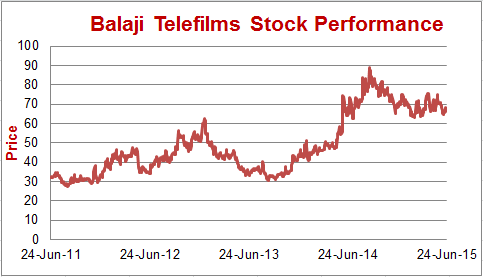

We first recommended Balaji Telefilms in Arp2013 at the price of Rs. 43. We further gave a short update on the new CEO of Balaji (Balaji: Management buying strengthens belief).

With FY15 results behind us, we reviewed Balaji Telefilms and think that Balaji is poised for a good time due to the improvement in profitability in serial business and large potential returns from movie business supported by a strong balance sheet.

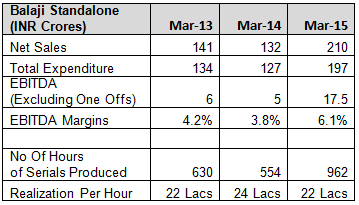

1. Consistently Improving Serial Business: Balaji earns fees per hour of serial telecast by broadcasters. Balaji’s serial business operates through its standalone entity.

- Prime Time Content Producer selling to Prime Clients: Most of Balaji’s serials are telecast during the prime time television of 7-11pm. Balaji also attracts all major marquee names like Star TV, Sony, Zee, Colors and Doordarshan. No other content producing house would have such a high bandwidth and industry knowhow in this domain.

- Improving Capacities and Cost Control: Balaji has substantially improved its capacities to produce serials - 962 hours of content was produced in FY15 as against 554 hours of content in FY14. This has been one of the prime most reasons for increase in operating profits at standalone levels to Rs. 17 crores for the year.

Serial business should sustainably produce a 1000 hours of programming content per year going ahead leading to a strong consistent cash flow generation.

2. Movie Business –Low Risk, High Profit Possibility: Balaji Telefilms Limited undertakes production & distribution of movies through its wholly owned subsidiary Balaji Motion Pictures Limited (BMPL). This division was started in FY08 and the focus has been shifting towards it. This business earns its revenue from the domestic and overseas distribution rights (theatrical), satellite rights, music rights and DVD rights. Another major source of revenue is through in-movie advertisements. An example of same is a movie Piku (not produced by Balaji), which collected Rs. 19 crores through in-house advertisements.

- Strong Movie Pipeline: Over last 8 years, Balaji Motion Pictures has produced 20+ movies. In FY15, 3 movies of BMPL did very well -Ek Villian, Ragini MMS II and Main Tera Hero. Balaji has a broad policy to venture into mid-budget movies with 4-6 movie releases per year. Some of the movies that are planned to be released in this year are Kya Kool Hai Hum 3, Udta Punjab, Half Girlfriend, XXX among others.

- Minimizing Risks: Movie production business is considered high risk; however, Balaji follows a strategy of pre-sale of movie rights in certain circles for distribution. Due to which, even before the movie is released, Balaji is able to recover large portion of its cost. This is also one of the reasons that it could not earn decent profits in some of the movies of the past. Eg: Dirty Picture which did very well on the charts was pre-sold entirely before the movie was released.

- High Profit Potential: However, over last 2 years Balaji has started to keep certain circles open for itself to capture the potential upside that may arise out of same. Along with that, upside can also creep in from performance revenues through satellite rights depending upon the success of the movie. With 4-6 movies in pipeline per year, it is conservative to expect profit of Rs. 2.5 crores per movie.

3. Strong Balance sheet; Treasury income provides cushion: Balaji is a debt free company with Rs. 155 crores of cash on balance sheet that translates into Rs. 23 per share. This cash has been generating Rs. 10 crores per year through investments in gilt funds and thereby provides cushion to Balaji which helps them to focus on movie business.

Valuation: At the CMP of Rs. 67, Balaji trades at around Rs. 440 crores of market cap and Rs. 155 crores cash.

With the serial business touching 1000 hours of production per year, focused mid-budget movie making supported by treasury income, gives enough safety and a strong upside potential in the company.

Here is Historical Stock Price