| Name | Reco Date | Price on Reco Date | Target | Prospero Rating | Report Date |

| ISGEC Heavy | 14Mar2014 | Rs. 960 | Rs. 2,200 - Rs. 2,800 | 9 / 10 | 26May2014 |

We had first recommended ISGEC to be bought at Rs. 950 - Rs. 1,050 Range in mid-March 2014. After our recommendation at Rs 950 - Rs 1050 range, this is the first time we are sending a detailed report on the same. Even at this price of Rs. 1,610 we recommend to Buy ISGEC Heavy. The reasons for the same are mentioned below.

A) Company Background:

ISGEC Heavy Engineering Limited (previously known as Saraswati Industrial Syndicate Limited) manufactures heavy engineering equipment for the power industry, sugar industry, fertilizer industry, and defense sector. The company’s product portfolio comprises of boilers, power plants, sugar machinery, fertilizer machinery, pressure vessels, heat exchangers, mechanical & hydraulic presses and castings.

History: Established in 1946, the initial business was of sugar production (sugar mill) and the company later diversified into heavy engineering. In 1964, they established a JV with John Thompson that was known as ISGEC John Thompson (IJT). In 1981, ISGEC acquired stake from John Thompson in the JV and also acquired majority stake in UP Steels. Both these companies were subsequently amalgamated into ISGEC Heavy Engineering Limited.

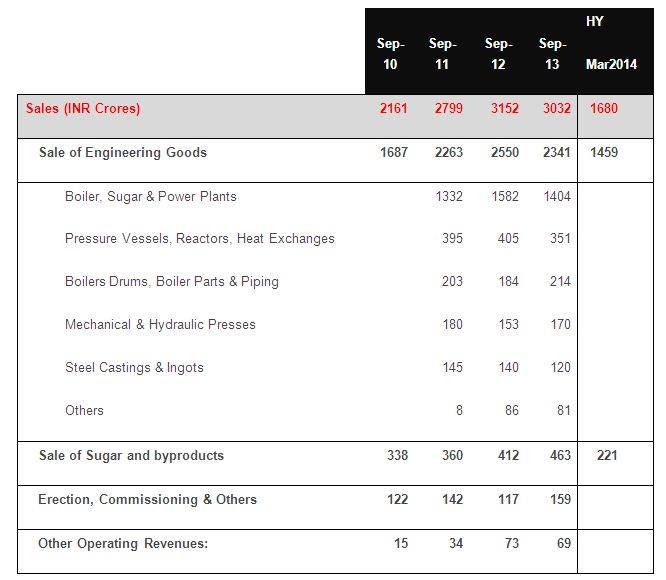

B) Revenue segmentation:

*Exports have grown much faster than domestic sales in the last 3-4 years due to slowdown in India.

C) Investments arguments:

1. A diversified engineering player with a focus on quality: Unlike many engineering players that are heavily dependent on a single industry, ISGEC has an extremely diversified revenue stream like sugar machineries, power machineries and others. It is this diversified revenue streams coming from sales to more than 70 countries that has helped the company to consistently grow from Rs. 300 crores revenue in 2001 to Rs. 3,000 crores revenues in 2013 without facing any significant headwinds during the recessionary period post 2008. On the manufacturing side, ISGEC has its facilities spread across 250 acres of land at various locations across Yamunanagar, Dahej, Bawal&Muzaffarnagar and offices in Noida, Pune, Chennai, Mumbai& Kolkata in India.

2. Quality leadership status in its field: ISGEC has been known for its quality, timely delivery and post installation service. ISGEC enjoys number uno position for a turnkey project provider to sugar plants. On the power boilers side, ISGEC has a very strong experience of producing more the 500 boilers around the globe. In the past, ISGEC could only produce boilers in the range of 10 TPH to 250 TPH, however, it now has the capability to produce anything up to 1,000 TPH.

3. Order book: As of December 2013, ISEC has an order book of Rs. 4,000 cr on a standalone basis executable roughly in 14-18 months. Add to that the orders in the new JV –ISGEC Hitachi Zosen that will focus on the process equipment to fertilizer industry. The traction in its entire business is reasonably good with strong demand from exports and potential revival of domestic economy.

4. Operating Leverage: Due to the economic slowdown, some segments of ISGEC have large under-utilized capacities and improving business climate can thereby lead to reasonable operational leverage.

5. Solid balance sheet: ISGEC has maintained a very strong financial position across last decade with near zero debt. The liabilities majorly comprises of advances from customers for project execution. ISGEC as a policy does not believe in client financing and never takes orders without advance. Advances can vary from 10% to 20% of the order size and are usually shown under the long term and short term borrowings.

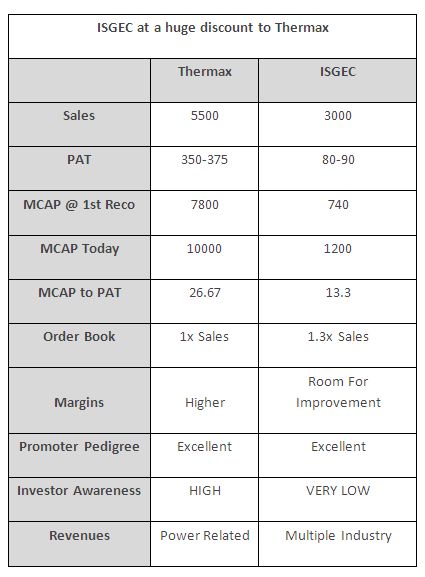

6. Attractive valuations: At the first reco price of Rs. 1,000, ISGEC was available at a market cap of Rs. 740 crores having sales of Rs. 3,000 crores and a profit of Rs. 85 crores. Based on the business profile and future growth possibility, ISGEC was extremely undervalued at Rs. 1,000. Further comparing ISGEC with industry leaders like Thermax only futher highlights the undervaluation at which ISGEC is trading. Based on the current order book, uptick in the business environment, healthy balance sheet and a very able management, we believe that ISGEC is poised to double its earnings in the next 3 years.

We think that at the CMP of Rs. 1,610 (1st Reco at Rs. 1,000), ISGEC has a lot to offer to long term investors and therefore we recommend to Buy at CMP.

Comparison of ISGEC and Thermax

D) Key risks

1. Overall depressed economic environment across India and major developing economies

2. ISGEC is currently exposed to currency risk - exports constitutes more than 60% of its revenues. However, the margins are already at a cyclical low and can be easily improved if the domestic demand picks up.