement linked to construction stage

This is in contrast to banks which employ external agencies to do the field visits and background checks on their customers. While costs for GRUH are surely higher than banks and large HFCs, they get compensated by higher yields. As a testimony to GRUH’s appraisal skills, GNPAs are best-in-class while credit costs have been as low as 8bps (similar to HDFC despite being in a riskier customer segment).

4) Best-in-Class Profitability ensures A Self-Feeding Growth Model: Presence in under-served segments, best-in-class liability profile and strong credit appraisal process has ensured average RoA of 2.6% and average RoE of 29% over the past ten years. This is clearly the best amongst Indian financial space (even better than the parent HDFC Ltd). GRUH is also one among the only two financial companies in India to have a self-feeding model i.e. they can grow without raising capital. This is possible only due to its super-normal profitability built on its niche presence in non-affluent segment.

Key Risks

1) Acute Slowdown in Real Estate: Demand scenario has weakened considerably over past two years and housing prices too have stopped rising. While growth for large players could be impacted, we still believe that GRUH has ample opportunity to grow.

2) Rising Competition: The attractive returns earned by GRUH & Repco have attracted a host of new players like Muthoot, Manappuram, Sundaram, Shriram and Mahindras into the low-ticket housing segment. If the competition intensifies, margins could come under pressure.

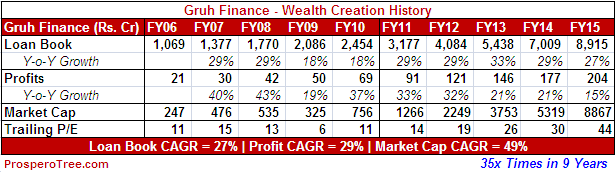

Wealth Creation in the Past

Over the past 10 years, GRUH's profits have compounded at the rate of 29% per annum. At the same time, its market cap has increased at the rate of 49% CAGR. An amount of Rs. 100,000 invest in 2006 would have yielded Rs 35,00,000 today implying 35x returns in 9-10 years.

Our View on GRUH Finance at Current Prices

GRUH Finance has given fantastic returns over the past ten years due to combination of both - strong earnings growth and an equally sharp valuation expansion. Its valuations have expanded from 11x trailing P/E in Mar’10 to 44x trailing P/E in Mar’15. While we remain confident of future growth prospects due to its impeccable business, the elevated valuations will limit the upside for current shareholders.

We believe that stock price can deliver 15% CAGR over next 3-5 years. Thus, investors looking for safety with returns expectations of 15% per annum can look to Buy the stock.

Historical Stock Price

*Achievement of Target Price does not imply Sell. We will explicitly release a Exit/Partial Sell Report at an appropriate time.

Dhruvesh Sanghvi is a Research Analyst registered with SEBI having registration No: INH000000875.

- Fresh Recommendation Reports: These reports are first-time initiation reports on the concerned stock. Usually these reports are followed by updates on the same.

- Update Reports: These reports include result update, event updates, annual report analysis and/or any other information that may be useful for the investor in relation to the concerned stock. Most of these update reports will have our current view on the same.

- Buy: This means buying the concerned stock at current market price.

- Buy on Dips: This means buying the concerned stock on the explained fall in price.

- Hold: This means holding the concerned stock until further update.

- Sell Partial: This means selling half of the existing position in the concerned stock.

- Exit: This means completely exiting the concerned stock.

4. Explanation of Indicative Target Price: Achievement of Target Price does not imply Exit / Sell Partial. We will explicitly release Exit/ Sell Partial Report at an appropriate time. If required, Indicative Target Price could be revised based upon business performance, market environment or any other important event.

DISCLOSURES by RESEARCH ANALYST UNDER SEBI (RESEARCH ANALYSTS) REGULATIONS, 2014 is as under:

• Introduction: Prospero Tree Financial Services is an independent equity research proprietorship firm of Mr Dhruvesh Sanghvi.

• Business Activity: Prospero Tree Financial Services is committed in providing honest views, opinions and recommendations on financial markets opportunities.

• Report Written by: Dhruvesh Sanghvi

• Disciplinary History: None

• Terms & Conditions: https://www.prosperotree.com/termsofuse

• Details of Associates: Not Applicable

• Disclosure with regards to ownership and Material Conflicts of Interest:

1. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services, its associates, its Research analysts hold any position in the subject company.

2. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services, its associates, Research Analysts, nor its relatives, have more than 1% ownership of the subject company at the end of the month immediately preceding the date of publication of this report.

3. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services, its associates, Research Analyst nor its relatives, has any other material conflict of interest at the time of publication of the research report or at the time of public appearance.

• Disclosure with regards to Receipt of Compensation:

1. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services or its associates, or Research Analyst has received any compensation or other benefits from the subject company or the third party in connection with the research report in past twelve months.

2. Neither Dhruvesh Sanghvi, Prospero Tree Financial Services or its associates, or Research Analyst have managed or co-managed public offering or securities for the subject company in past twelve months.

• Other Disclosures:

1. The Research Analyst has not served as an officer, director, or employee of the subject company.

2. The Research Analyst is not engaged in market making activity for the subject company.