We recommended JB Chemicals at Rs. 75-85 on 8Aug2013. At CMP of Rs. 221, JB Chemicals is already giving returns of 176%. First Report on JB Chemicals can be accessed here: JB Chemicals First Report. Here is the quick update on JB Chemicals.

In the past, our primary reason for buying JB Chemicals was reasonable growth across geographical segments, extremely strong balance sheet coupled with very cheap valuations. The story so far has panned out quite well and the valuations are catching up. However, the pointers below will help you to understand the future prospects better.

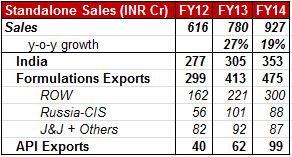

Sales Growth: JBChem is expected to continue growing at 15%-20% for at-least 2-3 years. The reasons are:

- Value growth in Indian business due to price increase for Rantec, Metrogyl and Nicardia

- Growth in exports formulations business with key focus on the US market. Just to note, ROW business (Rest of World business, non-Russia-CIS) has nearly doubled its sales from Rs. 162 crores to Rs. 300 crores.

Margin Expansion: The margin expansion story for JBChem should continue for 2 years due to:

- JB Chemical has started increasing prices for its 3 main products –Rantec, Metrogyl and Nicardia which was not possible in the previous regulations. As the cost is more or less fixed for these mature products, the increase in price of these medicines will directly lead to increase in margins for the company.

- A significant part of JB Chemicals' costs are fixed in nature. With increasing sales, the operating leverage will play out to an extent leading to higher profit growth.

Capacity Expansion: JBChem has planned to incur a capex of Rs. 150 crores in the next 15 months which will be funded completely by internal accruals. In the last 7 years, JBChem has never incurred such a large capex.

Valuations: At the CMP of Rs. 221, JB Chem has a market cap of Rs. 1,900 crore. Having a net cash of Rs. 400 crores on its balance sheet, JBChem is practically valued only at Rs. 1,500 cr. Based on the stability of revenues, profitability and current valuations, JBChem at Rs. 221 offers significant upside even at these levels.