| Name | Reco Date | Reco price | Target | Prospero Rating | Report Date* |

| JB Chemicals Ltd | 08Aug2013 | Rs. 75 - Rs. 85 | Rs. 150 - Rs. 200 | 8 / 10 | 08Aug2013 |

A) Company business:

- JB Chemical Ltd (JBCPL) is one of the oldest pharmaceutical companies in India known for its top brands -Metrogyl, Nicardia and Rantac.

- JBCPL exports to various countries with a strong presence in Russia, Ukraine, CIS countries and South Africa. It has recently invested in regulated markets like USA, Europe and Australia.

- The company manufactures its formulations and bulk drugs from its 10 plants, located mainly in Gujarat.

- Total revenue for FY13 is = Rs. 866 cr, PAT = Rs. 80 cr, MCAP = Rs. 708 cr

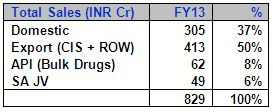

B) Geography revenue segmentation:

C) Investments arguments

1. Reasonable growth: The company's domestic business is growing at a decent rate of 10% - 15% in the recent past and is expected to continue. The exports growth is at a much higher rate with the company strengthening its base in Russia-CIS, USA & South Africa. We can expect the net sales of the company to growth anywhere above 15% for the next few years.

2. Strong Balance Sheet: The Company has cash and cash equivalents worth Rs. 550 crores. This translates to Rs. 65 per share. At the CMP of Rs. 83, this provides a huge safety net even if market forces discount this cash balance

3. Dividend yield: The company has been paying regular dividends and considering the recent dividend of Rs. 3 per share, the dividend yield turns out to ~4%. This can be treated as an additional safety.

4. Attractive Valuations: At the CMP of Rs. 83 and EPS of Rs. 9.4, the company is trading at a multiple of 8.8 times. However, if you consider the cash on balance sheet, the price to earnings multiple will look very low at 2 times. Even if you consider a cash discount to the cash lying on the balance sheet, the valuations are attractive.

5. Misconception about JB Chemicals: After selling its Russian OTC business to Johnson & Johnson, market participants argue that JB Chemicals does not have any significant business to run. This is a widespread misconception. Today, JB Chemicals sales of Rs 829 crores are higher than what it was before selling the Russian OTC business. We think that JB Chemicals future growth will be driven across both segments -Domestic as well as Exports.

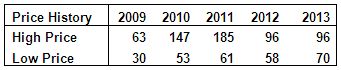

6. Note on valuation: Post the sale of Russian OTC business, the stock price hit a low range of Rs. 58 – Rs. 70 in 2012 & 2013. However, the company has started showing significant improvement in the domestic sales and international sales. Post its AGM in the last month, the share price has seen good stability and is trading consistently above Rs. 80. We think one should at least buy 50% of the required quantity at this point and buy the remaining over next 30 days in a staggered manner. With the kind of safety in the stock, and modest growth going forward, there is a good scope of price appreciating to 2 times in next 2 years.

*Report Date may sometimes be different from Recommended Date as drafting of reports can take time.